Blog

Blog

Últimos mensajes

Últimos mensajes

Temas mas recientes

Temas mas recientes

|

Esta sección te permite ver todos los posts escritos por este usuario. Ten en cuenta que sólo puedes ver los posts escritos en zonas a las que tienes acceso en este momento.

Mensajes - Derby

1

« en: Hoy a las 20:15:07 »

https://www.bloomberg.com/news/articles/2024-05-28/blackstone-buys-1-billion-mortgage-portfolio-from-germany-s-pbbBlackstone Buys $1 Billion Mortgage Portfolio From Germany’s PBB

Blackstone Inc. has bought a $1 billion mortgage portfolio from Deutsche Pfandbriefbank AG as the German real estate lender grapples with the impact of volatile commercial real estate markets.

The portfolio comprises of 11 loans secured against performing multifamily, office and hospitality assets in the US and UK, Blackstone said in a statement on Tuesday. Its real estate debt strategies unit is acquiring the assets on an all-cash basis, Blackstone said, without disclosing what it is paying for the loans.

The sale comes as part of a broader strategy by PBB to manage its balance sheet through divesting assets. The lender became one of the most prominent examples of European banks hit by fears that troubles in the US commercial property markets are spreading to Europe.

2

« en: Hoy a las 19:54:37 »

https://www.bloomberg.com/news/articles/2024-05-28/eu-nears-deal-on-failed-lenders-in-path-to-closer-banking-tiesEU Nears Deal on Failed Lenders in Path to Closer Banking Ties

Agreement by governments could come as soon as next month

German reservations have largely been addressed, sources say

The European Union is nearing a deal on measures that would make it easier to wind down smaller lenders that run into trouble, according to people familiar with the matter.

Governments may reach a deal on the crisis management and deposit insurance framework next month after addressing some concerns of countries including Germany, said one of the people, who asked to remain anonymous as an agreement has yet to be reached. Talks to hammer out the details together with other European authorities will probably continue into next year, they said.

Such a move would be a key step to regain momentum in deadlocked talks over forging closer banking ties in the region and ultimately facilitate cross-border bank mergers.

European banking fractured along national lines after the 2008 credit crunch and efforts to put in place the architecture needed for a truly unified market ran out of steam in recent years. The package that governments are set to agree on is commonly-viewed as a key step toward deeper and even thornier reforms such as a system of joint deposit insurance like the one that exists in the US.

France and Germany have recently sought to revive the issue of banking ties. The two countries’ leaders — Emmanuel Macron and Olaf Scholz — are discussing the matter during a state visit this week.

Last year, the EU’s executive arm suggested tapping national deposit protection funds to bridge gaps at failing banks that don’t have sufficient reserves of their own. Germany’s mass of smaller savings and cooperative banks slammed the plan, saying it would undermine the systems they have in place to protect savers.

Germany still has reservations on the use of such funds because it could weaken rules on forcing losses on a failed bank’s investors, said one of the people. Still, a deal is likely because negotiators are set to agree on strict conditions for when a bank that runs into trouble is sent into resolution, rather than being wound down under national insolvency laws, they said.

While the talks have been cumbersome, discussions on pooling deposit insurance are likely to be even more difficult. A related plan approved by a committee of European lawmakers in April drew swift criticism from German bank lobbyists.

German officials say the banking union isn’t just about deposit insurance and that work is needed in other areas, such as rules that would address banks’ large holdings of bonds issued by governments in their home markets.

5

« en: Hoy a las 18:25:02 »

https://www.bloomberg.com/news/articles/2024-05-28/europe-s-biggest-pension-fund-sells-10-billion-in-fossil-fuelsEurope’s Biggest Pension Fund Sells €10 Billion in Fossil Fuels

ABP has sold equity, bonds, oil futures linked to fossil fuels

Plans to phase out remaining €4.8 billion in illiquid assets

Europe’s biggest pension fund, Stichting Pensioenfonds ABP, has exited all liquid assets in oil, gas and coal worth about €10 billion ($10.8 billion), in an effort to be greener.

The last shares and bonds owned by the fund were sold in the first quarter of this year, Harmen van Wijnen, chairman of ABP’s board of trustees, said in an interview at the fund’s headquarters in Amsterdam. ABP, which had pledged to sell down a majority of the investments by early last year, no longer holds any “liquid assets” in fossil energy producers, he said.

In its latest disclosure since the 2021 commitment to cut €15 billion exposure to fossil fuels, the Dutch fund has gradually divested all stocks, bonds and investments in oil and gas futures contracts linked to fossil fuels, Van Wijnen said.

The fund has said the step is necessary after efforts to engage with fossil-fuel producers and get them to reduce their greenhouse gas emissions proved ineffective.(...)

“We only want to invest in companies that also have a vision and are on a pathway in the transition to a sustainable economy and companies that don’t harm climate or biodiversity,” Van Wijnen said.(...)

6

« en: Hoy a las 18:09:04 »

A ver si consigo ponerme al día... Empiezo por un artículo que firman Macron y Scholz de plena campaña electoral europea. https://www.ft.com/content/853f0ba0-c6f8-4dd4-a599-6fc5a142e879Macron and Scholz: we must strengthen European sovereignty

The EU needs more single market, innovation and investment to secure a common future

President Emmanuel Macron, left, at a recent press conference with Chancellor Olaf Scholz. France and Germany are proposing a renewed impetus for competitiveness for the EU’s next term © Halil Sagirkaya/Anadolu/Getty Images

In a few weeks, we Europeans will start setting out our agenda for the next term in the EU. Looking back at the challenges over the last five years — be it the pandemic, the ongoing Russian war of aggression against Ukraine or increasing geopolitical shifts — it is clear: Europe is experiencing its Zeitenwende*. We can’t take for granted the foundations on which we have built our European way of living and our role in the world. Our Europe is mortal, and we must rise to the challenge.

Strengthening our global competitiveness and enhancing our resilience while making the Green Deal and the digital transition a success is at the heart of responding to these challenges. To this end, France and Germany are proposing today a renewed impetus for competitiveness for the EU’s next term.

Europe must thrive as a strong world-class industrial and technological leader, while implementing our ambition to make the EU the first climate neutral continent. We can harness the potential of the green and digital transitions for developing the markets, industries and good jobs of the future.

To live up to these common ambitions, Germany and France are convinced that the EU needs more innovation, more single market, more investment, more level playing field and less bureaucracy.

Together, we will advocate to strengthen the EU’s sovereignty and reduce our critical dependencies, while building on the successful implementation of the agenda developed since the Versailles summit in March 2022. With an ambitious industrial policy, we can enable the development and rollout of key technologies of tomorrow, such as AI, quantum technologies, space, 5G/6G, biotechnologies, net zero technologies, mobility and chemicals. We have to make full use of and significantly accelerate existing EU instruments, from important projects of common European interest to the role of public procurement, considering a more strategic approach in relevant sectors, and to modernise our competition rules in view of global competitiveness.

We call for strengthening the EU’s technological capabilities by promoting cutting-edge research and innovation and necessary infrastructures, including those regarding artificial intelligence and health.

One of Europe’s greatest competitive strengths is the single market, allowing businesses to develop innovative products and services, to grow and to compete, while ensuring high standards. We need to reap its full benefits with a modernised single market, reducing fragmentation and barriers, fostering connectivity, enhancing skills, promoting mobility and convergence.

We call for an ambitious bureaucracy reduction agenda to deliver on simpler and faster administrative procedures and cutting bureaucratic burdens for businesses of all sizes. We welcome the European Commission’s initiative to reduce reporting obligations for our companies by 25 per cent. This promise has to be implemented with specific legislation. The principles of subsidiarity and proportionality need a fresh start, too.

We will jointly support an ambitious, robust, open and sustainable European trade policy that allows fair trade agreements and promotes EU interests, creates reciprocal market access opportunities and a clear level playing field with our trade partners. The EU should remain an advocate for the rules-based multilateral trading system and act for fair competition.

We will fully decarbonise our energy systems. And we will achieve this in a fully integrated and interconnected market while respecting national choices on the respective energy mix. This is the European way — and it will increase resilience, security of supply and pave the way for more sovereignty.

Finally, our collective investment efforts, both private and public, must match our ambitions. We need to unlock the full potential of our capital markets. Too many companies looking to fund their growth turn to the other side of the Atlantic. Too many European savings are being invested abroad rather than in Europe’s most promising start-ups and scale-ups. To mobilise the needed investments we have to get serious about a truly integrated European financial market with the banking and the capital markets union at its core, addressing fragmentation and ensuring global competitiveness of the European financial sector.

In doing so, we will have to relaunch the European securitisation market, improve the convergence and efficiency of the supervision of capital markets across the EU, harmonise relevant aspects of corporate insolvency frameworks and tax law, simplify the regulatory framework and develop a simple and effective cross-border investment and savings product for all. Private and public investments need to go hand in hand. We should make the EU budget fit for the future and further prioritise investments in transformational expenditure and European public goods while working on introducing new “own resources” as agreed in 2020.

Together, we call to put this agenda at the core of the coming term. The EU is our common future.

*Zeitenwende= turning point

7

« en: Mayo 25, 2024, 22:39:16 pm »

9

« en: Mayo 24, 2024, 21:25:38 pm »

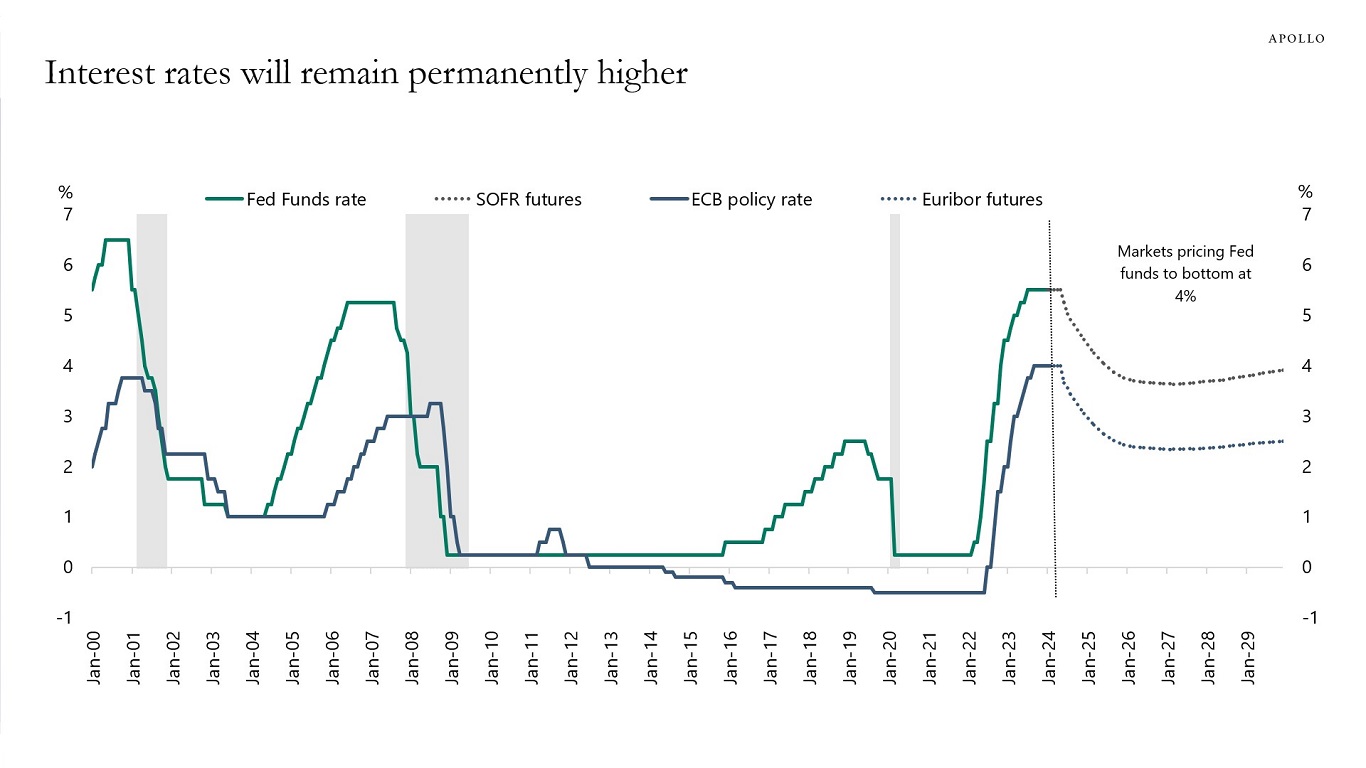

https://www.apolloacademy.com/the-outlook-for-inflation/The Outlook for Inflation

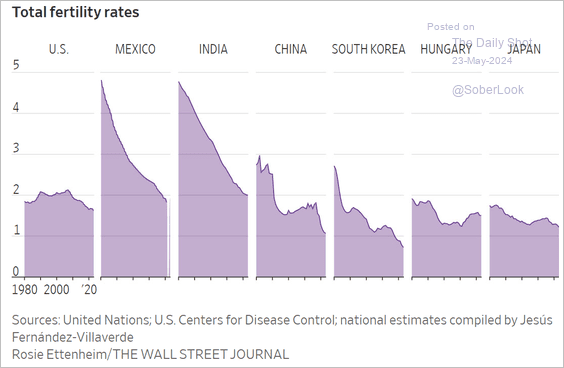

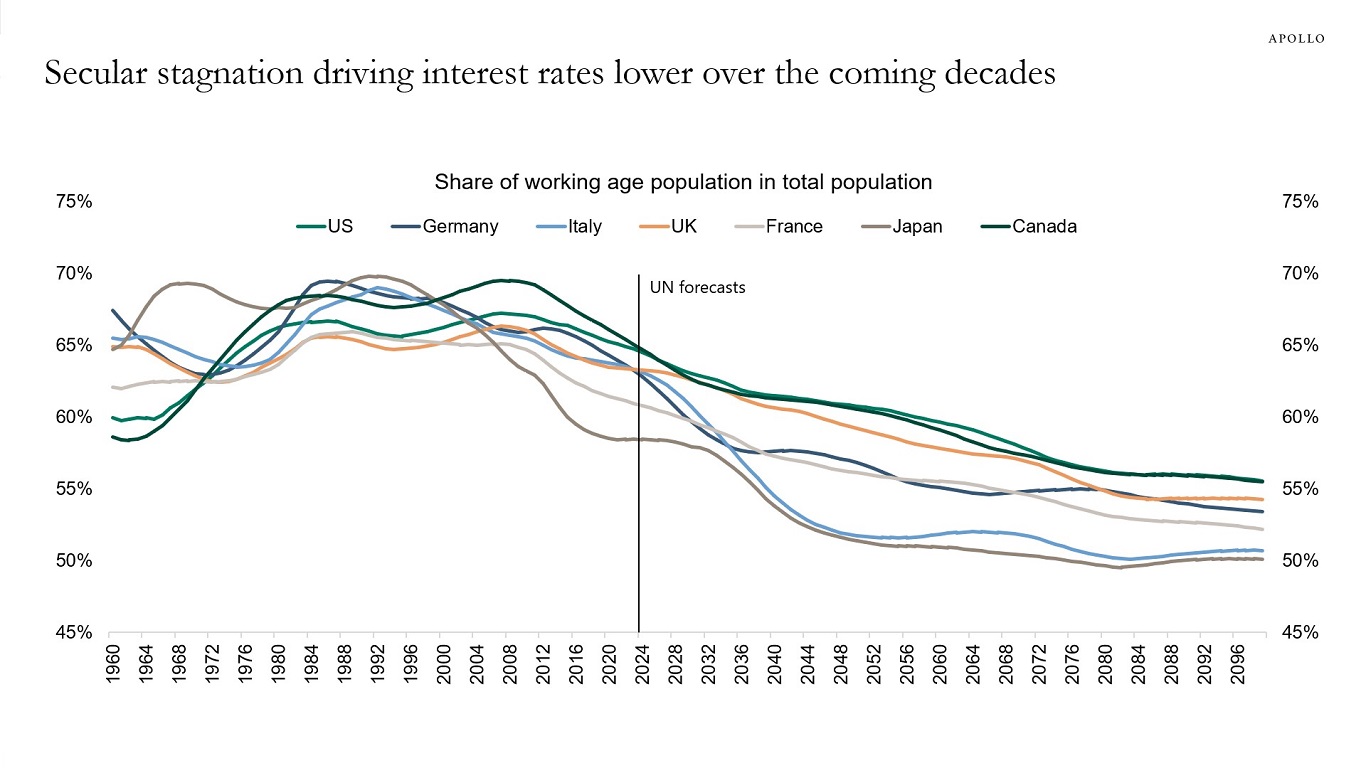

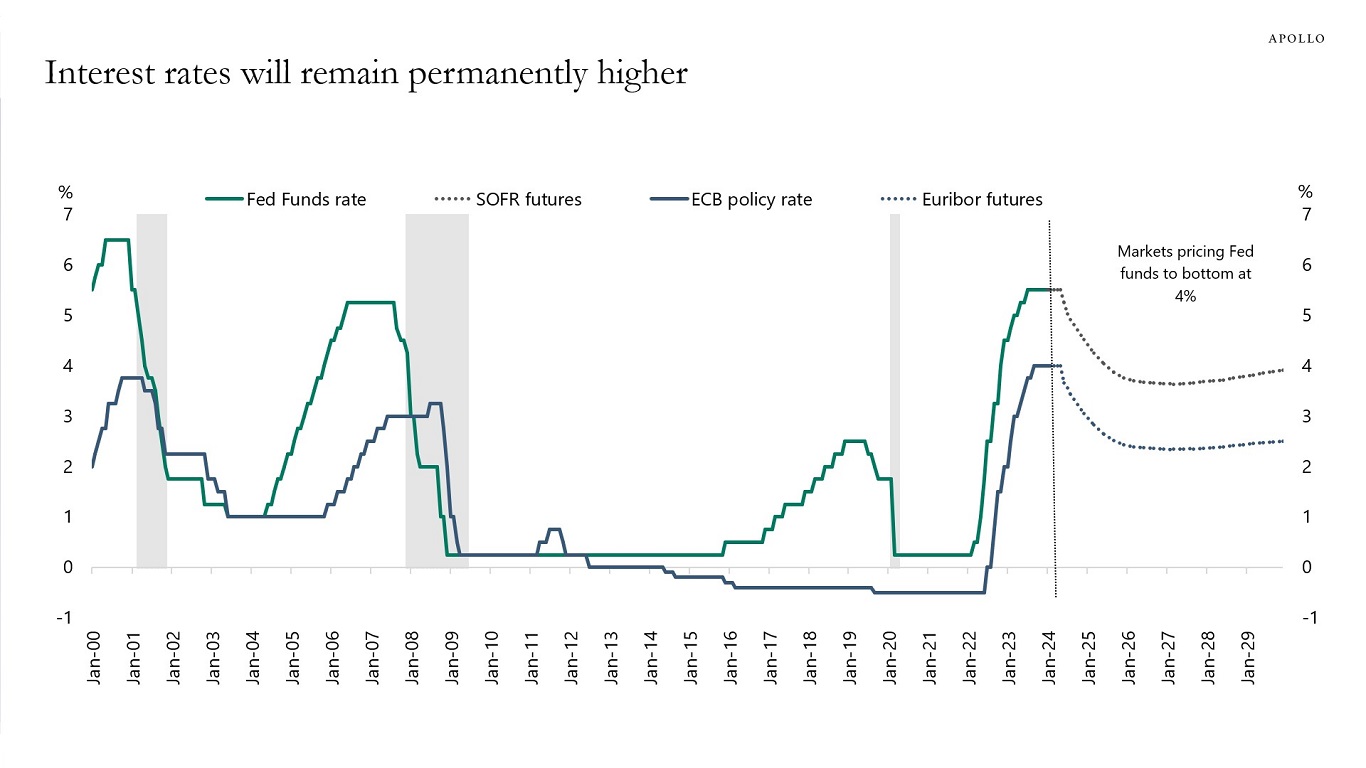

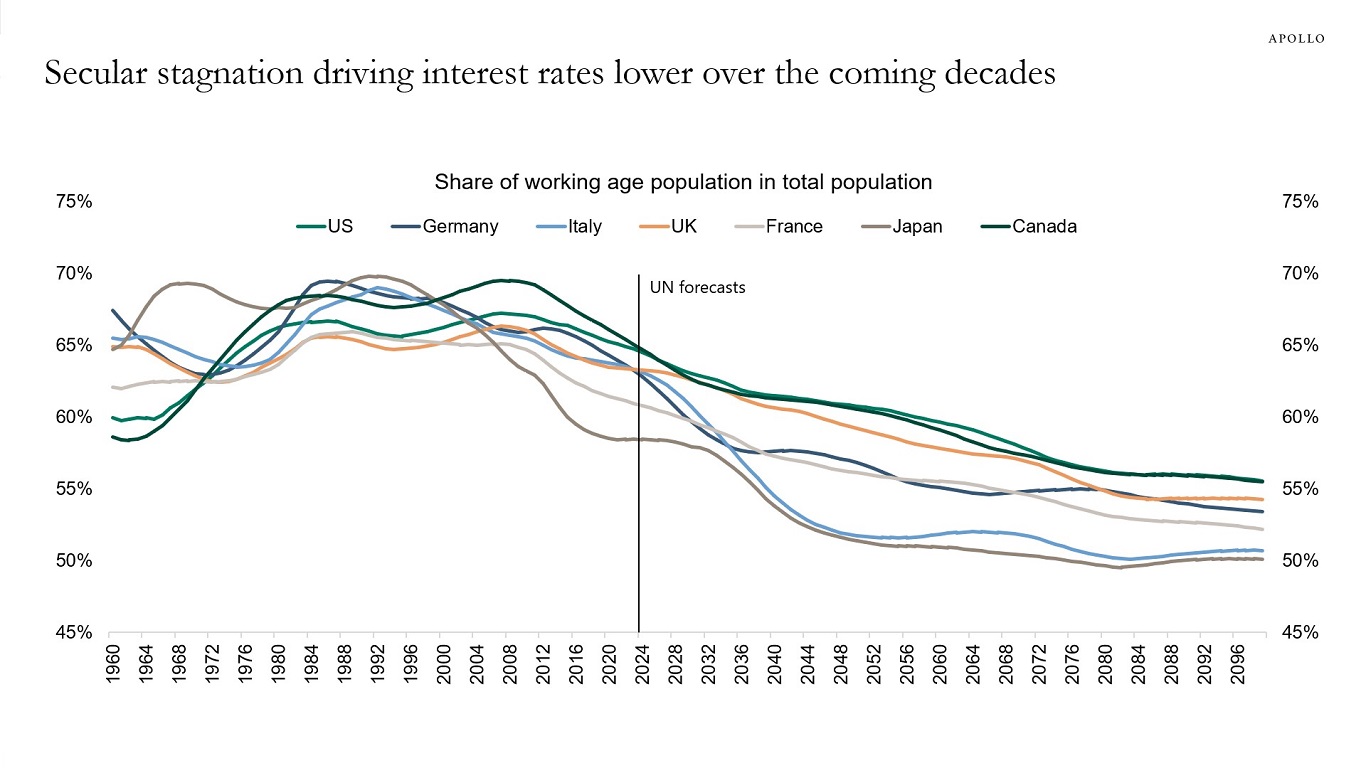

Demographic trends will weigh on inflation over the coming decades, but the secular stagnation forces pulling inflation down are currently being offset by upward pressures on inflation coming from deglobalization, energy transition, defense spending, restrictions on immigration, easy financial conditions, and easy fiscal policy.

Put differently, the structural forces pushing inflation down are currently being offset by cyclical forces putting upward pressure on inflation.

That’s the reason why interest rates will not only be higher for longer in the short term but also in the longer term, see also the second chart, which shows that the market is currently pricing that the Fed funds rate will be between 4% and 5% over the coming years.

10

« en: Mayo 24, 2024, 15:56:21 pm »

11

« en: Mayo 24, 2024, 15:41:07 pm »

No quería disgustarla, derby.

Solo es que echo de menos,el humor negro y en seguida lo veo por doquier.

Creo que hemos perdido algo importante sin él.

Sds.

No, no...sin problemas, reconozco me falta mucho de eso. Ejercitaré

12

« en: Mayo 24, 2024, 14:37:19 pm »

Estoy muy sorprendido por la aportación, derby.

No me esperaba ese nivel de cinismo y crueldad en vd.

Gratamente, en todo caso.

Sds.

No me debo haber expresado bien o no se ha entendido bien mi comentario. El incidente que daba pie a mi comentario me parece horrible, con el agravante del resultado de 4 fallecidos y 16 heridos graves y críticos. Una tragedia que deberá dar pie a la correspondiente depuración de responsabilidades y declaración de culpabilidades. Frecuentemente comentamos e hipotetizamos en este foro la situación que suponga la conclusión del sistema que hemos venido a denominar popularcapitalista, con el fin de la burbuja inmobiliaria. ¿Será rápida o lenta? Y si es rápida (sudden and sharp) ¿con qué implicaciones? La devaluación súbita del inmobiliario no viene sin un dolor agudo y estruendoso (se podrá silenciar más o menos). Cuando Asustadísimos se refiere al Hos*** o al Punto Final... lo que viene inmediatamente después es una caída o un derrumbe de precios. Y la noticia de hoy, por asociación de ideas, me ha llevado a pensar precisamente en el derrumbe y en las consecuencias del mismo. La caída de los precios inmobiliarios provocará el aplastamiento a nivel económico o financiero de tanta gente que ha invertido y se ha endeudado en el inmobiliario. Es una imagen o representación mental, nada más.

13

« en: Mayo 24, 2024, 11:23:18 am »

https://www.vozpopuli.com/espana/sobrepeso-terraza-local-playa-palma-mallorca-principal-hipotesis-derrumbe.htmlEl sobrepeso en la terraza del Medusa Beach Club, la principal hipótesis del derrumbe

La mayoría de las víctimas en el local de Playa de Palma (Mallorca) son extranjeros

Un posible sobrepeso en la terraza del edificio derrumbado en Playa de Palma (Mallorca) es seguramente lo que ha provocado el desplome de la infraestructura, un hecho que por el momento se ha cobrado la vida de cuatro personas y ha provocado 16 heridos. Los fallecidos son una española de 23 años, dos turistas alemanas de 20 y 30 y un senegalés de unos 40 años.

En detalle, parece que la terraza de la primera planta del bar de copas se vino abajo, seguramente por sobrepeso, y del impacto -de tres o cuatro metros- cayó sobre una bóveda, que también cedió. Debajo, en el sótano, estaba ubicada la zona de los comensales, que es donde se encontraron más víctimas. Así lo explicó el jueves por la noche en declaraciones los medios el jefe de Bomberos de Palma, Eder García, acompañado de varias autoridades insulares, entre ellas la presidenta del Govern, Marga Prohens; el alcalde de Palma, Jaime Martínez, o el delegado del Gobierno en Baleares, Alfonso Rodríguez.(...) ¿El Hos*** a que alude Asustadísimos será algo así? ¿Un derrumbe que provocará un hundimiento y el aplastamiento de los que están abajo? Me falta imaginación.

14

« en: Mayo 24, 2024, 11:12:06 am »

https://www.bloomberg.com/news/articles/2024-05-24/spain-s-property-growth-madrid-leads-europe-with-11-price-surgeMadrid Leads European House Price Gains With Double-Digit Surge

Prices jumped almost 11% in April compared with a year earlier

Property shortage is particularly acute in the Spanish city

Housing shortages are fueling dramatic price increases in some of Europe’s major cities, and Madrid is now leading the pack with a jump of almost 11% year-on-year.

Even with interest rates at multi-year highs, residential property is booming in the Spanish capital, according to the Bloomberg City Tracker, driven by locals desperate to get on the housing ladder before they are completely priced out and investors looking for returns.

Madrid has been particularly affected by an influx of Latin American money, exacerbating the squeeze on the market, as well as hype about certain districts. Carabanchel, traditionally a working class area, was named the third coolest neighborhood in the world last year. New house building is at historical lows, there is little urban land available for construction and few plans for new developments. Housing stock has fallen 11% in the last year, according to real estate website Idealista.

With so few properties available, sales fell 8% in the first quarter, according to the statistics office.

“An increasingly large housing deficit is accumulating,” said Beatriz Toribio, head of the Association of Builders and Developers of Spain. “Madrid is a very important economic hub and more and more people are coming to work and live in the city. Add that to the tourism pull, the cultural pull. The demand is increasing.”

Toribio wants more done to reduce bureaucracy and labor shortages, and says the government also needs to develop a long-term vision for housing.

Separate data from the Land and Property Registry show a similar trend in the Madrid province. Prices for new builds surged 14.5% in the first quarter of 2024 compared with the previous three months. In a Knight Frank index of prime properties, Madrid was the top-ranked European city in the first quarter.

To capture the latest housing-market trends in European cities, Bloomberg compiles figures from a range of providers. Some are asking rates and indicative levels, while others are official figures on transactions. Madrid prices are published or compiled by Idealista.

Madrid is the only city in the Tracker with prices rising at a double-digit pace. They increased 10.6% in April compared with the same month a year ago. When Bloomberg last highlighted the city, in the summer of 2023, the gains were around 5%.

Athens is up 9.6% year-on-year, slipping below 10% for the first time in 17 months. Apartment prices in Vienna registered gains of just over 7%, staying at the fastest since October 2022.

Prices are falling in only three out of the 12 European cities monitored. Paris was the worst performer, with a 7.5% decrease.

In Madrid, Elena Jori, director of real estate at agency Home Select, said the supply-demand imbalance means she expects prices will keep rising, and she also downplayed the risk of a property collapse.

“The current market has nothing to do with the one that caused the crash in 2008,” she said. “There is neither an excess housing stock, nor is financing cheap. We are precisely talking about a shortage of product.”

|