Blog

Blog

Últimos mensajes

Últimos mensajes

Temas mas recientes

Temas mas recientes

|

Esta sección te permite ver todos los posts escritos por este usuario. Ten en cuenta que sólo puedes ver los posts escritos en zonas a las que tienes acceso en este momento.

Mensajes - copo

1

« en: Julio 01, 2024, 19:39:05 pm »

Al final resultará que nadie fue socialdemócrata, y que siempre habían aborrecido a los moros, a los judíos y a los gordos

La situacion actual es clavada a la que vivimos durante el primer crash, cuando las hizquierdas asaltaron los cielos gracias al pollo sin cabezismo imperante.

Al final es como la sal. Un poco bien pues mejora el sabor, pero demasiada no es saludable. En la UE y EEUU, en un plazo de 20 o 30 años han modificado totalmente la demografía con todo lo que conlleva. Esto a la gente no le gusta y no quiere decir que uno sea racista. Ningún país permitiría tal modificación cultural dentro de sus fronteras salvo en Europa (en EEUU se puede entender porque tiene una historia de inmigración) pero en una zona consolidada como Europa solo provocará la crispación social y el aumento de los extremismos que es lo que está ocurriendo. El error cometido por todos los políticos es la laxitud en el control fronterizo, hecho que ha provocado cambios sociales y religiosos, aumento del precio de la vivienda, degradación laboral, aumento del gasto social e incluso aumento de la delincuencia en ciertos campos. Y las respuestas de los gobiernos son tan falsas como absurdas; No se pueden poner puertas al campo, si quieren entrar entrarán….. Cuando tenemos muchos ejemplos en el mundo de países con fronteras perfectamente controladas. Da miedo ver la poca visión de los gobernantes respecto sus decisiones y las consecuencias que provocan. La izquierda no ha cumplido su deber y punto. Saludos

2

« en: Junio 11, 2024, 09:30:35 am »

Dinero sin trabajar o algo parecido. https://www.thebignewsletter.com/p/economic-termites-are-everywhere?utm_campaign=post&utm_medium=webEconomic Termites Are Everywhere Why is this economy so difficult to manage? The macro statistics are hiding the experience of being cheated. MATT STOLLER JUN 08, 2024 Today I want to start with a comment by a colleague, Texas antitrust lawyer Basel Musharbash, observing a restaurant trying to do a renovation in Dallas. “Something funky is happening in the building materials supply chain,” he wrote . “A 3,000 sq. ft. commercial space in a strip mall shouldn’t cost $720,000 to renovate into an Italian food joint.” He’s right. It shouldn’t. And yet it does. This attitude of ‘something is very wrong with our society’ is everywhere now. Corporate procurement officers just assume costs are going up, it’s in budget projections for the Defense Department, and we expect cost overruns on everything. ‘Inflation’ is now a catch-all for a basic view that stuff is just going to suck more and more. So what’s going on? Today’s piece is about a concept I am going to call ‘economic termites,’ which are instances of monopolization big enough to make investors a huge amount of money, but not noticeable enough for most of us. An individual termite isn’t big enough to matter, but the existence of a termite is extremely bad news, because it means there are others. Add enough of them up, and you get our modern economic experience. The concept of an economic termite is the cousin to Cory Doctorow’s ‘enshittification’ or Yves Smith’s ‘crapification,’ terms that describe how a platform gradually degrades the quality of its service as it gains market power and gets pushed to extract cash by financiers. Economic termites describes where these same forces get into the mostly unseen business foundations of our society and profiteer. These termites are in the infrastructure or guts of business, like recruiting services, construction equipment or software, the industrial gasses that go into chemicals and electronics, and so forth. It’s the stuff you don’t see that makes our world turn, there’s fortunes to be made, and bottlenecks to foster. They also explain a dynamic we all face, a profound wariness in our society, a sense that stuff just costs more and is more difficult, for no discernible reason. Added up, these end up sapping our faith in the American system, because they make what seem like simple problems become not just unsolvable, but not even capable of being diagnosed. In this issue, I’ll cover some of the companies you don’t realize are gnawing at the foundation of our society - Verisign, Autodesk, Linde, Assa Abloy, Gracenote, and LinkedIn. And yes, there are legal tools to address them. But first we have to realize that these bottlenecks are everywhere. We’ll start with a corporation I pay to host this newsletter. The secret ingredient is crime : r/MitchellAndWebb Verisign: The Most Profitable Company in the Stock Market A few months ago, Verisign - which is the government-designated monopolist that runs the registration of .com addresses - announced a price hike, from $9.59 per year for .com addresses to $10.26. If you’ve ever bought or renewed a website, Verisign has gotten some of your money. I have to pay this fee to register TheBigNewsletter.com domain name, every year. So does everyone else who has a domain name. An increase of less than a dollar a year is not a big deal. But over the decades, these price hikes have been routine. A few years ago, the price to renew a .com domain was $6 a year. Then $7. Then $8. Verisign has hiked prices every year, up to the maximum set by the government (until Trump removed the price cap altogether in 2018.) Today, Verisign is the single most profitable company in the stock market, a great example of an economic termite. In 2013, its operating margins were 54.7%, by 2023 they grew to a crazy 67.1%. Verisign doesn’t invest this money; in 2023, it spent $882 million of it on stock buybacks. Its expenses are basically running a simple database, its strategy is to hike prices just below what will be noticed, and its method is to have politically connected people like Clinton Justice Department official Jamie Gorelick - who is one of Merrick Garland’s good friends - on its board. Where did Verisign’s monopoly come from? Well, it was due to the last four administrations choosing to ‘privatize’ domain registration to a ‘multi-stakeholder group,’ the Internet Corporation for Assigned Names and Numbers (ICANN), which has a deal with Verisign to allow it to maintain the monopoly. ICAAN could at any point put the contract out on domain management for bid, and you’d see corporations come in at $2/year, certainly much less than $10.26. But they haven’t ever done that. Their contract strikes me as unlawful, a straightforward agreement in ‘restraint of trade.’ Yet, Verisign has a weird agreement with U.S. government’s National Telecommunications Information Administration (NTIA), which is widely perceived to provide the firm with legal cover for its clearly monopolistic behavior. In less than three months, the NTIA, which is run by former Google lobbyist Alan Davidson, has a choice of whether to renew its agreement with Verisign. I don’t know what Davidson will decide. He might not perceive it as worth his time to fight with this economic termite. But he should, because termites are a bad sign. Also, I want my money back! AutoDesk: Taking “Hostages” in Architecture Talk to anyone in architecture or engineering design for big construction projects, and it’s not hard to find complaints about software provider Autodesk, which sits in the computer aided design (CAD) space. “I have personally been bullied by Autodesk while CTO at a design firm using predatory practices that dictated pricing unlike any software contract I've negotiated in my 30 year career,” one BIG reader wrote me. “I continue to hear stories from all leaders in the industry with aspirations to create a sustainable, human centered built environment, but limited by pricing and poor quality of a single tool (Autodesk).” Autodesk is the classic economic termite. As one Wall Street analyst put it in praising the stock, “Like other software suites providing extensive support for customer workflows, ADSK's offerings can demand premium prices due to their prevailing market dominance. When juxtaposed with the overall expenses of a construction project, which might reach millions of dollars, the cost of these products remains relatively minor.” There are rivals in the market, but as another source noted, “The switching costs associated with CAD software are gargantuan, a reality incumbents leverage more or less mercilessly.” The result, he added, is that “there’s not all that much organic innovation in the past 25 years, but lots of steady growth.” Just going to Glassdoor, there are a large number of employee complaints consistent with a firm that has market power, mostly about poor leadership and constant reorganizations due to acquisitions, but extending to unethical sales practices and a few claims of fraud. In 2020, UK based architecture firms penned an open letter to Autodesk complaining about high prices and poor innovation, “censuring the Silicon Valley-based design software and services giant for the mounting ownership costs—an increase as much as 70 percent over a five-year span through the end of 2019—of its central BIM product, Revit.” The software, they argued, has “remained mostly stagnant and that firms dependent on the aging software (it’s now 20 years old) have been faced with, among other things, ever-changing licensing models, aggressive sales tactics in enterprise licensing, and a lack of understanding of the business dynamics within the industry that the company serves.” The likely reason for this market power is that Autodesk makes it hard to switch, both through technical means and aggressive sales tactics. As one customer said in the Autodesk forums from a few years ago, “The only feature request I’ll make is antitrust action against Autodesk.” Generative AI might change the dynamic in the industry, but if there isn’t antitrust action, it will be deployed poorly. Linde: Industrial Gasses In 2018, the second and third largest industrial gas companies, Linde and Praxair, combined to become the biggest firm in a very concentrated industry. Industrial gasses are chemicals, like oxygen, nitrogen and argon, carbon dioxide, hydrogen, helium, acetylene and specialty gases, that go into a ‘countless’ number of products, from MRI machines to frozen fish to semiconductors to steel to carbon capture and renewable energy. The Biden Inflation Reduction Act has supercharged the industry. The merger was a controversial deal within the government, with the Trump Federal Trade Commission blessing the deal, though requiring the new firm to sell off some assets to a private equity joint venture. (FTC Commission Chopra dissented and opposed the merger.) Immediately after the combination with Praxair, Linde announced substantial price hikes, and it has continued to increase prices ever since. In the last quarter of 2023, for instance, according to Linde’s investment documents, its sales in the U.S. grew by 6%, “driven by 5% higher pricing and 1% volumes.” And the root of its pricing power isn’t hidden; in 2022, its 10% boost in profit was, according to the corporation’s annual report, “primarily due to higher pricing… driven by merger related assets.” Operating margins went from about 10% in 2019 to 16% in 2022 to 27.6% in 2023. In 2023, the company paid out 50% more to investors than it invested into the business. Today, the industry is a lot like Verisign, on a larger scale. Industrial gases are essential to customers, but also an afterthought, because they are usually a small percentage of the customer’s cost. No one really cares if there are price hikes, as long as the gases are delivered. It’s also hard to switch, distribution is a bottleneck, and long-term supply contracts are common. The result, for Linde, is high operating margins, low investment, and lots of dividends and buybacks. There are a few other big companies in the market, like Air Liquide, but the merger cut price competition substantially. Last year, Linde fortified its position in distribution, buying one of the biggest packaged gas distributors in America, nexAir. And its executives have announced they are looking for ‘tuck-in’ acquisitions, meaning they want to keep buying mid-market firms as a consolidation play. Unless you are buried in a supply chain somewhere, most people will never hear about the industrial gas price increase. But as with Verisign, a few pennies are coming out of your pocket every day because of this economic termite. Swedish Predators: Assa Abloy Swedish conglomerate Assa Abloy makes locks and smart locks that go into a large percentage of residential and commercial buildings. As with gases, locks are a small percentage of the cost of a building or house, so this industry is about power in distribution. Like many corporations with market power, Assa Abloy is a roll-up, having bought over 300 firms in the last 27 years. In 2023, it engineered a significant merger, to buy out Spectrum Brands’ industry-leading Kwikset line of business, and sell its own third place Yale and August business line to a new weaker firm called Fortune Brands. The Antitrust Division challenged the merger of the Kwikset brand, but Judge Ana Reyes forced a settlement to allow the merger to go through. Smart locks had been a competitive industry; from 2019, smart lock output nearly doubled, and prices dropped by 9%. That era seems to have ended with the merger. Assa Abloy raised prices in December, January, and February, and its main competitor, Fortune Brands, did as well. There are also complaints in the industry about increasingly coercive behavior. Here’s a story of a new innovative producer whose business was simply… turned off by the incumbents. As most of my connections, friends, and family know. I have been building a business called DailyAdventureBox since 2019. The business is a self-automated rental locker for outdoor sporting equipment, beach equipment, and camping equipment. We are or should I say, we were, on the verge of extreme success with multi-state operations with major hotels like Hilton Hotels & Resorts, IHG Hotels & Resorts, and Fairfield by Marriott. Sadly, my business is being forced into bankruptcy because of two multi-billion-dollar corporations not honoring their agreements..... ASSA ABLOY Group and Fortune Brands Innovations have destroyed my business and are not taking ownership of their wrongdoing. Long story short they agreed to partner with my company, they had us design our IOS/Android app to their code, and I developed my lockers around one of their smart lock products. After spending over $500,000 into the partnership, they decided to pull support. Causing my app to crash and all of my locations to be uninstalled. Now we are not operational and are at risk of forced failure for NO REASON. They believe that because I am a startup company, I cannot fight back. A bit of coercion leads to no innovation, and then a few pennies drawn from the pocket of every homebuyer, landlord, and renter out there… Entertainment Data: Gracenote In 2016, Nielson’s acquired a corporation called Gracenote for $560 million, which provides metadata for movie, music and TV listings for use in user interfaces on cable, satellite, streaming services, automobiles, hotels, and hardware. As of 2021, Gracenote was widely deployed throughout the industry, not just in most TV interfaces but in 250 million in-car entertainment systems. The rumors are Gracenote has 60% of the market. Gracenote seems to have provisions that prevent the use of multiple databases or combining its data with outside vendors to improve the service. “Gracenote will only license if we drop all the other databases, they will not allow to be combined with others,” wrote one person complaining on a forum. “The results from four databases are much better than one.” Here’s a contract from 2019, and the word ‘outside’ seems to be the mechanism by which Gracenote exerts power. Many of the customers for the data also make content that needs to be ‘datafied,’ there are a lot of conflicts of interest embedded in the market. And because data is woven into an organization’s fabric, switching costs are quite high. The restrictions on the use of data make moving gradually to another provider of data almost impossible, and prevent the use of different forms of data to make discovery of content better and cheaper. I can’t find pricing information, but since Nielson’s is now owned by private equity/hedge fund Elliot Management, I suspect they aren’t shy about taking advantage of market power. Another dime out of every viewer’s pocket. LinkedIn: Beyond Super Positive Corporate Blog Posts Over the years, professional recruiters have been telling me about increasingly worse terms offered by LinkedIn. What’s the problem? Is LinkedIn really a monopoly? Well maybe not from a consumer’s perspective. But from the perspective of recruiting firms? That case is more compelling. “LinkedIn is the only dominant social professional network, with ~1 billion public resumés,” I was told. “They have no true competitors in ‘sourcing software’ for recruiters searching to attract passive job candidates for most all veins of corporate work.” There’s also direct evidence of market power. Earlier this year, LinkedIn imposed a 174% price increase on its customers, who are professional recruiters that scour the database for potential hiring. And I looked into it, and yes, this one looks like a market power story. In fact, Reid Hoffman, the founder of LinkedIn and a big political donor, wrote a book called “Blitzscaling” in which he discussed the importance of getting big before anyone else. He used that recipe to build LinkedIn, the largest professional social media network, before selling it to Microsoft in 2017 for $26 billion. (Microsoft also owns GitHub, which is the other key place to source mid-career technical talent.) There are a number of mechanisms LinkedIn uses to maintain its monopoly. The key is, as Google and Amazon do in their areas of network dominance, to deny scale to potential rivals. While most people think a LinkedIn profile is a public facing resume, in fact, Microsoft fiercely controls who can access that data in bulk, litigating to deny the use of LinkedIn profiles to potential rivals, except for certain companies, “such as Google,” which are whitelisted. Why would Google be allowed to search LinkedIn profiles? I’m guessing there’s a market allocation agreement. After all, it would seem pretty trivial for Google to launch a rival product, but it hasn’t. Thousands of small agencies rely on LinkedIn, and have been gradually driven out of business as Microsoft, its owner, generates more revenue. These make it slightly more expensive to hire, an indirect tiny cost borne by everyone in the economy. I could on, and I eventually will. (For instance, Waste Management is an obvious termite.) But you get the point. Small hidden tollbooths everywhere eventually foster economic tyranny. Now of course it’s not all hidden. There are big monopolies in our economy. Live Nation/Ticketmaster, for instance, is likely responsible for big price increases in live entertainment, and UnitedHealth Group is driving up prices in health insurance. Oil price-fixing, rent price-fixing, and meat price-fixing are each individually a big deal. But the aggregate cost increases we’re seeing in random areas often can’t be traced to one big villain. But they can be traced to many small ones. Where did these economic termites come from? We decided four and a half decades ago that monopolies were good. After 1998, the Antitrust Division stopped bringing monopolization cases, and in 2005, the Supreme Court unanimously endorsed monopolization as foundational to the health of American economy. After twenty years of not bringing cases, business executives realized the best way to run a business was to create a tollbooth in some mostly unnoticed part of society. So now, each supply chain is made up of a bunch of different bottlenecks, too small to notice. That said, there are commonalities among these industries that make these problems easier to solve. Most of these firms use the tactic of building a network or standardizing a business on their platform, and then denying necessary scale to their rivals through technical, contractual, or business tactics. They often use exclusive contracts. They also often rely on expansive patent, copyright, or trademark claims, sometimes government sanctions for their market power. They are ‘capital light,’ usually in opposition to the new industrial policy goals of ‘bending metal.’ As the big antitrust claims work through the courts, and as government policy design moves away from supporting consolidation, trends in business will change. Executives will get worried about being sued. Rivals will start calling lawyers, class action attorneys will see more opportunity, journalists will write more stories, and judges will learn. It’s becoming easier to see analogies and bring private cases. And over time, we’ll start to once again see these kinds of monopolization techniques as we do other moral wrongs based on unfairly exploiting power. Thanks for reading! Your tips make this newsletter what it is, so please send me tips on weird monopolies, stories I’ve missed, or other thoughts. And if you liked this issue of BIG, you can sign up here for more issues, a newsletter on how to restore fair commerce, innovation, and democracy. Consider becoming a paying subscriber to support this work, or if you are a paying subscriber, giving a gift subscription to a friend, colleague, or family member. If you really liked it, read my book, Goliath: The 100-Year War Between Monopoly Power and Democracy. cheers, Matt Stoller Saludos

3

« en: Mayo 31, 2024, 09:40:32 am »

Me pregunto yo sin ser pro nada. Tendrán algo que decir los países que han decidido unirse,no? Es decir si se unen es por algo, quizás no se sientan seguros. E igualmente, tienen derecho a aliarse con quien quieran digo yo. O los pezqueñines deben obedecer órdenes?

Saludos.

5

« en: Mayo 28, 2024, 10:02:26 am »

Para mí la inflación no es tan rara, su origen viene de:

-Problemas de suministros energéticos de Rusia (toda Europa Central y Oriental depende del gas ruso...o dependía).

-Problemas logísticos y productivos que aún se arrastran del Covid.

-Problemas en el Mar Rojo.

-Conflictos comerciales entre EE.UU,Europa y China.

-Encarecimiento absurdo de la vivienda en TODA Europa.

-Políticas Next Gen y otras más para activar el consumo en Europa.

-Límite de mano de obra en Europa (no existen más remeros que mantengan los precios bajos, ergo, cada vez cobran más).

-Aumento del SMI.

-Problemas de falta de lluvia y producción escasa de frutas y verduras.

-Aumento de políticas verdes tales como la supresión de centrales térmicas de carbón, aumento de la producción por placas solares y aerogeneradores..... Que suponen a parte de un aumento de la inversión, también obligan a tener más centrales de ciclo combinado para cuando no hay sol o viento.

-Políticas de ayuda social que desincentivan (hasta cierto punto) la introducción al mercado laboral de millones de personas.

Y muchas otras razones.

Súmenlo todo y verán que la inflación no es tan rara.

Saludos.

6

« en: Mayo 22, 2024, 18:16:18 pm »

El Sáhara Español no era una colonia. Creo que era una provincia Española y tenían ciudadanía Española como cualquier peninsular.

Saludos.

7

« en: Mayo 22, 2024, 10:19:25 am »

[Milei se jiña en España al día siguiente de su viaje institucional-marginal: https://www.youtube.com/shorts/oyOEqt_ks4Y

A los anarcoparásitos les pasa que sus cerebros no aceptan que estamos en una nueva era multipolar en la que los Estados ya no son lo que fueron —'unidades de destino en lo universal'—, sino solo lo que siempre han sido objetivamente, un escalón intermedio del sector público administrativo: local, regional, estatal, supraestatal y mundial. La diferencia está en que ahora sabemos que no hay ningún 'Volksgeist' que canalizar a través de ninguna administracioncita pública. El problema es que lo sabemos los técnicos; y hay mucho aficionado suelto.

Entre los que ven el sector público como si fuera el útero de su madre están los anarcoparásitos, curiosamente. Entre ellos destacan, junto con Milei, dos conocidos 'estatalitas': Zelenski y Netanyahu. Los tres van a pasar a la historia.

Milei ha accedido a la jefatura de uno de los casi 200 Estados que hay con una campaña de odio, que es de lo que él sabe. Y le encanta ser jefe de Estado. Está como niño con zapatos nuevos.

Lo primero que ha hecho, sin debate alguno ni 'mercao', ha sido dividir por dos el valor de su moneda nacional respecto del dólar norteamericano (que es en la que él ahorra) y desalinear a su país del acuerdo BRICS+, al que pertenece la gran potencia de la zona, Brasil, y la potencia que prestaba apoyo financiero a su país, China, frente al Fondo Monetario Internacional. Por tanto, como él mismo dice, sería un zorro, pero un zorro estúpido que hace labor de zapa contra el Estado que él mismo preside, zapa supuestamente en favor del imperio crematocrático que él cree que, porque le sirve, le dará algo a cambio —imbécil desmemoriado de Las Malvinas—. N. B.: El Zorro literario hacía la zapa contra la California mexicana recién independizada de España —El Zorro, escrito por un norteamericano de Ottawa, en realidad, habla de cuán estúpidos serían los mexicanos por ser 'españolazos'—.

¿Qué leches hace el líder de la ultraderecha española abrazándose con un zorro?

Milei no es consciente de que, en realidad, no ha venido a España, sino a la Unión Europea. Ha venido en un vuelo oficial, en un avión oficial y a un aeropuerto militar. Ha presentado su libro autobiográfico y ha asistido a un acto electoral europeo de la extrema derecha, en medio de un proceso electoral europeo y con líderes políticos europeos. No le ha recibido nadie oficialmente, pero él se ha sentido una persona muy importante porque odia mucho a los rojos-de-mierda y ahora sabemos que, también, a España.]

[El trance final del cambio del modelo popularcapitalista por otro con más planificación se está sustanciando con varias guerras, guerras que van a limpiar al mundo de Estaditos y estatalitas.

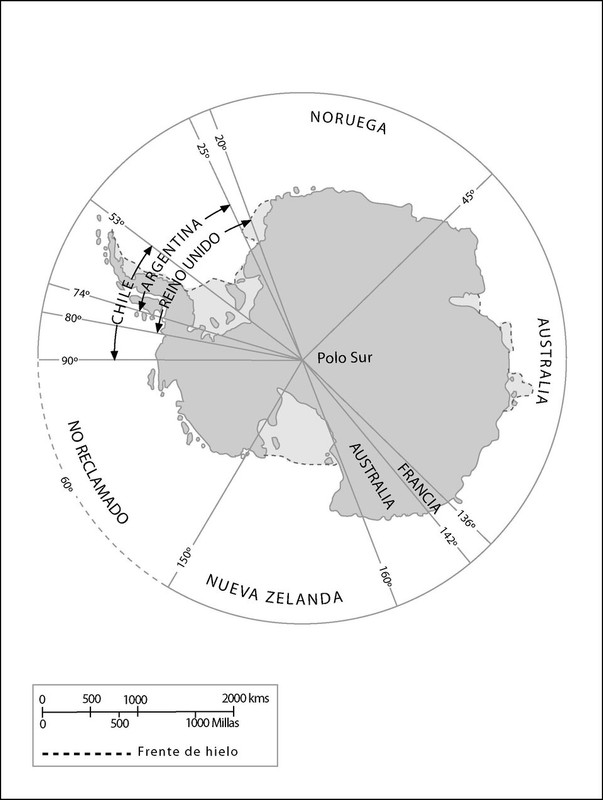

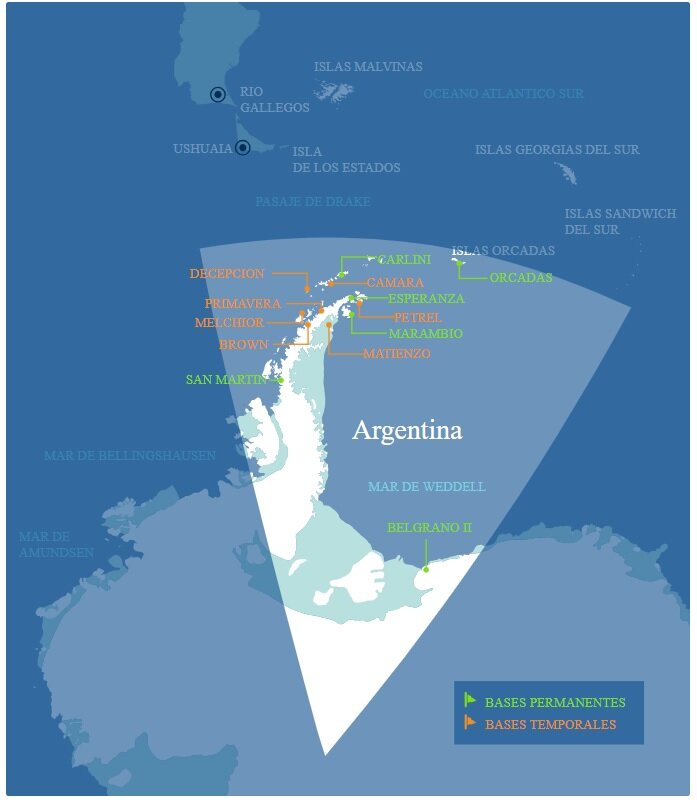

Fíjense cómo se da aquí la noticia del supuesto hallazgo de petróleo en el mar de Weddell:

https://www.emol.com/noticias/Internacional/2024/05/14/1130770/rusia-descubrimiento-petroleo-antartica.html

Ya hemos visto aquí que la Patagonia, realmente, es de Chile:

https://www.transicionestructural.net/index.php?topic=2604.msg227077#msg227077

Ahora, lean esto:

https://elpais.com/chile/2024-05-20/el-gobierno-chileno-tilda-a-kast-de-antipatriota-por-calificar-de-travesti-politico-a-boric-en-espana.html

Y, después de ver la fecha de esto y entender lo que es, lean dos veces la siguiente frase literal extraída del cuerpo del documento:

https://www.whitehouse.gov/briefing-room/presidential-actions/2024/05/17/national-security-memorandum-on-united-states-policy-on-the-antarctic-region/

— The United States recognizes the value and importance of establishing, enforcing, monitoring, and adaptively managing fully and highly protected large-scale marine protected areas as tools to conserve Antarctic marine living resources, their ecosystems, and the benefits they provide.

Adaptively managing, je, je.

La empresa rusa descubridora es estatal (Rosgeo), je, je. Leemos: El hallazgo se agregaría a la disputa ante la Organización de las Naciones Unidas (ONU) por la soberanía de las Islas Malvinas, las Georgias del Sur y las Sandwich del Sur. ¡Ja, ja ja!

Parece ser que el gobierno argentino le ha pedido al ruso que confirme la noticia del hallazgo. Huelga decir que este lo ha hecho.

https://uk.news.yahoo.com/antarctic-treaty-russia-oil-and-gas-surveys-162324757.html

¡Qué pedazo de marioneta es Milei!]

[Qué poco queda, señoras, señores, para el Hostión-2025.]

Hola. No defenderé a Zelenski. Pero es comprensible que defienda su territorio. Entiendo que lo que propones es que debería haber abdicado ante Rusia. Ojo al otorgar victorias fáciles, que la gente se emociona en conquistar territorios. Con esto no quiero decir que odie a nadie, ni entienda todas las posturas. Simplemente que no entiendo esa manía a Zelenski. ¿Mejor un cobarde? Puede ser. Y ojo, no habla de una cosa que zarandea el mundo, y es el auge del patriotismo. ¿La gran pifiada de Europa? Simple y claro: -depender militarmente de EE. UU -depender energéticamente de Rusia. -Depender industrialmente de China. No odio a ningún país mencionado, pero es una debilidad inmensa depender de un solo país. El bocachancha de Milei es un donnadie. Saludos.

8

« en: Mayo 20, 2024, 10:01:58 am »

https://www.eleconomista.es/economia/noticias/12819640/05/24/china-lanza-un-gran-rescate-para-su-sector-inmobiliario-con-una-potente-flexibilizacion-hipotecaria.html

Saludos.

Hola. Quien haya seguido el sector de la construcción, tanto de viviendas como de infraestructuras, habrán flipado con la transformación, ningún país en la historia ha construido tanto en tan poco tiempo. Ver el cambio en ciudades como Shenzen o Shanhai que no se parecen en nada a hace 20 años o las infraestructuras en puentes, trenes,carreteras...... Pero aunque esto parezca algo bueno, en el fondo es una inversión infrautilizada, es una forma ineficiente de invertir los enormes excedentes. Recuerda a la España del boom pero a lo bestia. Ya veremos como reacciona China ante tal situación y si sabe adaptar la economía a la nueva realidad. Saludos.

9

« en: Abril 30, 2024, 19:53:07 pm »

https://www.ft.com/content/879f5de7-cd9b-4987-9c2b-8b23cf0f3800

China’s problem is excess savings, not too much capacity

Policymakers on either side of bitter trade dispute seem to confuse two issues

While China and its trade partners continue to clash bitterly over manufacturing overcapacity and global trade, much of the discussion seems to be occurring at cross purposes.

Excess Chinese capacity in targeted industrial sectors is one area of contention. Excess Chinese savings driven by the suppression of domestic demand is another issue. These two points of contention are very different but analysts and policymakers on either side seem to confuse the two.

In the former case, Beijing has targeted certain industries such as electric vehicles and solar panels that it believes to be strategically important, and has implemented policies that are designed to give Chinese producers in these sectors a long-term comparative advantage. There is nothing especially Chinese about this strategy. Most large economies also employ policies to support or protect favoured sectors.

As these policies work at the expense of foreign manufacturers, they often generate a great deal of outrage, but much of this reaction is self-serving. Comparative advantage, which is what drives the benefits of trade, implies that some countries are able to produce certain goods more efficiently than others. The purpose of trade, after all, is to concentrate production in those countries that have a comparative production advantage.

But comparative advantage is only realised in the exchange of goods, and not in their production. This is where the problem of excess Chinese savings emerges. China’s structurally-high domestic saving rate is the result of a decades-long development strategy in which income is effectively transferred from households to subsidise the supply side of the economy — the production of goods and services. As a result of these transfers, growth in household income has long lagged behind productivity growth, leaving Chinese households unable to consume much of what they produce.

Some of these subsidies are explicit but most are in the form of implicit and hidden transfers. These include directed credit, an undervalued currency, labour restrictions, weak social safety nets, and overinvestment in transportation infrastructure. These various policies automatically force up Chinese savings. By effectively exporting excess savings through the subsidy of the production of goods and services, China is able to externalise the resulting demand deficiency.

The fact that China dominates certain manufacturing sectors is perfectly consistent with free trade and comparative advantage. It is excess savings that creates a problem for the global economy — and it should be noted that many countries besides China engage in similar behaviour, including Germany and Japan. The problem is that these excess savings represent the suppression of domestic wages, and thus domestic demand, to achieve global competitiveness.

These are classic beggar-thy-neighbour trade policies in which unemployment — the consequence of deficient domestic demand — is exported by running trade surpluses. These surpluses must be absorbed by trade partners, usually in the form either of higher unemployment, higher fiscal deficits or higher household debt.

This is why the policy implications of the two points of contention are very different. The problem of excess savings can make the problem of excess capacity much worse. Trade-deficit countries seek to protect their economies from the excess saving of demand-deficient countries. This can be in the form of restrictions on trade or on capital inflows.

Beijing will no doubt continue to protect and support industries it deems to be strategically important, as will the US, the EU, and the rest of the world. This will lead inevitably to clashes, rising protectionism and widespread overcapacity in some sectors. In a well-functioning global trading system, countries produce goods in which they have a comparative production advantage, and then exchange them for goods in which they don’t. Thus the global economy is better off, even if individual sectors suffer.

When the purpose of exports, however, is to externalise the problem of weak domestic demand, the global economy can only be worse off, as John Maynard Keynes noted at Bretton Woods. The world must resolve the issue of excess savings and unbalanced trade, even as individual countries clash separately over excess capacity and comparative advantage. Muy buen artículo. Thanks Derby

10

« en: Abril 19, 2024, 18:46:33 pm »

Pura ironía.

El capitalismo clásico construía viviendas. Le interesaba producir lo más barato posible y si hacía falta hacía barrios enteros para sus trabajadores.

El socialismo actual, sublimación del poder del propietariado, ha provocado escasez de viviendas. Cuando más social, más cara la vivienda y peor vive el trabajador.

Pero ya sabemos, la culpa es de Amancio Ortega o Bill Gates, por supuesto.

Cuanto deseo que vuelva la izquierda clásica culta, con capacidad de análisis real y con la función de contrapeso al capitalismo tradicional.

El socialismo actual quiere igualar a todos, pero por abajo.

Por ejemplo,a quienes representa el socialismo actual? Sí, a funcionarios y pensionistas. Máximos exponentes de la burbujilla de medio pelo patria que está fastidiando no a una, sino a varias generaciones.

Nunca el socialismo predicó vivir de los demás, nunca, tenemos un falsosocialismo parásito, el socialismo hablaba de derechos del trabajador, no hablaba de exprimir a los demás trabajadores.

El socialismo se ha convertido en lo que siempre juró contra lo que lucharía. Un parásito del trabajador.

Ahora tenemos unos Estados mastodónticos, con déficits brutales, que no responden a las necesidades de la sociedad y que fracturan la sociedad, ya sea por confrontación política, territorial o económica.

En China no gastan un carajo el Estado y los trabajadores no viven tan mal, y sobretodo, viven mucho mejor de lo que nos cuentan los medios informativos (o desinformativos). Díganme, Como se puede competir contra un país trabajador, con pocas cargas fiscales y deuda, con trabajadores contentos y con ganas de progresar? Por cierto, China usará todas las viviendas de promotoras quebradas para repartir viviendas por doquier a precio muy ajustado. Saben perfectamente que con la vivienda no se juega.

Saludos.

12

« en: Marzo 18, 2024, 10:05:52 am »

https://www.ft.com/content/8703874e-44cb-4197-8dca-c7b555da8aefBrazil launches China anti-dumping probes after imports soar Please use the sharing tools found via the share button at the top or side of articles. Copying articles to share with others is a breach of FT.com T&Cs and Copyright Policy. Email licensing@ft.com to buy additional rights. Subscribers may share up to 10 or 20 articles per month using the gift article service. More information can be found at https://www.ft.com/tour. https://www.ft.com/content/8703874e-44cb-4197-8dca-c7b555da8aef Brazil’s industry ministry has launched a number of investigations into the alleged dumping of industrial products by China as Latin America’s largest economy reels from a wave of cheap imported goods. At the request of industry bodies, the ministry has in the past six months opened at least half a dozen probes on products ranging from metal sheets and pre-painted steel to chemicals and tyres. The Brazilian measures come at a time when the world is bracing for a flood of exports from China as the world’s second-largest economy struggles with excess capacity amid a property sector slowdown and weak domestic demand. To stimulate its economy, China is investing in advanced manufacturing, especially in solar energy, electric vehicles and batteries. In addition to Brazil, China’s steel exports to Vietnam, Thailand, Malaysia and Indonesia have risen sharply in recent months. Developed markets have started taking extensive measures against imports from China, with the EU launching an anti-subsidy probe into Chinese EVs and the Biden administration recently raising security concerns over the Asian country’s vehicles. China’s exports grew 7.1 per cent in the first two months of this year, far outpacing growth in imports. “Prolonged declines in China’s export prices may cause trade tensions between China and some major economic powers to rise,” analysts at Nomura said in a research note on Friday. China’s exports to and imports from Brazil both rose by more than a third in the first two months of the year, according to Chinese customs data. “Last year saw one of the most critical situations in the entire history of the national chemical industry,” said André Passos Cordeiro, president of the Brazilian chemical industry association. “We see temporary increases in import tariffs as an indispensable regulatory tool for combating these predatory operations and preserving the domestic market.” The trade tensions create a dilemma for leftwing president Luiz Inácio Lula da Silva, who has sought to both nurture relations with Beijing and protect and develop Brazil’s national industries. Since returning to the presidency for a third non-consecutive term last year, Lula has put industrial policy at the heart of his economic strategy. But Brasília is also likely to try avoid a confrontation with Beijing, which is its largest trading partner and significant purchaser of commodities such as soyabeans and iron ore. Last year, Brazil exported more than $104bn worth of goods to China, while importing $53bn. Of the 101mn metric tonnes of soyabeans shipped from Brazil last year, 70 per cent, worth about $39bn, went to China. One of the most recent investigations was launched earlier this month following a request by CSN, a large Brazilian steel producer, which alleged that between July 2022 and June 2023 imports of particular types of carbon steel sheets from China rose almost 85 per cent. In opening the probe, which is scheduled to take 18 months, the industry ministry said there were “sufficient elements that indicate the practice of dumping in exports from China to Brazil . . . and damage to the domestic industry resulting from such practice”. Brazilian steelmakers have requested the government slap tariffs of between 9.6 per cent and 25 per cent on imported steel products. Overall imports of steel and iron from China rose from $1.6bn in 2014 to $2.7bn last year. Soaring steel imports are a particular sore spot for the Brazilian government as the Latin American nation is one of the world’s largest exporters of iron ore — a primary ingredient in steel production. Chemicals and tyres are also points of contention, with the industry ministry launching separate investigations in recent months. According to official data, imports from China of the chemical phthalic anhydride rose more than 2,000 per cent in volume terms between July 2018 and June 2023. In the same period, imports of tyres grew more than 100 per cent to 47mn units from 23mn units, with roughly 80 per cent coming from China. Brazil is not the only emerging market to voice concerns about the surge in industrial products from China. In Thailand, the government has accused Chinese companies of evading anti-dumping duties, while industry groups have warned of big losses from cheaper steel in the market. Vietnam’s government has launched investigations into dumping of wind towers and some steel products from China after complaints from the local industries. Recommended The Big Read The looming trade tensions over China’s subsidies In August last year Mexico imposed tariffs of 5-25 per cent on imports of hundreds of goods from countries with which it does not have a free trade agreement, with China being one of the countries most affected. The tariffs were put in place amid increasing pressure from US officials, who have suggested that Mexico is not doing enough to clarify the origins of steel imports from third countries, in what trade experts say is a reference to China. The Chinese government did not immediately reply to a request for comment. It has consistently attacked what it calls “protectionism”, particularly by the US and the EU. Buen ejemplo de como afecta la política industrial China en el resto del mundo. Al final aboca a muchos países a perder la industria nacional con lo que eso conlleva y convertirse en exportador de materias primas, o a aplicar políticas proteccionistas. Tiende a confundirse la política comercial con el imperialismo o control. Creo que es un error cuando la gente plantea que China quiere dominar el mundo, soló sigue el modelo económico vigente desde hace décadas y que tan bien le funcionó. El problema es que ahora, representando el 17%-18% del PIB mundial produce el 32% de las manufacturas mundiales, hecho que conlleva a graves distorsiones en el comercio y que terminará con que todos los países apliquen aranceles para proteger la industria local. En el caso de Brasil, según tengo entendido, es la principal economía de América del Sur y la que más industria tiene y es normal que quiera protegerla. A nivel interno choca con Lula y la política de acercamiento a China, ya veremos como termina, pero creo que aplicarán aranceles. El comercio global funciona muy bien en equilibrio, sin distorsiones. Al final estas situaciones se arreglan con más proteccionismo, no general, pero sí aplicado a ciertas industrias clave en cada país. Pensad que recuperar la industria perdida cuesta mucho, se pierde el know how , la infraestructura y las redes comerciales tanto locales como internacionales. Brasil, al igual que muchos países no quiere convertirse en un exportador de materias primas sólo, y es entendible. Que quede claro que China no quiere cambiar nada, no tiene aspiraciones sobre los demás, simplemente son las consecuencias de una política industrial terriblemente subvencionada en un país que son 1.400.000.000 de personas. Hu Jintao ya vio hace más de una década el agotamiento del modelo Chino. https://www.reuters.com/article/negocios-economia-china-modelo-idLTASIE6120AV20100203/Por el momento no ha cambiado nada y eso ejemplifica lo difícil que es transicionar para un país, cambiar sus instituciones. En nuestro caso tenemos el problema de la pisitofia y estamos viendo lo difícil que es cambiar la situación dados los intereses creados. Y es interesante ver la complejidad general para no caer en simplistas argumentos de preferencias políticas o sociales. Y que en muchos casos no se basa en amigos o enemigos. No existe un eje del mal. Saludos

13

« en: Marzo 07, 2024, 12:24:01 pm »

[El adiós de Victoria Nuland —y con ella, el de su marido Robert Kagan— tiene mucho significado. Aunque parezca mentira, es rusa por parte de padre. Este es un evento de gran calidad estructuraltransicionista.]

Victoria Nuland es la señora que organizó el golpe de estado - inconstitucional por supuesto- contra el presidente ucraniano Yakunovitch, que era prorruso, y que se habia inclinado por unirse a la Union Euroasiatica en vez de a la UE porque Rusia ofrecia mas dinero a Ucrania a cambio, lo qur provoco que las regiones del Este y Sur de Ucrania se levantasen contra el golpe y, a partir de ahí, ya saben todos el resto. Es la misma señora que cuando se le advirtió de que a la UE no le iba a gustar nada lo que estaba organizando dijo, " que se joda la UE". Casada con Robert Kagan, uno de los neocon más peligrosos, es ciertamente de ascendencia rusa, al igual que su marido. Cualquiera diría que tiene alguna cuenta pendiente con su país de origen y ha estado cobrándosela.

Por otro lado está claro que el ataque a Rusia formaba párte de la estrategia neocon para el nuevo siglo americano, que consistía en asegurar el acceso de los Estados Unidos a las fuentes de recursos y la eliminación de posibles rivales en el siglo XXI. Curiosamente estos neocons eran la mayoría troskos en su juventud, discípulos de Karl Strauss, que a su vez lo era de Karl Schmidt el jurista aleman que creo el soporte legal del estado nacionalsocialista alemán.

PD Edito para comentar que Nuland se va, no la echan. O al menos es lo que parece. Es más un " he hecho mi trabajo" que un cambio de política en la administración Biden.

No pasa el filtro de wikipedia:

Tras la huida del presidente de Ucrania Víktor Yanukóvich en dirección desconocida el 21 de febrero de 2014,38 la Rada Suprema destituyó del cargo a Yanukóvich por «el abandono de sus funciones constitucionales».39 El 23 de febrero de 2014, el jefe del grupo parlamentario del Partido de las Regiones que lideraba Yanukóvich, Oleksandr Yefrémov, responsabilizó a Yanukóvich del saqueo del país y del derramamiento de sangre.40

[...]

Los sucesos se habían desencadenado en Kiev la noche del 21 de noviembre de 2013, un día después de que el Gobierno de Ucrania hubiera suspendido in extremis la firma del Acuerdo de Asociación y el Acuerdo de Libre Comercio con la Unión Europea (UE).1

Aunque el 30 de marzo de 2012, Yanukóvich y los líderes de la UE habían acordado un estatuto de asociación de Ucrania con la UE, la entrada en vigor se fue aplazando y las negociaciones quedaron estancadas durante un año, entre otras razones porque una de las exigencias europeas era la liberación de Yulia Timoshenko y Yuri Lutsenko, opositores al Gobierno. Ello no impidió que durante los meses previos al inicio de las protestas, Yanukóvich prometiera realizar las reformas necesarias para seguir adelante con las negociaciones.

Victoria Nuland

https://es.wikipedia.org/wiki/Victoria_Nuland

Euromaidán

https://es.wikipedia.org/wiki/Euromaid%C3%A1n

https://es.m.wikipedia.org/wiki/Wikipedia:Aviso_de_contenido

Wikipedia no son las tablas de Moisés

Nadie lo niega. Pero aportar fuentes a tales afirmaciones ayuda al debate. Saludos

14

« en: Marzo 01, 2024, 12:16:50 pm »

Hoy estoy obtuso, Asustadísimos. ¿ En qué se traduce eso? ¿En bajada brusca de tipos? ¿En subida brusca de tipos? ¿En medidas fiscales? Porque si ahora bajan los tipos lo único que pasaría si no hay otras medidas es que gente volverá a endeudarse, con lo que los precios de la vivienda subirán, al menos eso he entendido que se ha explicado en el foro - a lo mejor no lo he entendido bien-, y si suben los tipos no hay represión financiera sino todo lo contrario

La cosa es que esta vez tienen que morir las expectativas. Las burbujas especulativas se nutren de las expectativas y de la financiación. La crisis de 2008 demostró que cortar la financiación no es suficiente, desde luego interrumpe la burbuja pero por sí misma no basta. Las expectativas pueden sobrevivir "esperando tiempos mejores".

Por lo tanto, efectivamente hay un problema con los tipos si bajan demasiado pronto. Ya han visto el bombardeo de "noticias" bailando la danza de los tipos bajos, que hay que aguantar que no pueden tardar en llegar. El rentismo y la especulación están dejando muy claro dónde están posicionados.

Ahora se trata de matar las expectativas, y como ya se ha señalado mucho en el foro, hay que hacer algo más que subir tipos. Bastante más. Hay que dejar claro que El Pisito no es la vía para enriquecerse y vivir de poner el cazo. Aunque el inmobiliario comercial y de oficinas ya está colapsando, el residencial es el búnker final, el nivel final de esta pesadilla de videojuego. Ármense de paciencia porque si creen que esta partida va a ser corta lo llevan claro.

Pues que anuncien un plan para reconvertir edificios de oficinas en vivienda, otro plan para construir (ni que sea algo) vivienda pública, subida del IBI a las 3eras viviendas (vamos a ser benevolentes con la segunda vivienda), prohibir airbnb en algunas ciudades (Barcelona, Madrid, Valencia, Bilbao, etc)...

Sólo si se anuncia una medida tras otras, cada 2 meses se podrá empezar a matar al rentismo. Y ojo, que esto se tiene que magener 3 o 4 legislaturas, no 1!

Mucho más fácil. Limitación de los pisos turísticos en zonas tensionadas a, digamos, 1 por cada 3000 viviendas, y obligatoriedad de que los pisos turísticos cumplan con ciertos requisitos (nada de zulos cuquificados). Por ejemplo, que tengan que tener al menos una habitación (nada de estudios), mínimo 50 mts cuadrados, sean exteriores y tengan que estar insonorizados por Ley. Te quitas de enmedio todos los infrapisos que se compraron para alquiler vacacional.

A eso le añadimos un globo sonda de que se va a expropiar el usufructo de los pisos vacíos en zonas tensionadas durante 20 años y se van a alquilar por el precio de referencia (los beneficios de ese alquiler irán, por supuesto, al dueño del piso, descontando los gastos de gestión de la administración y cualquier reforma que se haya tenido que hacer para hacerlo habitable).

Estas dos cosas se pueden hacer en esta legislatura. Con la mierda que está saliendo en el Koldogate, el gobierno tiene distracciones hasta 2026.

Leí por ahí que en Madrid los pisos turísticos son uns 20.000, insuficientes para modificar la pisitofia. Saludos.

15

« en: Febrero 29, 2024, 19:32:40 pm »

El nuevo límite al alquiler frenará la reforma de pisos en Barcelona: la inversión ya no se amortizará

Lástima del muro de pago. Pero ya ven la "amenaza", se acabó eso de alicatar el baño para sacarle 200 o más al mes al "hactibo".

Ahora viene la capacidad de resistir del propietariado. Alimentados están, con pensiones, sueldos públicos o privados..... veremos la capacidad de resistir al sentido común que dicta que la vivienda es un bien básico.

Se imaginan la que armaría todo el mundo si la sanidad tuviera el mismo nivel especulativo?

Saludos.

La diferencia con la sanidad es que tu enfermedad no implica la salud de otro. Ah, si mis hijos pudieran sanar a base de enfermar a los hijos de los demás...

Exacto, es más rastrero aún.

|