Blog

Blog

Últimos mensajes

Últimos mensajes

Temas mas recientes

Temas mas recientes

|

Esta sección te permite ver todos los posts escritos por este usuario. Ten en cuenta que sólo puedes ver los posts escritos en zonas a las que tienes acceso en este momento.

Mensajes - Derby

1

« en: Hoy a las 11:16:17 »

https://www.ft.com/content/af44329d-e861-449e-9d2f-0656e2e0aa15A message from the IMF on how to fix the EU’s ‘limping’ single market

Also in this newsletter: former executive of a scandal-embroiled Polish oil group is running for a seat in EU parliament

Good morning. You’re getting the newsletter from me this week while Henry is away for the next 10 days.

But first, he left a dispatch from the chief of the IMF, who has a primer on how to boost the EU’s economic confidence. And our man in Warsaw looks into the embattled former head of Poland’s national oil company’s pursuit of a seat in the European parliament.

Cool, calm, collected

As European leaders grapple with how to reverse the continent’s sense of economic malaise, the head of the IMF has a piece of advice to start: stop being so critical, writes Henry Foy.

Context: How to improve EU competitiveness is a key focus for Brussels, as member states fret that the bloc is rapidly falling behind the US and China.

“Europe is rich. [The] question is how you . . . get Europe to regain self-confidence. I’ve never seen anybody succeeding with a lack of confidence,” said Kristalina Georgieva, the fund’s managing director. “So maybe if the European leaders talk more about what Europe can do rather than what it cannot, we’ll be in a better place.”

She said that while “Europe has strengths”, the issue was that “the single market is still limping”. According to Georgieva, Europe’s main disadvantages against the US are a lack of domestic energy supplies, a fractured capital market and a failure to leverage migration.

But she’s got a fix at least for the latter two.

“The capital markets union is absolutely essential for European competitiveness, because in the absence of it, the financial assets of Europe do not work hard enough,” Georgieva said about Brussels’ eternal project to harmonise financial markets.

“If you compare the United States and Europe in terms of size of financial assets, they’re pretty much the same . . . But in the United States, the functioning of the capital markets is what makes a huge difference in how these financial assets deliver for the economy.”

“These are 27 countries, of course. They are not one country as the United States is,” she added. “But even so, there is much more that you can do. And it doesn’t cost money. The only thing it requires is political will.”

Georgieva also said that migration could provide a solution to Europe’s ageing population.

“We have an ageing population in Europe. And immigration is not an easy topic,” the Bulgarian said. “But despite all the agitations [over migration] in the United States, the inflow of immigrants makes a huge difference to the US economy. Whereas in Europe, that is not so much the case.”

The spectacular economic growth of 10 countries that joined the EU two decades ago is one of the continent’s clearest success stories. But as the early gains start to fade and living standards catch up, a new impetus is needed.(...)

2

« en: Hoy a las 10:08:20 »

https://www.ft.com/content/c2973eac-16c3-47b3-9e45-64d5da0e7e8a#post-98f022e4-fd45-4ff5-8ef9-41da9ec37770Births in Germany fall to lowest level for a decade, compounding demographic challenges

German births fell last year to their lowest level for a decade, while the number of marriages also declined sharply close to record postwar lows, compounding the demographic challenges facing Europe’s largest economy.

The 693,000 babies born in Germany last year dropped 6.2 per cent from the previous year to the lowest level since 2013, according to figures published by the federal statistical office on Thursday.

The difficulty of tackling Germany’s ageing population was underlined by a 7.6 per cent drop in the number of marriages in the country, which fell to the lowest level since the start of the data in 1950 — excluding 2021 when pandemic lockdowns caused many nuptials to be postponed or cancelled.

3

« en: Ayer a las 21:26:02 »

https://www.ft.com/content/5babf13a-3a23-4b24-947f-a958c3df0192Federal Reserve signals that interest rates will remain higher for longer

US central bank says there has been a ‘lack of further progress’ towards 2 per cent inflation goal

The Federal Reserve has signalled that US borrowing costs are likely to remain higher for longer, as a it wrestles with persistent inflation across the world’s biggest economy.

The Federal Open Market Committee said after its meeting on Wednesday that there had been “a lack of further progress” towards its 2 per cent inflation goal in recent months — an addition to its statement that in effect delays rate cuts until the second half of this year at the earliest.

“It is likely to take longer for us to gain confidence that we are on a sustainable path down to 2 per cent inflation,” Fed chair Jay Powell said during a news conference. “I don’t know how long it will take,” he added.

But the Fed also indicated that it was not yet considering new rate rises to counter the recent uptick in inflation, saying that the risks to meeting its joint goals of full employment and subdued price pressures had “moved towards better balance over the past year”.

“I think it’s unlikely that the next policy rate move will be a hike,” Powell said.

The comments from Powell came as the US central bank held interest rates at 5.25 per cent to 5.5 per cent, a 23-year high that has been in place since the summer of 2023.

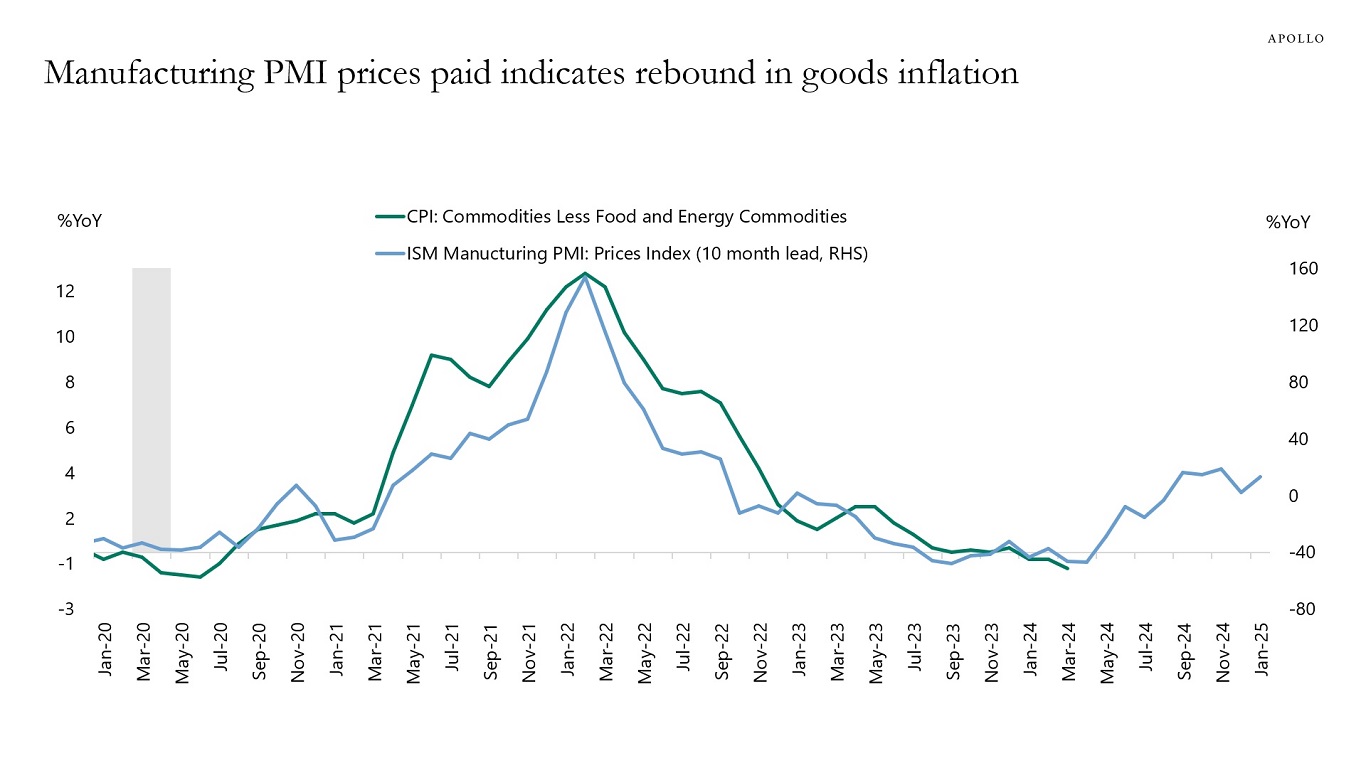

The higher-for-longer rate signal from the Fed follows recent data showing that inflation had crept higher again, largely driven by costlier fuel, while the US economy grew more slowly in the first quarter of the year than expected.

The comments from the central bank also mean that borrowing costs could remain higher for many US voters in the run-up to this year’s presidential election in November. President Joe Biden said recently that he “expected those rates to come down” this year.

“The Fed’s room for manoeuvre has shrunk drastically, with inflation ticking up, growth slowing, and the political calendar becoming an increasingly tight constraint,” said Eswar Prasad, an economics professor at Cornell University.

“The spectre of stagflation, which the Fed seemed to have decisively put behind it in 2023, is now back in the picture,” he added.

The Fed also announced that from June it would reduce the cap on the amount of US Treasury bonds it allows to mature each month, without buying them back, from $60bn to $25bn. It would still allow up to $35bn in mortgage-backed securities to roll off the balance sheet. Any principal payments in excess of the $35bn cap would also be reinvested in Treasuries.

In a market where some Treasury auctions are currently at record sizes, the slowdown in quantitative tightening could help bolster prices, and lower yields.

US rate-setters had hoped to cut interest rates three times this year, but higher-than-expected inflation in recent months has raised the prospect that the Fed will keep borrowing costs at current levels for the duration of 2024.

Ahead of the meeting, traders in the futures market were betting on between on and two cuts this year, with the first reduction not fully priced in until December.

As Powell spoke on Wednesday, US stocks rose, reversing earlier losses, while Treasury yields dropped. The two-year yield, which moves with interest rate expectations, slid 0.09 percentage points to 4.94 per cent. Market expectations of rate cuts later this year, as observed in the futures market, were little moved in the middle of the press conference.

The Fed statement on Wednesday came after recent price data showed its progress in lowering inflation in 2023 has stalled this year.

The headline personal consumption expenditures measure, on which the Fed’s 2 per cent goal is based, edged up in March — to 2.7 per cent, from 2.5 per cent in the year to February.

Rate-setters’ preferred gauge of underlying price pressures, core PCE, which strips out volatile food and energy prices, was unchanged at 2.8 per cent.

While the progress on inflation has stalled, economic growth has also fallen back, with gross domestic product dropping in the most recent quarter to an annualised rate of 1.6 per cent, down from 3.4 per cent in the fourth quarter of 2023.

Analysts have also warned that turmoil in the Middle East could push oil prices higher, adding to inflation for other goods.

The jump in fuel costs led some analysts to warn about the prospect of “stagflation” if energy prices continued to rise while economic growth cooled.

4

« en: Ayer a las 20:29:45 »

5

« en: Ayer a las 18:00:00 »

https://www.cnbc.com/2024/05/01/why-hundreds-of-us-banks-may-be-at-risk-of-failure.htmlFED NOTES

Why hundreds of U.S. banks may be at risk of failure

Hundreds of small and regional banks across the U.S. are feeling stressed.

“You could see some banks either fail or at least, you know, dip below their minimum capital requirements,” Christopher Wolfe, managing director and head of North American banks at Fitch Ratings, told CNBC.

Consulting firm Klaros Group analyzed about 4,000 U.S. banks and found 282 banks face the dual threat of commercial real estate loans and potential losses tied to higher interest rates.

The majority of those banks are smaller lenders with less than $10 billion in assets.

“Most of these banks aren’t insolvent or even close to insolvent. They’re just stressed,” Brian Graham, co-founder and partner at Klaros Group, told CNBC. “That means there’ll be fewer bank failures. But it doesn’t mean that communities and customers don’t get hurt by that stress.”

Graham noted that communities would likely be affected in ways that are more subtle than closures or failures, but by the banks choosing not to invest in such things as new branches, technological innovations or new staff.

For individuals, the consequences of small bank failures are more indirect.

“Directly, it’s no consequence if they’re below the insured deposit limits, which are quite high now [at] $250,000,” Sheila Bair, former chair of the U.S. Federal Deposit Insurance Corp., told CNBC.

If a failing bank is insured by the FDIC, all depositors will be paid “up to at least $250,000 per depositor, per FDIC-insured bank, per ownership category.”

6

« en: Ayer a las 11:37:43 »

https://www.bloomberg.com/news/articles/2024-05-01/bbva-s-deal-appetite-signals-a-bigger-shakeup-at-european-banksBBVA’s Deal Appetite Signals a Bigger Shakeup at European Banks

Sabadell said Tuesday it has received bid proposal from BBVA

Spain is a hotbed for domestic banking consolidation in Europe

The animal spirits look like they’re returning to European banking.

The announcement by Banco Bilbao Vizcaya Argentaria SA on Tuesday that it wants to begin talks to take over Banco Sabadell SA comes as further evidence that a long hoped-for consolidation in the region’s banking market is accelerating.

While a tie up would not be the transformational, cross-border merger that many bankers and regulators have wanted, it stands to create a lender with more than €1 trillion ($1.1 trillion) in assets and a market value close to Banco Santander SA’s current €72 billion valuation. It would give BBVA a profitable UK business as well as enable them to grow their Mexican business.

An unusual confluence of factors has arrived. After almost two years of interest rate hikes, many lenders have reaped record profits that they’re under pressure to put to good use — and buybacks aren’t always the answer. As the focus now turns to when rates will go down again, executives are looking for opportunities to diversify.

“As we slowly approach the first potential European Central Bank and Bank of England rate cuts, consolidation across the industry will gain front seat,” said Filippo Maria Alloatti, an analyst at Federated Hermes.

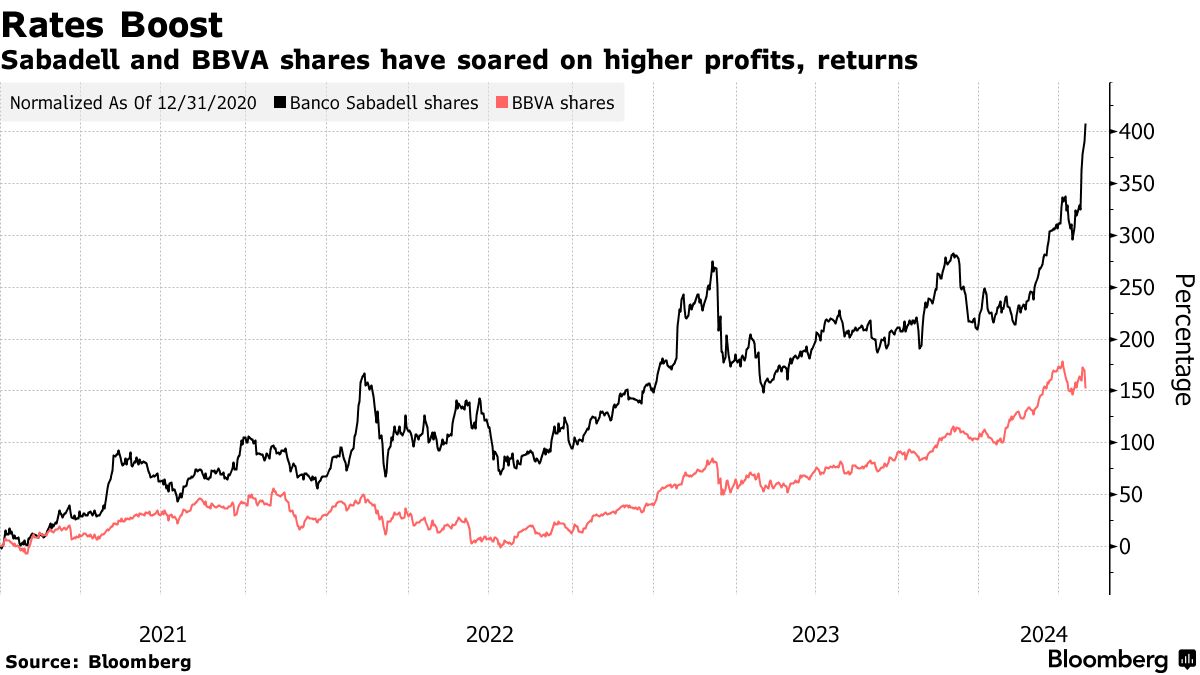

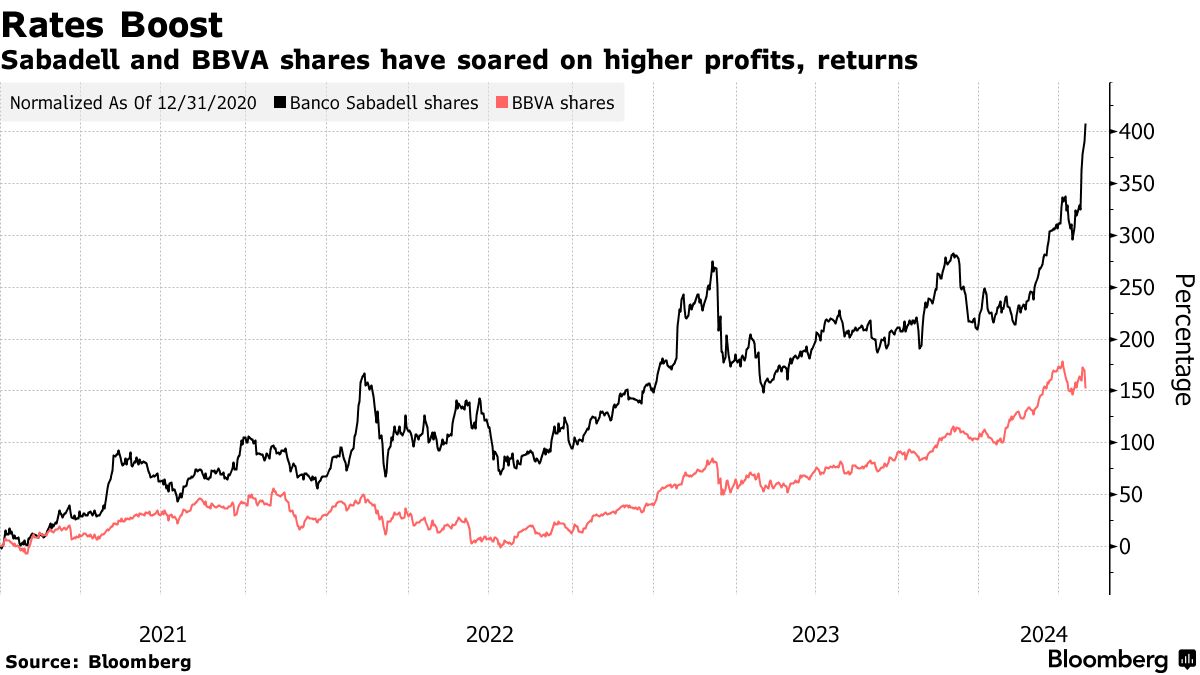

European lenders have seen a 25% increase in 2024 consensus net profit since the start of 2022, spurred by rising interest rates, according to Bloomberg Intelligence. Record profits, including among the Spanish and Italian retail-banking groups that have benefited from the economic growth in Southern Europe, are beginning to shake up established patterns.

This year, Spain, Portugal and Greece — bolstered by booming exports, tourism and lower energy prices — are expected to be among the top performing economies in the euro region, according to the European Commission.

BBVA Chairman Carlos Torres now joins UniCredit CEO Andrea Orcel and others openly on the hunt for deals. Orcel’s bank bought the Greek government’s 9% stake in Alpha Bank in October and announced a tie-up in Romania. The Italian has made no secret of the fact that he has billions of euros in spare capital looking to be put to use.

French lenders are also on the move, where the eye for transactions goes beyond one-for-one mergers in banking. Earlier this month BNP Paribas SA agreed to buy Fosun International Ltd’s stage in Belgian insurer Ageas for about €730 million. Societe Generale SA disposed of two units within days this month, helping to arrest a slump in its stock price.

In the wake of the financial crisis a decade and a half ago, Spain experienced a rapid concentration of banks. Lenders in the country cut their number of branches by almost two thirds and the number of staff by over 40% since the end of 2008, according to credit rating firm S&P. CaixaBank acquired Bankia in 2020 and Unicaja bought Liberbank the same year, while Santander took over smaller lender Banco Popular in 2017.

Europe’s bank leaders for years have emphasized the need for transformational deals to stand out in a fragmented market that’s glutted with thousands of smaller, regional lenders. The lack of common deposit protection across the European Union and cumbersome regulations have stymied such efforts across borders.

The so-called “banking union” project has been stalled for years on the lack of political will — yet even there are some signs of change. Earlier this month European lawmakers approved the first step in a plan to pool insurance for bank depositors.

7

« en: Ayer a las 11:25:49 »

https://www.vozpopuli.com/economia_y_finanzas/banca/sabadell-exige-bbva-lanzar-oferta-serio-efectivo-negociar-fusion.htmlEl Sabadell exige a BBVA lanzar una oferta “en serio y en efectivo” para negociar la fusión

“Somos compradores”, transmiten desde el seno del Sabadell, reticente sobre todo por el negocio en Turquía.

El Sabadell vuelve a dar calabazas al BBVA en su nuevo intento de compra. Al menos, en un primer momento. La entidad de origen catalán se resiste a caer en las redes del banco de La Vela y le exige lanzar una oferta “en serio y en efectivo”, como trasladan a Vozpópuli fuentes solventes cercanas a la operación. La intención del BBVA pasa por un canje de acciones, con una prima de más del 20%, pero la cúpula del Sabadell se opone a aceptar estos términos.

En todo caso, la intención de fusión no es amistosa y no está pactada entre las cúpulas de ambos bancos. Como publicó este medio, BBVA planeaba una oferta plenamente en acciones, ofreciendo una ecuación de canje con una prima de entre el 20% y el 25%. Es decir, estaría dispuesto a ofrecer al Sabadell una horquilla de entre 0,23-0,25 acciones por cada una de la entidad de origen catalán.

“No tienen intención de vender el banco. Les va muy bien. Se consideran compradores y no vendedores”, afirman fuentes financieras próximas al Sabadell. De hecho, la entidad había aparecido en las quinielas de fusiones como comprador de Unicaja, que de momento ha dado un tiempo prudente al nuevo CEO, Isidro Rubiales, para tratar de dar la vuelta al banco.

Fuentes cercanas al Sabadell transmitían en privado hace unos días que habría que esperar para otra ronda de concentración bancaria por las altas valoraciones en Bolsa. "Exigen pagar primas muy elevadas", aseguraban las fuentes, que situaban al banco como "comprador" y apuntaban más hacia un momento en el que el BCE empezara a definir de forma clara el nuevo escenario de tipos.

El lastre del negocio de Turquía

Las reticencias del Sabadell se deben sobre todo al negocio en Turquía, el talón de Aquiles de BBVA desde hace tiempo. La cúpula directiva del Sabadell tampoco tiene interés en crecer más en México, en donde tiene una pequeña presencia y donde ya se planteó salir antes de la fusión frustrada en 2020.

"En La Vela se lamentan de perder la oportunidad en 2020, a precios más bajos. "Torres va a caer en el mismo error", insisten en el seno del Sabadell

Con las condiciones actuales, una oferta en acciones, en el seno del Sabadell se considera que la operación volvería a descarrilar. “No se entiende cómo Carlos Torres va a caer en el mismo error”, trasmiten fuentes internas del banco de origen catalán.

A finales de 2020, BBVA puso sobre la mesa unos 2.500 millones para hacerse con el Sabadell. Pero las diferencias de precio y el reparto de la cúpula tiraron por tierra las negociaciones apenas dos semanas después de confirmar los contactos ante la CNMV. Desde ese momento, dentro La Vela muchos directivos lamentaba la “oportunidad perdida”, como indican fuentes próximas a la entidad presidida por Carlos Torres.

"BBVA y Sabadell crearían un gigante bancario con un billón de activos en el mundo y disputarían el liderazgo en España a CaixaBank

El BBVA confirmó ayer que ha trasladado al presidente del consejo de administración de Banco de Sabadell el interés en iniciar negociaciones para explorar una posible fusión. Minutos después, el banco presidido por Josep Oliu anunciaba que había recibido "a las 13.43 horas" una "propuesta indicativa" para su integración, lo que daba muestras de que no se trataba de una fusión amistosa.

Buenas valoraciones en Bolsa

El planteamiento de una fusión con un canje de acciones tiene todo el sentido económico, como indican distintas fuentes financieras. Tanto BBVA como Sabadell se han anotado fuertes subidas en Bolsa al calor del ciclo histórico de aumentos de los tipos. El banco de La Vela ha superado máximos y ha protagonizado un rally bursátil superior al 60% en el último año. En los últimos cuatro años, las acciones del Sabadell se han multiplicado por cinco.

BBVA se lanzó a por el Sabadell en 2020 tras vender la filial de Estados Unidos por 9.600 millones, que le generó un exceso de capital de unos 8.000 millones. Pero tras el fracaso de las conversaciones de hace casi cuatro años, se estima que el talón disponible para adquisiciones asciende a unos 2.500 millones, que sería insuficiente para lanzar una OPA en efectivo.

BBVA tiene en la actualidad un valor en bolsa cercano a los 60.000 millones, mientras que la capitalización de Sabadell ronda los 10.000 millones. La integración de ambas entidades crearía un gigante bancario de cerca de un billón de activos en todo el mundo y disputaría el liderazgo en España a CaixaBank y al Santander.

8

« en: Abril 30, 2024, 21:11:44 pm »

https://www.bloomberg.com/news/articles/2024-04-30/rogoff-says-markets-would-upend-political-bashing-of-the-fedRogoff Says Markets Will Thwart Any Political Pressure on Fed

Harvard economist cites fiscal policy impact in his calculus

Rogoff says there is some ‘reversion to the mean’ under way

Harvard University economics professor Kenneth Rogoff said that financial markets would effectively impose restraint on any move by a US president to force the Federal Reserve into easing monetary policy.

“If you take away Fed independence, investors are going to get jittery, inflation expectations are going to go up, the dollar’s going to tank,” Rogoff said on Bloomberg Television’s Wall Street Week with David Westin. “For better or for worse, maybe, I think markets will throw a pretty cold bucket of water on the president if he tries to do that.”

With the Fed for now pledging to keep interest rates at the highest level in decades, investors have been eyeing speculation that former President Donald Trump might seek to force policymakers into cutting their benchmark should he win November’s election. Rogoff noted that there are also progressive Democrats who have tried to pressure the Fed into easing.

“Almost no matter who’s in power, they’re looking for ways to try to loosen monetary policy,” Rogoff said. “The progressives have ideas for taking away Fed independence too. They’re not at the tip of the tongue of President Biden or Jared Bernstein and his advisers, but they are ideas floating out there.”

Bernstein, who heads President Joe Biden’s Council of Economic Advisers, last week highlighted the importance of shielding the Fed from politics. “I can spend a long time talking to you about economies that have been brought to their knees when the independence of the central bank has been compromised,” he said.

Rogoff, a former International Monetary Fund chief economist, also said that political influence will be difficult for the Fed to reject in its entirety.

Rate Outlook

“Of course the Fed’s heart is in the right place, but it’s hard to be an island of technocratic tranquility in the middle of a sea of political turmoil,” he said.

He also said he expects long-term interest rates to remain elevated for years to come. Ten-year Treasury yields are currently around 4.66%, compared with an average of 2.36% over the past decade.

“Long-term interest rates are probably higher for as far as the eye can see,” Rogoff said. “Even after the Fed unwinds its interest-rate hikes, I think they’re going to stay higher for a very long time.”

(Updates with further comments from Rogoff starting in fourth paragraph.)

9

« en: Abril 30, 2024, 15:56:40 pm »

https://www.ft.com/content/879f5de7-cd9b-4987-9c2b-8b23cf0f3800China’s problem is excess savings, not too much capacity

Policymakers on either side of bitter trade dispute seem to confuse two issues

While China and its trade partners continue to clash bitterly over manufacturing overcapacity and global trade, much of the discussion seems to be occurring at cross purposes.

Excess Chinese capacity in targeted industrial sectors is one area of contention. Excess Chinese savings driven by the suppression of domestic demand is another issue. These two points of contention are very different but analysts and policymakers on either side seem to confuse the two.

In the former case, Beijing has targeted certain industries such as electric vehicles and solar panels that it believes to be strategically important, and has implemented policies that are designed to give Chinese producers in these sectors a long-term comparative advantage. There is nothing especially Chinese about this strategy. Most large economies also employ policies to support or protect favoured sectors.

As these policies work at the expense of foreign manufacturers, they often generate a great deal of outrage, but much of this reaction is self-serving. Comparative advantage, which is what drives the benefits of trade, implies that some countries are able to produce certain goods more efficiently than others. The purpose of trade, after all, is to concentrate production in those countries that have a comparative production advantage.

But comparative advantage is only realised in the exchange of goods, and not in their production. This is where the problem of excess Chinese savings emerges. China’s structurally-high domestic saving rate is the result of a decades-long development strategy in which income is effectively transferred from households to subsidise the supply side of the economy — the production of goods and services. As a result of these transfers, growth in household income has long lagged behind productivity growth, leaving Chinese households unable to consume much of what they produce.

Some of these subsidies are explicit but most are in the form of implicit and hidden transfers. These include directed credit, an undervalued currency, labour restrictions, weak social safety nets, and overinvestment in transportation infrastructure. These various policies automatically force up Chinese savings. By effectively exporting excess savings through the subsidy of the production of goods and services, China is able to externalise the resulting demand deficiency.

The fact that China dominates certain manufacturing sectors is perfectly consistent with free trade and comparative advantage. It is excess savings that creates a problem for the global economy — and it should be noted that many countries besides China engage in similar behaviour, including Germany and Japan. The problem is that these excess savings represent the suppression of domestic wages, and thus domestic demand, to achieve global competitiveness.

These are classic beggar-thy-neighbour trade policies in which unemployment — the consequence of deficient domestic demand — is exported by running trade surpluses. These surpluses must be absorbed by trade partners, usually in the form either of higher unemployment, higher fiscal deficits or higher household debt.

This is why the policy implications of the two points of contention are very different. The problem of excess savings can make the problem of excess capacity much worse. Trade-deficit countries seek to protect their economies from the excess saving of demand-deficient countries. This can be in the form of restrictions on trade or on capital inflows.

Beijing will no doubt continue to protect and support industries it deems to be strategically important, as will the US, the EU, and the rest of the world. This will lead inevitably to clashes, rising protectionism and widespread overcapacity in some sectors. In a well-functioning global trading system, countries produce goods in which they have a comparative production advantage, and then exchange them for goods in which they don’t. Thus the global economy is better off, even if individual sectors suffer.

When the purpose of exports, however, is to externalise the problem of weak domestic demand, the global economy can only be worse off, as John Maynard Keynes noted at Bretton Woods. The world must resolve the issue of excess savings and unbalanced trade, even as individual countries clash separately over excess capacity and comparative advantage.

10

« en: Abril 30, 2024, 15:48:31 pm »

https://www.bloomberg.com/news/articles/2024-04-30/vanke-to-exit-non-core-business-divest-assets-for-liquidityVanke to Exit Non-Core Business, Divest Assets for Liquidity

Developer to focus on three main real estate businesses

Chairman Yu pledged to cut debt by half in five years

China Vanke Co. will exit non-core operations and divest assets as the developer seeks to boost liquidity amid the sector’s unprecedented downturn, according to a memo from a shareholder meeting on Tuesday.

The company will “trim down” and adjust its model for raising money, Chairman Yu Liang said in the meeting. It will also exit all businesses except for the three main operations, which focus on property development, real estate management services and rentals.(...)

11

« en: Abril 30, 2024, 15:17:59 pm »

https://www.bloomberg.com/news/articles/2024-04-30/beijing-further-loosens-home-buying-curbs-in-non-core-areasBeijing Further Loosens Home Buying Curbs in Non-Core Areas

China’s capital city Beijing will allow families to buy one more home in non-core areas, as even the nation’s largest cities are buckling under the pressure of a record real estate downturn.

Households that reach current homeownership limits will be allowed to purchase another outside the fifth ring, according to a statement from the city’s housing commission.(...)

12

« en: Abril 30, 2024, 15:14:48 pm »

https://www.bloomberg.com/news/newsletters/2024-04-30/biggest-threat-to-the-uk-housing-market-is-rising-interest-ratesThe Biggest Threat to the UK Housing Market

Mortgage rates are steadily ticking higher.

Will rising mortgage rates stall the housing recovery?Photographer: Chris Ratcliffe/Bloomberg

The big threat to the UK housing market this year

This morning we got the latest chunk of data on the state of the UK housing market, and it suggests that the recovery continues.

According to the Bank of England, mortgage approvals for new home purchase picked up again in March. Overall, there were 61,300 approvals, up from 60,500 in February.

For perspective, that’s getting close to the 2014 to 2019 monthly average of around 66,000, as shown on the chart below. In case it’s not obvious, I’ve chosen those years as they are the closest thing to a recent “stable” economic period for the housing market, coming before the pandemic, and after the market had broadly recovered from 2008.

What’s behind this recovery? You could point to a number of things. There’s got to be an element of pent-up demand here. When you want to move, you want to move, and you’re only going to delay for so long — particularly when monthly rents are so expensive too.

But I think the obvious key point to note is that the effective interest rate on new home loans declined significantly in March, to 4.73% from 4.9% in February. The rate peaked in November at just over 5.3%, according to the BOE’s data. In other words, loans to buy houses have become more affordable, while house prices haven’t really gone anywhere.

All’s well that ends well? (At least, assuming that you don’t mind house prices still being extremely high, distracting massively from the efficient allocation of capital in the broader UK economy, but that’s another story.)

Well, obviously this is where we come to the snag.

Interest Rates Keep Ticking Up

Broadly speaking, mortgages are priced off market expectations for future interest rates. That way, a bank can lend you money for five years at one rate and be sure that it’ll make a profit on the loan.

This is all affected by the intensity of competition in the market (and UK mortgage lending is like UK supermarkets — extremely competitive) and regulation and all the rest of it, but if you want to know if mortgage rates are heading higher or lower, your best initial bet is to look at what markets expect to happen.

As we’ve pointed out here before, market expectations for interest rates have been climbing pretty much non-stop since the turn of the year. Expectations are now roughly back to where they were in November 2023.

So I’m wondering what will happen now that mortgage rates are creeping higher again. The best-buy five-year fix now seems to be up over 4.1% — at the start of the year it was below 4%. Two-year fixes are closer to 4.6%.

Now, rising rates don’t necessarily mean the market will run aground again. There’s a tricky balancing act here. If the UK economy does OK (and it seems to be, despite the reluctance of many to accept that), then you’ll have a combination of rising real wages (ie higher pay post-inflation) plus job security, plus home deposit stashes earning real interest.

If you assume broadly static or weakly rising nominal house prices, then in that scenario, a continuing recovery — perhaps then leading to more strongly rising prices — makes logical sense. It also helps that lending standards are being relaxed a little — there are more products available now with sub-5% deposits, notes Niraj Shah at Bloomberg Economics.

And momentum matters. Moving house is a slow and painful process. It involves a lot of cost in terms of both money and time. At any given point in the process, each of those individual costs is a sunk cost — whether you pull out or go ahead, you’ve lost the money either way, and if you’re making a mistake, it’s better to stop rather than compound it.

But as those of you who’ve read your behavioural economics primers will know, our brains are not wired to view costs — emotional, temporal, or financial — in this way, which is why we can be prone to seeing bad decisions through to their inevitable disastrous climax.

So turning the housing market round again, once it’s got a head of steam behind it, is not a rapid process. Particularly as banks are keen to lend.

For now, I think the main risk this year will be if inflation remains sticky, and hopes for rate cuts fade further. I don’t currently have a strong conviction on which way that’s going to go. All I would suggest is that if you are facing refinancing your mortgage in the near future, start looking now. You can always change your mind closer to the actual deadline.

Send any feedback, opinions or questions to jstepek2@bloomberg.net and I’ll print the best. If you were forwarded this email by a friend or colleague, subscribe here to get your own copy.

13

« en: Abril 30, 2024, 10:00:22 am »

https://www.elconfidencial.com/inmobiliario/inversiones-alternativas/2024-04-30/perdidas-historicas-fondos-inmobiliarios_3875406/INVERSIÓN

Los fondos inmobiliarios pierden dinero por primera vez desde la gran crisis financiera

El giro al alza de los tipos de interés ha llevado a que los rendimientos de los fondos de inversión inmobiliaria hayan sido negativos por primera desde el año 2009

Un año para olvidar. Así podría resumirse el sentir en los responsables de los grandes fondos inmobiliarios internacionales, que por primera vez desde la crisis gran financiera han visto cómo los retornos de estos vehículos han sido negativos. Dicho con otras palabras, han perdido dinero, algo desconocido desde 2009.

Quien ha puesto negro sobre blanco este dato ha sido la consultora McKinsey, que su último informe Global de Mercados Privados (McKinsey Global Private Markets Review 2024: Private markets in a slower era) pone el acento en dos significativos indicadores que permiten medir la temperatura real del mercado inmobiliario.

Por una parte, destaca que la recaudación global de los fondos cerrados, lo que se conoce en la jerga del sector como fundraising, cayó un 34% el pasado ejercicio. Por otro, que los retornos hasta septiembre de 2023 registraron una caída del 4%, algo no visto desde el estallido de la burbuja inmobiliaria.

"La incertidumbre de la demanda, la desaceleración del crecimiento de los alquileres y los elevados costes financieros elevaron las tasas de capitalización y presionaron los precios, todo lo cual afectó tanto al volumen de transacciones, como a la recaudación de fondos y al desempeño de las inversiones", señalan los expertos de McKinsey en su informe.

El giro al rojo del rendimiento de estos vehículos es la última evidencia del cambio de ciclo al que se enfrenta el mercado. La era de dinero barato y tipos cero que siguió a la crisis financiera benefició especialmente al sector de la inversión inmobiliaria, ya que los inversores institucionales aumentaron su exposición a este tipo de activos ante la falta de rentabilidad de otros productos.

A esto se unió la propia recuperación del mercado, que, tras tocar suelo entre 2010 y 2013, en función de los países (con España a la cola), se sumó al crecimiento económico que sigue a toda crisis, lo que alimentó todavía más el peso de este tipo de activos en las carteras de los grandes vehículos de inversión internacionales.

Sin embargo, todo este esquema se vino abajo con el giro de las políticas de tipos de interés de los bancos centrales. Primero la Fed (Reserva Federal estadounidense), en la primavera de 2022, y después el BCE (Banco Central Europeo), a las puertas del verano, iniciaron una histórica espiral de subidas, con un nivel de intensidad y celeridad nunca visto, que rompió la cintura de los grandes inversores.

Las primeras alertas saltaron a finales de 2022. Fue entonces cuando el fondo Blackstone Real Estate Income Trust (BREIT) se vio obligado a limitar las retiradas de fondos de sus clientes, tras recibir solicitudes de reembolso que excedieron su límite. Después llegaron los casos de SREIT (Starwoodv Real Estate Income Trust) y KREST (KKR Real Estate Select Trust).

Como recuerda CVC en su informe de salida a bolsa, "a medida que los precios del sector se ajustan a la nueva normalidad macroeconómica, el volumen de transacciones, la recaudación de fondos y el rendimiento de las inversiones se han visto significativamente afectados".

Este cambio de marchas beneficia a las estrategias oportunistas frente a las conservadoras (core y core plus), ya que los inversores tienen otras clases de activos donde pueden obtener mejores rendimientos o similares, con mucho menor riesgo, como la deuda pública. Por tanto, para atraer dinero a la inversión inmobiliario, se requiere poner el foco "en la apreciación del capital por encima de la generación de ingresos", como recuerda McKinsey en su informe.

Aunque el caso de los fondos inmobiliarios sea especialmente destacable, por haber arrojado pérdidas por primera vez desde la gran crisis, la realidad es que "el rendimiento de la inversión en todas las clases de activos del mercado privado no alcanzó los promedios históricos", destaca la prestigiosa consultora estratégica en su estudio.

Los fondos de capital riesgo cerraron en positivo, pero con el rendimiento anual más bajo de los últimos 15 años, excluyendo 2022, mientras que en los fondos de infraestructura fue menos de la mitad de su promedio a largo plazo e inferior a los rendimientos de dos dígitos generados en 2021 y 2022. Sólo la deuda privada consiguió salvar la cara, "lo que ilustra el atractivo anticíclico de esta clase de activos". https://www.mckinsey.com/industries/private-equity-and-principal-investors/our-insights/mckinseys-private-markets-annual-review

14

« en: Abril 29, 2024, 21:23:30 pm »

15

« en: Abril 29, 2024, 20:22:01 pm »

La insoportable levedad (contradicción) del ser... https://www.lavanguardia.com/local/barcelona/20240429/9606329/contrataque-pisos-turisticos-legales.htmlTurismo

El contrataque de los pisos turísticos (legales)

Gestores de HUTS se defienden de los ataques que les culpan de buena parte de los problemas de acceso a la vivienda

Las idas y venidas de los turistas con maletas generan muchas quejas vecinales Propias

Los gestores de los pisos turísticos legales de Catalunya están pasando al contrataque. Porque hace años que buena parte de la clase política de este país y un montón de asociaciones ciudadanas afines les culpan de todos los problemas en relación al acceso a la vivienda. Y el decreto ley de la Generalitat que básicamente faculta a los ayuntamientos para revocar licencias levantó ya todas las lanzas.

La Federació Catalana d’Apartaments Turístics (Federatur) montó este lunes en el Col·legi d’Economistes de Catalunya un debate para advertir que las restricciones no lograrán que los jóvenes encuentren piso con mayor facilidad. De hecho, dieron a entender, mientras que las administraciones insistan en emplear los pisos turísticos como cabeza de turco y no se decidan de verdad a engordar el parque público de vivienda la situación continuará empeorando.

¿Cuántos pisos turísticos en activo suma Barcelona? pues unos 7.500 ¿y cuántos pisos vacíos se encuentran en la ciudad? pues unos 75.000 son considerados como de uso esporádico. Los números los aportó Luis Falcón, director de la consultoría inAtlas. “Está visto que el Plan Especial Urbanístico de Alojamientos Turísticos de los gobiernos de Ada Colau no mejoraron el acceso a la vivienda, y el decreto ley de la Generalitat tampoco lo harán”.

“Estamos siendo víctimas del populismo –terció Gonzalo Bernardos, profesor de Economía de la Universitat de Barcelona–. Colau empezó a culpar al turismo de todos los males. Quieren que Barcelona sea un pueblo de mala muerte ¿y de qué quieren que vivamos? ya no hay industria. Somos una capital mundial de startups gracias a los extranjeros q vienen a la ciudad. Pero a este paso en Barcelona no tendremos ni estudiantes”.

Además, el abogado Pablo Molina señaló que algunos planteamientos de la norma de la Generalitat, como el de permitir cinco años de actividad a modo de indemnización, es un sistema como poco arriesgado. “Y no se están atendiendo las particularidades de cada municipio. Los poderes públicos han de hacer vivienda pública. En realidad no están gestionando el problema”.

“Nosotros no estamos en contra de que se regule el sector –apuntó David Riba, presidente de Federatur–. Obviamente el crecimiento descontrolado es muy peligroso. Pero están olvidando que nuestros clientes solo se gastan el 30% de su presupuesto en alojamiento".

|