Blog

Blog

Últimos mensajes

Últimos mensajes

Temas mas recientes

Temas mas recientes

|

1

« Último mensaje por Derby en Hoy a las 19:48:28 »

https://www.ft.com/content/b5863435-451c-4ed7-925c-1464dabf32a9Capital Group and KKR partner to offer private assets to wider audience

World’s largest active asset manager and buyout firm to make available hybrid public-private funds to wealthy investors

Please use the sharing tools found via the share button at the top or side of articles. Copying articles to share with others is a breach of FT.com T&Cs and Copyright Policy. Email licensing@ft.com to buy additional rights. Subscribers may share up to 10 or 20 articles per month using the gift article service. More information can be found at https://www.ft.com/tour.

https://www.ft.com/content/b5863435-451c-4ed7-925c-1464dabf32a9

Capital Group and KKR are combining forces to offer hybrid public-private investment funds to wealthy individuals, in a move that seeks to open up the fast growing alternative sector to a much wider range of investors.

The partnership links Los Angeles-based Capital, the world’s largest active asset manager with $2.6tn in equity and bond funds and a strong distribution network, with KKR, one of the best known private credit providers. Their first products, blended public and private credit funds, will launch next year.

The two firms say this is the start of a broader platform that will make alternatives — private equity, credit, infrastructure and real estate funds that have previously been sold almost exclusively to institutions and the super wealthy — available to a broader range of investors.(...)

The move comes as traditional asset managers have been snapping up alternatives providers in an effort to move into the higher fee-paying area and counter outflows from actively managed public funds. Meanwhile, the biggest alternatives providers, including KKR and Blackstone, have been rolling out products aimed at wealthy individuals.

But growth has been hampered by a lack of distribution channels and some investors have concerns about the liquidity of alternative funds, which hold harder-to-sell assets and offer only quarterly withdrawals.(...)

2

« Último mensaje por tomasjos en Hoy a las 19:39:43 »

Más oficialización. Hemos superado los precios de la burbuja https://www.larazon.es/madrid/burbuja-inmobiliaria-madrid-aun-mas-grande-que-2007-precios-venta-alquiler-marcan-maximos_20240523664f24a83a4a7f000130718d.html Los sueldos, con los datos de Becerra, están por debajo de los de hace diez años, y los precios superan los de 2007. O sea, que estamos más allá del limite. Por cierto que la inflación alemana está en el 4,7 con lo que de bajadas de tipos nada.

3

Phase 2 of the Office Revolution is Here; What Tenants Need to Know

Ruth Colp-Haber · 2024.05.23

| | Ruth Colp-Haber |

Since the onset of the pandemic, there has been a revolution in office work as technology allowed people to work from home. As I have discussed at length in many commentaries there are pluses and minuses to this approach.

However, one thing is certain. Any predictions that employees would be returning to the office in droves at the behest of management have been well and truly debunked. Over four years into Covid, the metrics show that roughly half of office employees come to the office both in New York City and the entire country. Further, a recent employer survey by Flex Index has found that as of the second quarter of 2024, 69% of companies with U.S. headquarters offer some degree of work location flexibility, and just 31% require their employees to be full-time in the office. This is a significant increase from the first quarter of 2023, when just 51% of employers offered workplace flexibility, As a corollary, the largest plurality of employees work on a “structured hybrid” basis, which only requires them to be in the office certain days as opposed to a full-time work requirement.

Accordingly, as remote work has now become normalized, we can confidently declare that phase 1 of the office revolution is over.

Sadly, this particular form of urban carnage is just beginning. Work from home has been a slow-moving time bomb as leases which used to be 5+ years in duration come off the books and many tenants take less space when they make their next move. Some new developments like Hudson Yards have prospered, but only at the expense of older buildings whose tenants they cannibalized. Four years on from the start of Covid, work from home is now solidly entrenched in the business landscape and is here to stay. Except for the top buildings most landlords can’t cope with a major long-term vacancy and haven’t found alternative uses for the space. Conversions to residential use are fine but are relatively rare because they are expensive and most office buildings don’t have suitable floorplans allowing for the change of use.

We are now in phase 2 of the office revolution, which is effectively the finance phase. We take no pleasure in pointing this out, but many landlords are struggling due to the triple whammy of reduced rent rolls, higher operating costs, and limited financing options.

Values are plummeting in most buildings and borrowing costs are significantly higher. Even if the Federal Reserve cuts rates at some point, most economic observers believe that the days of easy money are in the rear-view mirror and we can expect a higher neutral rate of interest. One good piece of news is that these wise men and women believe there’s no long-term threat to the financial system here. The big banks are very well capitalized and can handle the bad loans. Of course, that is not to say that other debacles like Silicon Valley Bank and Signature Bank are not in the cards.

This new phase also has an impact on tenants. Traditionally, it is the landlord who requests the financial statements of its prospective tenants to assess if they will be able to pay the rent during the lease term. However, that paradigm has now been turned on its head. For the first time in history, tenants need to become familiar with the financial condition of their landlord. That is because so many buildings are in default, or even facing foreclosure, and that number will only increase.

There are many recent examples of this distressing trend. During just the past week or so, there was news that the commercial backed security loan collateralized by Bloomberg Tower at 731 Lexington Avenue is going to special servicing (even though Bloomberg just signed a new lease to remain there until 2040), an action to foreclose upon 750 Lexington Avenue was filed, and a Financial Times article reported on the difficulties being experienced by RFR, the half-owner of the Chrysler Building and the trophy Seagram building which has only been able to get a one-year loan extension. And this is just the tip of the iceberg.

What all these landlord defaults also mean is that tenants need to protect themselves in negotiating certain lease provisions. Most importantly, tenants should demand that the funds for any future work that needs to be done by the landlord be placed in escrow to ensure completion. Similarly, tenants should ensure that all commissions be put in escrow so that they are not liable for any of these expenses.

Another concern is what will happen to building services in the event of a default or foreclosure. The best answer is hopefully nothing if the bank, special servicing agent or trustee is maintaining the building properly. For example, the venerable Helmsley Building at 230 Park Avenue has been in special servicing for over six months. To my experienced eyes, there is no difference whatsoever at 230 Park since it went to special servicing.

However, that may not always be the case. While I don’t expect that landlords will be turning off the heat in February, a new manager might look to reduce expenses in less visible ways, such as skimping on security and cutting maintenance staff. We haven’t seen this yet, and the focus has all been put on improving services to attract tenants, but when push comes to shove it is possible that services in buildings under pressure could deteriorate. Remember that the tenant leases are the most important asset a landlord has so any owner will want to keep up the appearances of a building and not lose more tenants. Nevertheless, it is important to assess the future financial viability of a building by understanding the tenant rent roll and the landlord’s financing profile.

To be fair, any building can be sold at any time. Even in the best of times and in the best buildings, the quality of a new owner can be problematic.

However, the bottom line is this. Almost every major landlord must deal with a significant drop in demand for its inventory which is now baked in the cake. Danger lies ahead in the form of more building defaults, foreclosures and bankruptcies in the second phase of the office revolution. Hopefully, I am wrong but by all appearances phase 2 is just getting started. Let’s just hope it stays under control.

If you need assistance navigating this new phase of the office market or just have questions, please contact us at Wharton Property Advisors. We always represent our clients with creativity, integrity, diligence and independence.

Thank you,

Ruth Colp-Haber Saludos.

4

« Último mensaje por Frommer en Hoy a las 18:53:14 »

Catacrac! final

5

« Último mensaje por senslev en Hoy a las 17:26:26 »

6

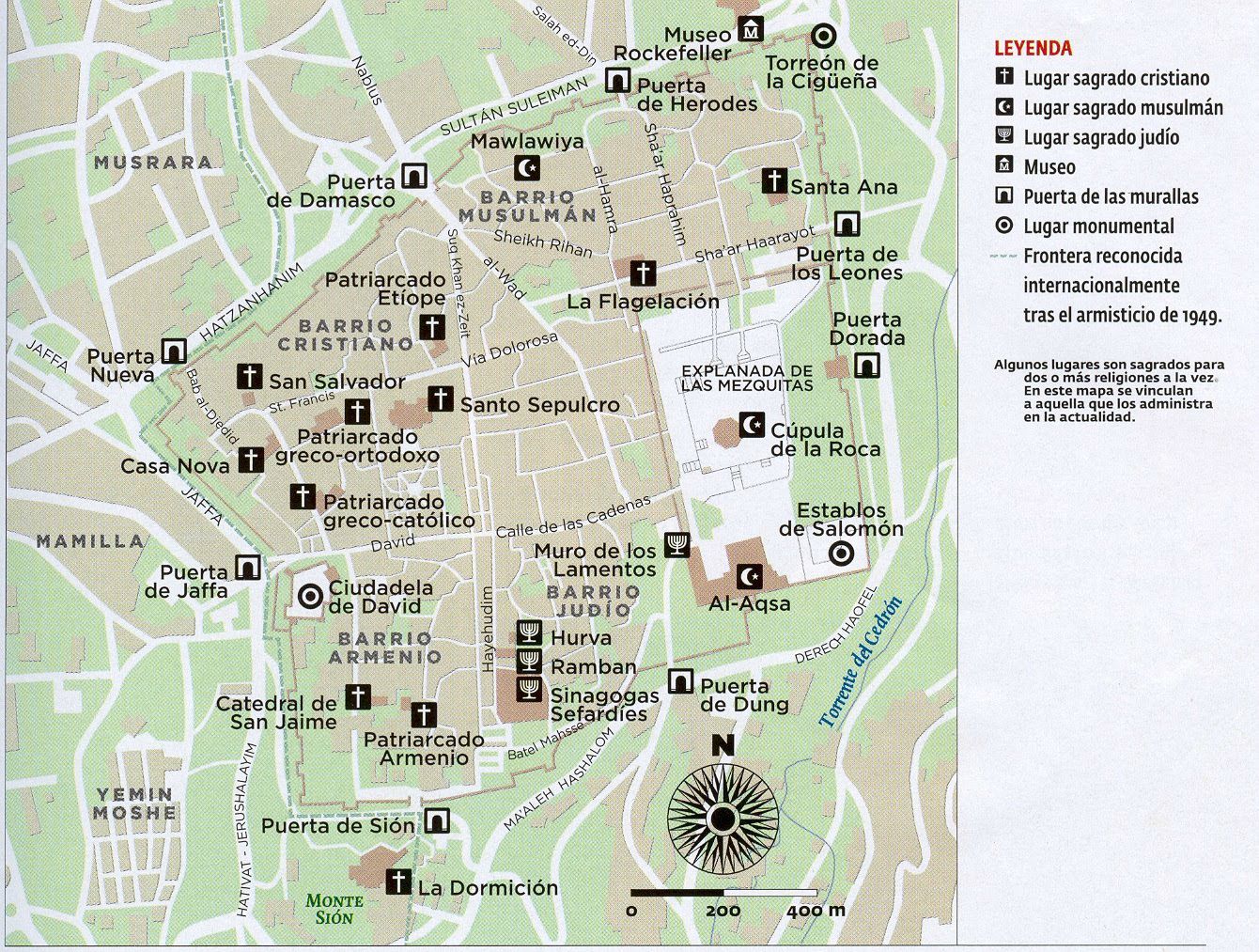

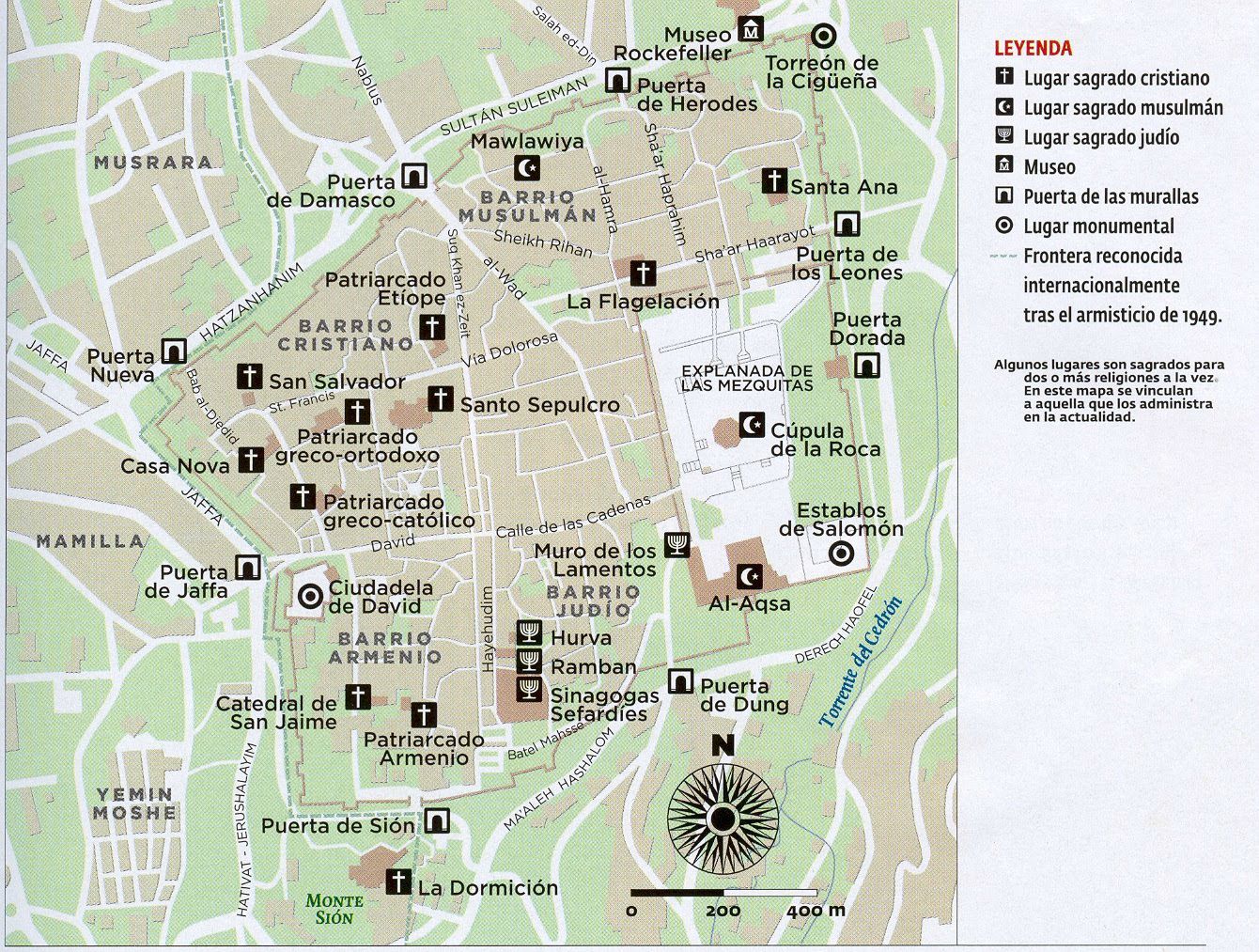

https://www.eldiario.es/madrid/somos/chamberi/ministerio-defensa-privatiza-75-anos-hospital-militar-chamberi-entrega-grupo-quiron_1_11370551.htmlPor otra parte, no sé yo si solidificar la solución de las dos Coreas es muy operativa para Israel-Palestina, vistos lo antecedentes. Eso sí, una potencia nuclear ya tenemos, y eso es tiempo ganado. La idea de Gadafi de un Israel que englobara israelíes y árabes, judíos, sunitas y drusos, siempre me pareció el auténtico camino hacia la paz, aunque Gadafi estuviera pensando en úteros más que en pistolas. De todas formas, no hay solución posible mientras Jerusalén siga estando ahí.

7

« Último mensaje por cujo en Hoy a las 14:15:26 »

SOLUCION FINAL 25

8

« Último mensaje por R.G.C.I.M. en Hoy a las 13:45:07 »

Va un cura en misa a dar la comunión y abre el sagrario. Se encuentra a un tipo de cuclillas dentro con gafas de sol y chasqueano los dedos de lado a lado. El cura: -"Oiga!!!! Pero qué hace usted ahí dentro?  " ( sorprendido e indignado). El susodicho vacilón: - " es que yo... ... soy la Hostia!!!"

9

« Último mensaje por R.G.C.I.M. en Hoy a las 13:35:59 »

No, no.

No estamos a lo miwrda que es la democracia.

Por lo menos yo.

Yo estoy a lo mierda que es ESTA democracia en ESTE momento, con ESTAS circunstancias.

He aprendido 3n la vida que los principios inamovibles se respetan con diferentes límites , y las herramientas se aplican variables en grado y modo según la circunstancia.

Por eso amo los sapienciales, especialmente el eclesiastés.

Hay un tiempo para todo...

Es muy budista. Pero de aquí.

Me voy a 3xpkicar de otro modo.

La violencia es el último recurso. Y más en la educación de un vástago. Pero con un límite muy definido, no conzco ningún caso en el que en determinada circunstancia, el único y más 3xpeditivo modo de enderezar al niño no sea una buena y didáctica bofetada.

Si por principio supeditamos la 3xigencia de NO violencia absoluta, a mi parecer conculcamos el bien mayor de formación de un carácter y espíritu virtuoso.

El problema es donde estableces los.limites.

Yo creo que hoy, ya hemos sobrepasado bastantes, y el niño ya va a la universidad, le chulea a mamá, se droga, pide la paga, va a manis contra el fascismo, se carga en los ricos y no pega palo al agua. Y es que el padre desapareció hace años y la mamá ha querido mucho al niño y el rol del hombre ni lo ha olido porque es muy violento irracional y poco compasivo. Y no hacia falta para eduvsr al niño.

Soy un facha retrógrado???

Sds.

10

Ok.

Pero a lo que estábamos era lo mierda que es la democracia... y a igualdad de todo lo demás.

El caso es que no... que no es tan mierda.

|

Mensajes recientes

Mensajes recientes

" ( sorprendido e indignado).

" ( sorprendido e indignado).