Blog

Blog

Últimos mensajes

Últimos mensajes

Temas mas recientes

Temas mas recientes

|

Esta sección te permite ver todos los posts escritos por este usuario. Ten en cuenta que sólo puedes ver los posts escritos en zonas a las que tienes acceso en este momento.

Mensajes - Derby

1

« en: Hoy a las 15:28:53 »

https://www.ft.com/content/f7070bac-6312-4156-b390-8fd36ef40c39#post-5f2ba872-4dbe-49d1-91a7-c0752515ff95Germany says Ukraine can hit military targets in Russia with German weapons

Germany has followed the US in granting Ukraine permission to attack military targets on Russian territory using German weapons.

Steffen Hebestreit, spokesperson for Chancellor Olaf Scholz, said Russia had recently been launching “co-ordinated attacks” on areas around Kharkiv “from positions in the immediately adjacent Russian border region”.

He said western leaders were convinced Ukraine had the right under international law to defend itself against these attacks. “It can also deploy weapons that have been supplied [by the west], in compliance with its international legal obligations, to do that, including weapons that we have supplied,” he said.

Weapons supplied by Germany that might be used for such attacks include the Panzerhaubitze 2000 and Mars II rocket launcher. https://www.ft.com/content/cae8f22b-4b12-4bcd-acc8-31deeff7cc42Joe Biden allows Ukraine to use US weapons to hit targets in Russia

Shift by Washington comes after weeks of pressure from Kyiv and its allies

US President Joe Biden has approved Ukraine’s use of American-made weapons to strike within Russia as long as the targets relate to Moscow’s offensive in the Kharkiv region, a US official said on Thursday.

The decision marks an important shift from Washington’s previous position that Ukraine should not use US weapons to strike targets in Russia — and follows growing pressure on Biden from Kyiv and its allies.

“Over the past few weeks Ukraine came to us and asked for permission . . . that went right to the president. And as you heard, he has approved the use of our weapons for that purpose,” secretary of state Antony Blinken said on Friday in Prague. He added that the US would continue to adapt its policies regarding the use of its weapons by Ukraine.

Ukraine requested permission during a video call with top US officials on May 13 to use US weapons systems against targets in Russia that were being used for its assault on Kharkiv, according to a US official. The request was approved in recent days by Biden.

Germany announced on Friday that it was following the US in allowing Ukraine to use German-supplied weapons to attack military targets in Russia.(...)

2

« en: Hoy a las 10:51:11 »

Yo no he llegado a ver estas cláusulas pero van en consonancia con lo que he comentado en varias ocasiones en relación a la normativa catalana sobre la contención de rentas que fue declarada inconstitucional por el TC. Había la casi certeza de que esta normativa era temporal, que terminaría siendo declarada inconstitucional o derogada de cualquier otro modo. El artículo alude a unas cláusulas que se incluyeron en los contratos de arrendamiento estableciendo que para el supuesto de que la contención de rentas, que fijaba la renta a la firma del contrato, se declarase inconstitucional se aplicaría el precio de mercado. En marzo de 2022 se declaró la inconstitucionalidad de la normativa de contención de rentas y automáticamente, aplicando estas "cláusulas berlinesas", se actualizó la renta de estos contratos al precio de mercado. https://www.lavanguardia.com/economia/20240531/9691835/primer-fallo-favor-clausulas-berlinesas-contratos-alquiler.htmlPrimer fallo a favor de las ‘cláusulas berlinesas’ en los contratos de alquiler

Una sentencia de un juzgado de Barcelona da la razón a los propietarios del inmueble

La regulación de los alquileres en Catalunya aprobada a finales de 2020 llevó a algunos propietarios a incluir la llamada cláusula berlinesa en los contratos de arrendamiento. Esta medida, utilizada por primera vez en Berlín, ciudad que fue pionera en el control de rentas, implica que el contrato incorpora dos precios. El primero hace referencia al tope que marca la ley, mientras que el segundo es el pactado en el mercado entre ambas partes. De esta forma, los propietarios se reservaban el derecho de subir los precios en caso de que el Tribunal Constitucional tumbase la normativa, como finalmente ocurrió en marzo de 2022.

Tras meses de debate público sobre su legalidad, el Juzgado de Primera Instancia número 55 de Barcelona acaba de fallar a favor de la existencia de estas cláusulas. El caso se refiere a un arrendatario, que en el momento de aplicar la renta pactada a precio de mercado, presentó una demanda ante el juzgado solicitando la nulidad de la referida cláusula por considerarla abusiva. La sentencia ha desestimado íntegramente las pretensiones del inquilino, confirmando la validez y la aplicación de la medida pactada por las partes.

En la decisión del juzgado, ha sido clave que el recurso de inconstitucionalidad ya estuviera interpuesto porque demuestra que la normativa pudiese ser anulada era una posibilidad conocida. Por otro lado, también se destaca que la actuación del arrendador fue transparente y clara en la redacción del contrato de alquiler.

La argumentación del demandante señalaba que la Ley de Arrendamientos Urbanos no permite que haya actualización en cualquier momento, más allá de la actualización anual del IPC. “Es algo discutible, porque se admite que se puedan pactar bonificaciones y reducciones”, señala el socio del despacho CIM Tax & Legal, Carlos Muñoz, que ha defendido a la propiedad en este proceso. Sin embargo, el abogado apunta que realmente en este caso no hay una actualización, sino uno, que se encuentra limitado por la regulación.

La sentencia puede ser recurrida, pero marca una primera tendencia

Muñoz reconoce que se trata de una sentencia de primera instancia y que, por tanto, no sienta jurisprudencia y puede ser recurrida a instancias superiores. Sin embargo, subraya que marca una primera tendencia en este tema. En este sentido, apunta que estas cláusulas se han vuelto a recuperar desde la aplicación de la ley de alquileres aplicada por el Gobierno y que, de momento, sólo se está aplicando en Catalunya. “Con los recursos de inconstitucionalidad que quedan por resolver, este fallo judicial cobra especial relevancia”, comenta el abogado.

El Tribunal Constitucional rechazó la semana pasada varios recursos en contra de la nueva Ley de Vivienda que se centraban en materia de competencias administrativas. Sin embargo, quedan por resolver todavía varios escritos que entran en el fondo de la cuestión.

3

« en: Hoy a las 10:22:47 »

https://www.bloomberg.com/news/articles/2024-05-31/china-s-60-million-homes-are-hard-to-sell-even-in-big-citiesChina’s 60 Million Homes Are Hard to Sell Even in Big Cities

Housing inventory is at a historic high, S&P analyst says

Oversupply is most acute in the nation’s capital city

The central bank recently announced a 300 billion yuan ($41 billion) initiative for local governments to purchase unsold homes. Photographer: Andrea Verdelli/Bloomberg

Chinese policymakers have identified reducing a glut of housing inventory as the key to ending the nation’s unprecedented property slump. It’s easy to see why.

The country has the equivalent of 60 million unsold apartments, which will take more than four years to sell without government aid, according to Bloomberg Economics. The oversupply is dragging down prices at the fastest rate in a decade, giving people less reason to buy a home. The situation is worst in the capital city.

To break this vicious cycle, the central bank recently announced a 300 billion yuan ($41 billion) initiative for local governments to purchase unsold homes. On the demand side, it urged cities to reduce minimum downpayments and mortgage rates to entice buyers. But it remains to be seen whether the steps will succeed in shrinking supply and ending the crisis.

“Housing inventory is at its highest in China’s history,” said Jay Lau, a property analyst at S&P Global Ratings. “The latest property policies could be a temporary confidence booster.”

Below are charts that show the scale of China’s problem with unsold housing.

Top Cities

Even in China’s four tier-1 cities, where the market is relatively resilient, it will take an estimated 27 months to sell the supply of new homes as of April, according to China Real Estate Information Corp. That is the longest in at least seven years. By comparison, the US has about nine months’ supply of new homes, according to the US housing department.

Three of China’s biggest cities — Shanghai, Shenzhen and Guangzhou — have rolled out major easing for homebuyers, slashing downpayment requirements and allowing room for cheaper home loans. Analysts expect Beijing, the other tier-1 city, to do the same. China’s capital has the longest monthly overhang in unsold homes, according to CRIC.

There’s no guarantee that the loosening will revive home sales immediately. Homeowners even in big metropolitan areas are losing conviction in their decades-long belief that property is a reliable store of wealth, according to Yan Yuejin, director of E-house China Research & Development Institute.

“There is a fundamental change in homebuyers’ confidence over the biggest cities in the long term,” Yan said. “While low-tier cities have higher outstanding housing stock, the major inventory issue lies in bigger ones.”

As of April, about 80% of China’s cities had an inventory absorption pace that was worse than a “warning line” of 18 months, according to CRIC. That’s even after developers refrained from offering new projects amid lackluster sales, leading new supply to shrink 20% from March.

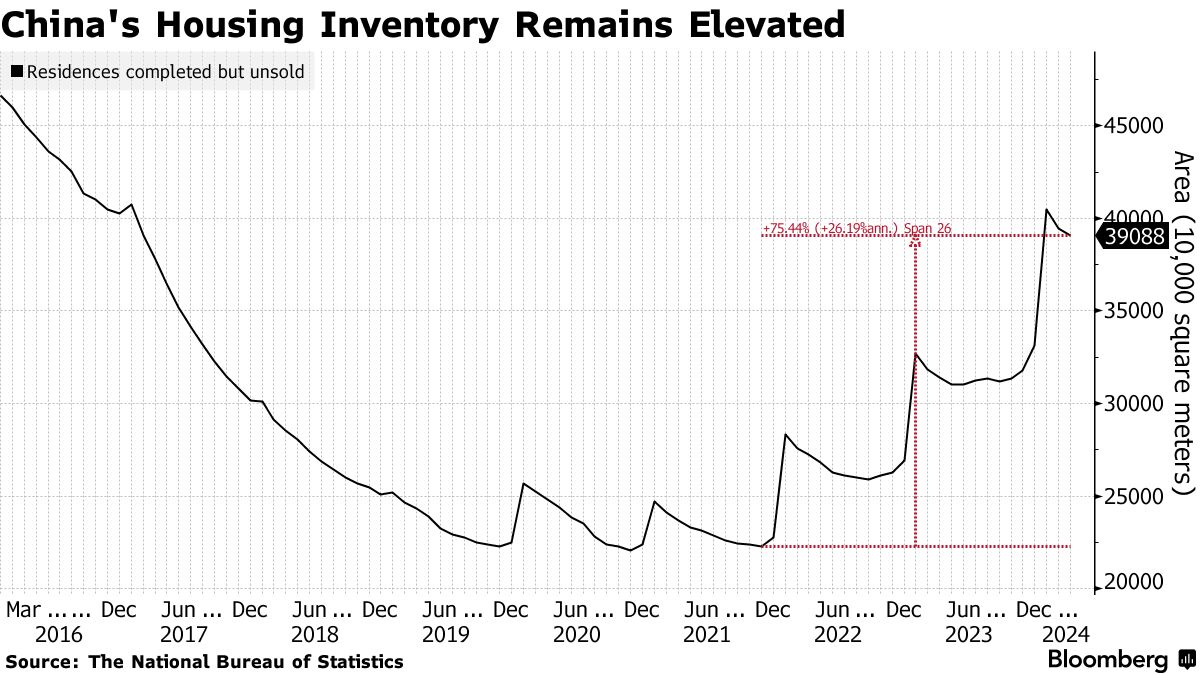

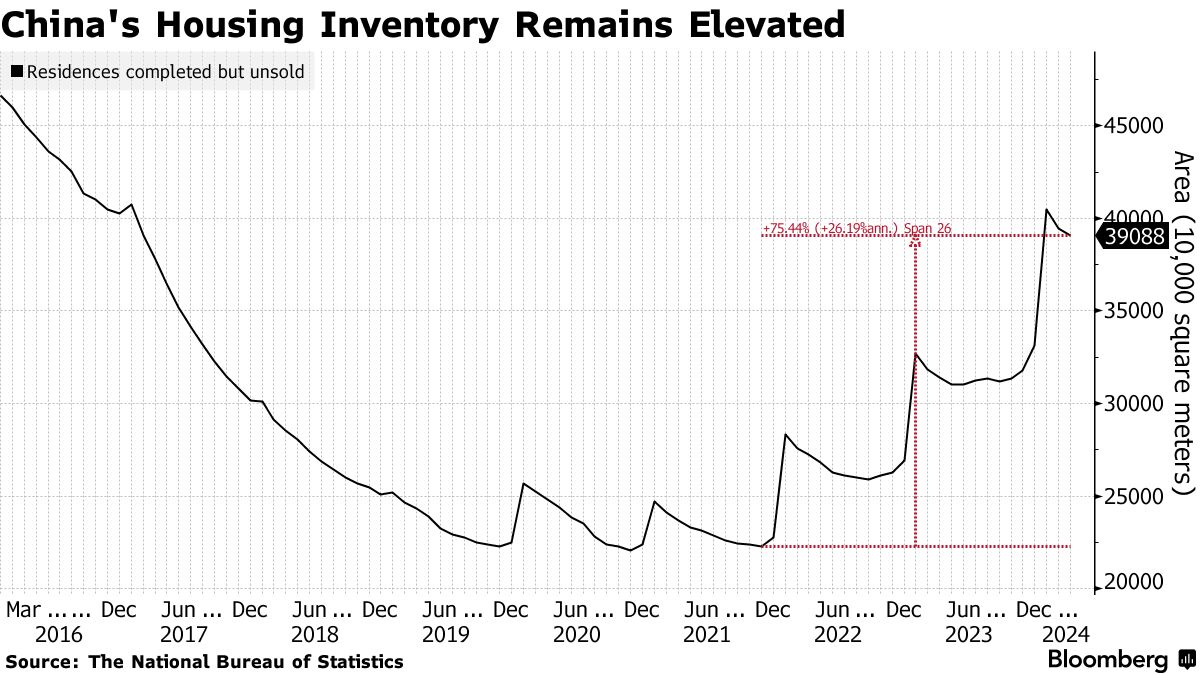

Floor Space

The challenge looks just as daunting when measured by floor space. Residences completed by developers but unsold expanded to 391 million square meters nationwide as of April, the highest since 2017, official data show. Including properties that are almost finished and approved for presale, the stock is much larger at about 1.8 billion square meters, JPMorgan Chase & Co. estimates. Most of the excess sits in lower-tier cities, according to S&P.

China’s support package announced on May 17 is estimated to translate into 500 billion yuan of credit to help government-backed firms buy housing stock from developers. Yet that is unlikely to make a big enough dent in the supply, according to economists.

Reducing the inventory to a more optimal level through government-backed acquisitions would require 5 trillion yuan, according to JPMorgan analyst Karl Chan. CGS International Securities HK’s Raymond Cheng estimates 1 trillion yuan to 2 trillion yuan of funding is needed.

There are also questions over the program’s implementation as smaller trials earlier have struggled to get traction amid questions over the incentives for local governments, developers and banks.

Developer Relief

Not all of China’s developers will be able to tap the property-purchase plan to swap inventory for much-needed cash. Many have pledged a large part of their real estate held for sale to secure loans, making it tough for them to divest the assets, said Bloomberg Intelligence analyst Kristy Hung. KWG Group Holdings Ltd., for example, pledged 92% of its properties held for sale as of the end of last year, according to BI.

[img]https://i.imgur.com/TLrrNI8.png[img]

The rescue fund might have more meaningful impact in injecting liquidity for China Vanke Co. and Longfor Group Holdings Ltd., whose unpledged properties held for sale exceeded their short-term debt as of last year, BI estimates. They now have the option to offload slow-selling inventory to local government-backed firms at a discount to beef up cash.

4

« en: Ayer a las 19:39:09 »

https://www.ft.com/content/96697013-abe9-4873-84fa-fabe59775affUS to offer Ukraine security pact as tensions rise between allies

Agreement next month aims to placate Kyiv officials who fear relationship with Washington has hit a low

The US is close to signing a new bilateral security pact with Ukraine in a signal of support aiming to assuage Kyiv after “tense” relations that some Ukrainian officials say have hit their lowest ebb since Russia’s full-scale invasion.

The agreement would be the most significant in a series of deals Ukraine has struck with Nato countries that lays out commitments on long-term support, including military training, intelligence sharing and economic assistance.

Volodymyr Zelenskyy’s frustration with Joe Biden was laid bare this week, when the Ukrainian president rebuked his US counterpart in unusually blunt terms, saying Biden’s plan to attend a Democratic fundraiser rather than Ukraine’s peace summit on June 15-16 was “not a strong decision”.

One Zelenskyy-appointed senior government official who spoke to the Financial Times about the US-Ukraine relationship said: “We are farther apart than ever since the war started. It is very, very tense.”

However days before the peace summit, Zelenskyy and Biden are expected to sign a bilateral security agreement on the sidelines of the G7 meeting in Italy next month, US officials told the FT.

The pact has been negotiated during weeks of increasingly strained relations between Kyiv and Washington. Zelenskyy’s office this week issued a memo to officials and MPs, seen by the FT, that instructs them to criticise both Biden and Chinese President Xi Jinping for not attending the summit. “If they don’t [attend], then what is their real interest?” the memo wrote.

Several Ukrainian officials said that Kyiv’s bitterness over lack of top-level US support for its peace summit initiative was just one of many points of friction with Washington and other western partners that have erupted at a particularly difficult time for Ukraine’s leadership.

More than a dozen current and former Ukrainian officials and G7 country diplomats in Kyiv who spoke to the FT point to a clutch of contentious issues. These include Congress’s six-month delay in approving US military assistance; the expected lack of substantive progress towards Nato membership for Ukraine at the alliance’s Washington summit in July; the Biden administration’s prohibition on Kyiv’s use of American-supplied weapons inside Russia; and Ukraine’s drone strikes on Russian oil refineries.

Ukrainian attacks on two radar systems that form part of Moscow’s nuclear warning system over the past week have been a particular point of conflict with Washington, which is worried that it may provoke Moscow and further escalate the war.

Volodymyr Zelenskyy is flanked by Belgian defence minister Ludivine Dedonder and prime minister Alexander De Croo this week after Belgium agreed to provide Ukraine with F-16 fighter jets © Olivier Hoslet/EPA-EFE/Shutterstock Volodymyr Zelenskyy is flanked by Belgian defence minister Ludivine Dedonder and prime minister Alexander De Croo this week after Belgium agreed to provide Ukraine with F-16 fighter jets © Olivier Hoslet/EPA-EFE/Shutterstock

Other points of concern relate to diverging strategies on how Ukraine can achieve victory and what that victory might look like, as well as Zelenskyy’s little explained removal of top government and military officials the US had worked closely with.

Several Ukrainian government officials and diplomats from G7 nations cited the firing of commander-in-chief Valery Zaluzhny in February and infrastructure minister Oleksandr Kubrakov this month. Both men were well respected and enjoyed close working relationships with US and EU officials. The officials told the FT that G7 ambassadors have warned Zelenskyy’s government about what they see as disruptive and inexplicable moves.

The fraying relations and discord come as Ukrainian forces struggle to hold their defensive lines against a bigger and better-armed Russian army in the east, and while Zelenskyy is under huge pressure to mobilise more men and take other unpopular decisions to bolster the war effort.

Zelenskyy’s press secretary did not immediately respond to questions about relations with Biden’s White House.

The Biden administration has been among Ukraine’s most steadfast supporters, committing more than $175bn in emergency assistance to the country since the start of Russia’s all-out invasion in February 2022. Biden has repeatedly stated that the US would stick by Ukraine’s side for “as long as it takes”.

A US official said while there were points of disagreement in any bilateral relationship, there had been positive developments that had cheered officials in Kyiv. These include the US approval for Kyiv’s use of long-range 300km Atacms missiles and Congress passing $60bn of aid last month.

The US official also said Ukraine’s request to use US weapons to strike inside Russia was relatively recent, coming three weeks ago when Russian forces opened a new front in the north-eastern Kharkiv region. The official said the request is being evaluated by the Biden administration, suggesting a shift was possible soon.

But a second senior Ukrainian official said Zelenskyy has grown more “emotional and nervous” over the situation on the battlefield and what they say the president sees as Washington’s eagerness to start negotiations with Russia, despite the White House stating in public that it is entirely a decision for Kyiv to initiate such talks.

Zelenskyy “thinks they want the war to go away before the [US] election”, the official said. He added that the Ukrainian president was also unhappy with the Biden administration’s insistence that Kyiv not hit Russian oil infrastructure over fears of raising global gas prices in an election year.

A third senior Ukrainian official used the word “paranoia” to describe the feeling inside the presidential office in recent months, as Zelenskyy and his team have worked to prepare for next month’s peace summit. “Zelenskyy has deep anxiety about the military situation but especially about the peace summit in June,” the official said.

A woman holds a portrait of a Ukrainian soldier at a memorial area in Kyiv © Roman Pilipey/AFP/Getty Images A woman holds a portrait of a Ukrainian soldier at a memorial area in Kyiv © Roman Pilipey/AFP/Getty Images

The Ukrainian president has tried to attract leaders from as many countries as possible to his summit in Switzerland, with the aim of uniting the global community against Vladimir Putin’s aggression. The Russian president has not been invited.

Representatives from more than 80 countries have confirmed their attendance, according to the memo and Zelenskyy. Meanwhile, Russia has been working to convince developing countries to sit it out.

Zelenskyy’s office wrote a memo on May 26 that outlines talking points for officials and MPs to use when speaking with western partners and media about the summit, and specifically instructs Ukrainian officials and lawmakers to pile public pressure on Biden and Xi.

“It is unlikely that the world will understand President Biden and President Xi if they do not join in the realisation of such undeniably just goals and bringing peace closer.”

Zelenskyy himself criticised the lack of response from the Biden administration during a visit to Brussels on Tuesday. “I am aware that America supports this summit, but we not aware on which level,” Zelenskyy said.

“I believe that the peace summit needs President Biden,” Zelenskyy continued. “His absence will only be a personal, standing applause to Putin.”

US officials say that Ukraine scheduled the summit in Switzerland for June 15 and 16 despite being told that Biden would probably be unable to attend. A senior official will represent the US at the meeting.

“The US and President Biden has been there for President Zelenskyy and for the people of Ukraine, and that will continue regardless of who sits in what chair at the peace summit,” White House National Security Council spokesperson John Kirby said on Wednesday.

Several members of Zelenskyy’s own government said they are beginning to worry about the methods employed by their president to communicate with the US. One said that Zelenskyy was “very irritated” with Biden, adding they were concerned about “openly provoking” the White House.

“What do you say in America?” a fourth Ukrainian government official asked the FT. “Do not bite the hand that feeds you.”

5

« en: Ayer a las 19:10:58 »

https://elpais.com/economia/2024-05-30/el-problema-de-la-vivienda-amenaza-el-crecimiento-economico-segun-el-consejo-economico.htmlEl problema de la vivienda amenaza el crecimiento económico, según el Consejo Económico

Una cuarta parte de la población se encuentra en riesgo de pobreza y exclusión social, según resalta la memoria socioeconómica y laboral de 2023 del organismo

La magnitud del problema en el acceso a la vivienda trasciende los límites del sector inmobiliario y corre el peligro de afectar a la economía española. Esta advertencia es una de las principales reflexiones que recoge la Memoria Socioeconómica y Laboral 2023 elaborada por el Consejo Económico y Social (CES), y que su presidente, Antón Costas, y el responsable de la Comisión de Trabajo que la ha redactado, José Ignacio Conde-Ruiz, presentaron este jueves en la sede del organismo en Madrid. Otra de las denuncias que subraya el informe es que más de una cuarta parte de la población (26,5%) se encuentra actualmente en situación de pobreza y riesgo de exclusión social, pese a la mejoría del mercado de trabajo y al buen comportamiento de las finanzas del país. Algo que ambos responsables han calificado de “inaceptable”.

“Aunque, a nivel general, podemos sacar pecho [acerca de la evolución de la economía española en 2023], a la vez, es posible decir que hay una serie de elementos que resultan advertencias importantes para el mantenimiento de este cambio. Y, entre ellas, está que el problema de la vivienda puede acabar estrangulando el buen comportamiento de la economía y del mercado laboral”, ha reflexionado Antón Costas. “No lo digo en el sentido de que pueda llegar a crear una crisis económica, pero sí de que pueda afectar a otras actividades y sectores, como, por ejemplo, el turismo”, ha matizado.

Conde Ruiz, por su parte, ha resaltado que la memoria también relaciona los problemas del sector inmobiliario con otros fenómenos como la movilidad de las personas, y, por extensión, de los trabajadores. “La vivienda repercute en la eficiencia, puesto que la movilidad es fundamental, porque si no hay viviendas, nadie va a ir a los sitios donde pueden necesitarse trabajadores, por mucho que los salarios sean altos”, ha indicado.

El economista, al tiempo, ha recordado que las economías de aglomeración —esto es, cuando varias empresas conviven en una misma ciudad, por ejemplo, y esta concentración de trabajadores provoca que se creen distintos servicios y negocios alrededor—, son “un fenómeno global” y actualmente “se está dando en algunas zonas en detrimento de otras”, lo que puede generar “cuellos de botella”.

Ambos intervinientes han justificado la falta de una evaluación de los efectos de la Ley de Vivienda, aprobada hace un año, por considerar que todavía no ha pasado el tiempo suficiente para hacer un análisis “tajante y con datos”.

La memoria completa, de 509 páginas, y repartida en distintos bloques, analiza desde el comportamiento macro que tuvieron las finanzas del país en el último ejercicio, hasta el impacto de las políticas sociales sobre el bienestar de los ciudadanos. En este punto, Costas ha sentenciado que la pobreza “no es solo un problema moral”, sino también económico, puesto que, de acuerdo con diferentes estudios internacionales, “las inversiones en la infancia son las que presentan unas mayores tasas de retorno”; y político puesto que “estás impidiendo el desarrollo de un cuarto por ciento de la población de tu país”.

Niveles prepandemia

El informe del CES también señala que el consumo en los hogares españoles se mantuvo fuerte pese al aumento de los tipos de interés y los altos precios, algo que se produjo gracias a la mejora del empleo y los salarios, la confianza del consumidor y el acceso al crédito. Sin embargo, indica que “la inversión sigue débil”, ya que aún no se han recuperado los niveles prepandemia. Sin embargo, indica que espera que esto mejore con el Plan de Recuperación, Transformación y Resiliencia (PRTR) y una disminución de la incertidumbre.

En el ámbito laboral, el texto detalla que 2023 fue positivo con récords de empleo y reducción del desempleo, y que los salarios mejoraron gracias al V Acuerdo por el Empleo y la Negociación Colectiva (AENC). Un pacto bilateral, alcanzado entre sindicatos y patronales, que en opinión de Costas de muestra ser “muy poderoso” por los distintos efectos positivos que ha provocado sobre la economía —como el aumento del gasto—, y que evidencia como el diálogo social es un “activo intangible importantísimo para el buen funcionamiento de la economía y la sociedad”.

Respecto al hecho de que a lo largo del año pasado se alcanzasen menos acuerdos a tres bandas, Costas le ha quitado hierro, y ha concebido la actual “sequía” a un “cambio de ciclo”. Sin embargo, el presidente del CES ha insistido en que las conversaciones entre los representantes de los trabajadores y de los empresarios —cuyas principales organizaciones están representadas dentro del órgano consultivo del Gobierno en materia socioeconómica y laboral y, por tanto, comparten las conclusiones que se presentan en este informe— siguen siendo fluidas y eficaces. https://www.ces.es/documents/10180/5311478/Memoria_2023_APROBADA.pdf

6

« en: Ayer a las 18:31:59 »

https://www.cnbc.com/2024/05/30/feds-williams-says-inflation-is-too-high-but-will-start-coming-down-soon.htmlFed’s Williams says inflation is too high but will start coming down soon

NEW YORK — New York Federal Reserve President John Williams on Thursday said inflation is still too high but he is confident it will start decelerating later this year.

With markets on edge over the direction of monetary policy, Williams offered no clear signs on where he is leaning as far as possible interest rate cuts go. Instead, he reiterated recent positions from the central bank that it has seen a “lack of further progress” toward its goals as inflation readings have been mostly higher than expected this year.

“With the economy coming into better balance over time and the disinflation taking place in other economies reducing global inflationary pressures, I expect inflation to resume moderating in the second half of this year,” Williams said in remarks at the Economic Club of New York. “But let me be clear: Inflation is still above our 2% longer-run target, and I am very focused on ensuring we achieve both of our dual mandate goals.”

For nearly a year, the Fed has been in a holding pattern, keeping its benchmark borrowing rate in a range between 5.25%-5.5%, the highest in more than 23 years.

Williams called policy “well positioned” as the Fed seeks to keep the labor market strong and bring inflation back to its 2% target. Most inflation indicators are near 3% now; a key reading from the Commerce Department is due Friday.

Inflation as measured through the Fed’s preferred yardstick — the personal consumption expenditures price index — is expected to come in at 2.7% for April, according to the Dow Jones estimate. Williams said he expects PCE inflation to drift down to 2.5% this year on its way back to 2%.

“We have seen a great deal of progress toward our goals over the past two years. I am confident that we will restore price stability and set the stage for sustained economic prosperity. We are committed to getting the job done,” he said.(...)

7

« en: Ayer a las 18:00:58 »

— Se está dando la noticia del envío a Ucrania de asesores o instructores militares del Estado francés como si se tratara de dos cosas: 1.º Un «desembarco» en Ucrania. 2.º Una «toma de liderazgo» en una supuesta coalición de países prestos a ayudar militarmente a Ucrania, nada de OTAN.

Demasiado bombo y platillo, ¿no creen? Encaja, a la perfección con nuestra tesis de que estamos ante el mutis anglo invicto, con una 'mise-en-scène' francesa, único Estado 'atómico' de la UE, para que la derrota cuente en el marcador de esta.

Formaría parte de esta 'mise-en-scène' un enfriamiento de los lazos intra-OTAN, algo que es verosímil tras las elecciones norteamericanas de noviembre. Concretamente la noticia ha aparecido en Reuters: https://www.reuters.com/world/europe/france-could-announce-sending-military-trainers-ukraine-soon-diplomats-say-2024-05-30/France could announce sending military trainers to Ukraine soon, diplomats say

PARIS, May 30 (Reuters) - France could soon send military trainers to Ukraine despite the concerns of some allies and criticism by Russia, and may announce its decision next week during a visit by the Ukrainian president, three diplomatic sources said.

The diplomats said Paris hoped to forge and lead a coalition of countries offering such assistance to Kyiv's war effort even though some of its European Union partners fear it could make a direct conflict with Russia more likely.

France would initially send a limited number of personnel to assess the modalities of a mission before dispatching several hundred trainers, two of the diplomats said.

Training would centre around demining, keeping equipment operational and technical expertise for warplanes to be provided by the West, they said. Paris would also finance, arm, and train a Ukrainian motorised brigade.

"The arrangements are very advanced and we could expect something next week," said one of the sources.

Ukrainian President Volodymyr Zelenskiy is due in France on June 6, the 80th anniversary of D-day, when Allied soldiers landed in Normandy to drive out Nazi German forces during World War Two. He will hold talks with French President Emmanuel Macron in Paris the next day.

Ukraine's top commander said on Monday he had signed paperwork allowing French military instructors to visit Ukrainian training centres soon.

Ukraine's Defence Ministry, in a "clarification", said Kyiv had been expressing interest in a project involving receiving foreign instructors since February.

Russian President Vladimir Putin portrayed the presence of regular French military in Ukraine as a step towards global conflict.

TALK OF A COALITION

France has trained about 10,000 Ukrainian troops since Russia invaded Ukraine in February 2022, but has done so within the EU. The new mission would not be under EU or NATO auspices, the diplomats said.

Speaking after a Franco-German cabinet meeting this week, Macron did not deny the possibility of sending instructors following the Ukrainian comments, saying that he did not comment on "rumours or decisions that could come."

France's defence ministry said training on Ukrainian soil was among subjects that had been discussed since February.

"Like all the projects discussed at that time, this track continues to be the subject of work with the Ukrainians, in particular to understand their exact needs," it said.

Baltic states have in the past indicated they could join France in such a project.

"Lithuania is ready to join a coalition led by France for example which would train soldiers in Ukraine," Lithuanian Foreign Minister Gabrielius Landsbergis told France's LCI television on May 20.

EU defence ministers on Tuesday debated the idea of training Ukrainian forces in Ukraine but did not reach a common position, EU foreign policy chief Josep Borrell said.

(This story has been corrected to fix the spelling of Josep Borrell in paragraph 16) https://www.ft.com/content/37ed6927-c1e2-4ed3-be2a-871e03fd9ebbFrance leads initiative on sending military trainers to Ukraine

Paris and Kyiv in talks ahead of D-Day anniversary when Volodymyr Zelenskyy will visit France

(...)Estonia’s Prime Minister Kaja Kallas told the Financial Times earlier this month that there were already “countries who are training soldiers on the ground” in Ukraine. She argued that if training personnel were attacked by Russian forces it would not automatically trigger Nato’s Article 5 mutual defence clause: “It is not how it works. It’s not automatic. So these fears are not well-founded.”

President Zelenskyy’s office declined to comment on Thursday. The French defence ministry said it was still working with its Ukrainian counterparts “in particular to understand their exact needs”.

Asked for details on Tuesday at a press conference in Germany alongside chancellor Olaf Scholz, Macron did not deny the plans, but said he would “not comment on what were uncoordinated and unfortunate communications”.

“I will have the opportunity when president Zelenskyy comes to France next week to receive him and to express myself very precisely on what we are going to do,” he said.

8

« en: Ayer a las 17:19:11 »

Jeffrey Sachs: The Untold History of the Cold War, CIA Coups Around the World, and COVID's Origin https://www.youtube.com/watch?v=JS-3QssVPegChapters: 0:00:00 Intro 0:20:17 Why did America push for Ukraine to Join NATO? 0:58:34 What is a Neocon? 1:25:28 Regime Change Never Works 1:36:27 Who Blew up the Nord Stream Pipeline? 2:01:45 COVID Origins

9

« en: Ayer a las 15:24:35 »

https://www.ft.com/content/c67bcd76-309b-47d4-9352-e06f4b92156c#post-3476fac3-eace-4a7b-bc8f-e193a18cbbdfEurozone unemployment falls to lowest level since 1999

Eurozone unemployment dropped further in April, falling by 0.1 percentage points as a strong jobs market took the rate to its lowest level since the formation of the currency bloc in 1999.

The euro area’s seasonally-adjusted unemployment rate fell to 6.4 per cent, with just under 11mn people unemployed, according to data from Eurostat, the EU’s statistics agency, on Thursday. This was down from 6.5 per cent in March.

Across the wider EU region the figure was 6 per cent, amounting to 13.1mn people, a reading that remained flat on the previous month.

10

« en: Ayer a las 10:05:57 »

https://www.bloomberg.com/news/articles/2024-05-30/china-vanke-in-advanced-talks-with-banks-for-6-9-billion-loanChina Vanke in Advanced Talks With Banks for $6.9 Billion Loan

China Vanke Co., the Chinese state-backed developer that’s become the latest flashpoint in the nation’s property crisis, is in advanced talks with major banks for a loan of about 50 billion yuan ($6.9 billion), people familiar with the matter said.

If signed, it would be the largest loan in Asia Pacific, excluding Japan, since Taiwan-based National Housing and Urban Regeneration Center’s $14 billion deal in 2022, according to Bloomberg-compiled data. Talks over the facility, led by Industrial & Commercial Bank of China, began a few months ago after financial regulators instructed the banks to offer funding support to the developer, said the people, who asked not to be identified as the matter is private.(...)

11

« en: Ayer a las 09:37:10 »

https://www.bloomberg.com/news/articles/2024-05-30/us-banks-have-a-commercial-property-blind-spot-risk-study-warnsUS Banks Have a Commercial Property Blind Spot Risk, Study Warns

Term loans and credit lines for REITs add to systemic risk

Fed stress tests should consider such lending, authors say

Large US banks may be more exposed to commercial property than regulators appreciate because of credit lines and term loans they provide to real estate investment trusts, according to a new study.

Big banks’ exposure to CRE lending grows by about 40% when that indirect lending to REITs is added, wrote researchers including Viral Acharya, a professor of economics at New York University. That’s largely been missed in the debate about the risks the troubled industry poses to lenders, they argue.

“Everyone is focusing on on-balance sheet loans by banks,” Acharya, a former deputy governor at the Reserve Bank of India, said in an interview. “We should not get caught in a blind spot that large banks have relatively less exposure than smaller banks.”

REITs have faced challenges since the start of the pandemic as working from home threatens the long-term value of offices while high borrowing costs have hurt many multifamily investments. Some investors responded by pulling money from trusts over the past two years, including those managed by Starwood Capital Group and Blackstone Inc., which limited redemptions to preserve liquidity.

High Stress

REITs are companies that own, operate or lend to income-producing real estate. They are obliged to make large dividend payouts each year, meaning they’re comparatively cash poor. As a result, they tend to draw down credit from banks when they’re worried about redemptions and there’s high stress in the wider economy, making it a concern for the researchers.

That can create “sudden encumbrance of capital and/or liquidity,” the report says. Regulators should better incorporate a lender’s exposure to property investment trusts when conducting stress tests on bank capital, it added.

The risk from draw-downs can’t be easily managed by banks because borrowers decide when they make them, which “can exaggerate banks’ cyclical risks”, according to the report. In some cases, the money seems to be used to buy additional properties, the researchers found.

“Collateral damage to the largest banks from intensive credit line draw-downs means that systemic risk from total CRE exposure is probably much greater than if you only look at direct exposure,” said Manasa Gopal, an assistant professor of finance at Georgia Tech, who’s one of the report’s authors.

Of the largest five US banks by market capitalization, Morgan Stanley has the highest percentage of its own credit lines committed to REITs, according to fellow co-author Max Jager, assistant professor at the Frankfurt School of Finance & Management. Still, on an absolute basis Morgan Stanley’s exposure is smaller than its peers’. A company spokesperson declined comment.

Higher Fees

Credit lines to REITs have grown at a much faster rate than to other borrowers, and lenders should charge higher fees for the products to compensate for the risk they’re assuming, the researchers said.

Months before Blackstone REIT halted redemptions toward the end of 2022, the firm secured an increase in its credit line at a little changed or unchanged spread “despite the obviously increased credit and draw down risks,” according to the report.

“BREIT has a proactive and disciplined approach to managing liquidity,” a representative for Blackstone said in a statement. “It has maintained ample levels of liquidity through the cycle to run its business effectively and has a strong balance sheet.”

Large US banks had $345 billion of indirect exposure to commercial real estate in the fourth quarter of 2022, the analysis found. That’s up from $109 billion in the same period of 2013.

Still, leverage ratios for REITs remain low. Their debt to market assets ratio stood at 33.8% at the end of the first quarter, according to research by representative body NAREIT, meaning they “are facing less stress” than counterparts with higher debt loads.

In the wake of the pandemic, much of the risk to banks from lending to stressed REITs was mitigated by the Federal Reserve’s backstop measures that ensured banks had sufficient liquidity to meet demands, Acharya said. That might not always be the case.

“The credit line has an episodic aspect to it, you don’t know exactly when that event is going to happen,” he said. “The risk is that we don’t know exactly how the episodes play out.”

12

« en: Ayer a las 09:19:03 »

https://www.ft.com/content/18b931cb-5ab5-43c6-812b-50c57b4c7688Shared ownership has created new victims of precarious housing

What used to be a good deal compared with private renting has become a financial trap

Reeling from the impact of the Grenfell Tower tragedy and the still-unfolding damp and mould scandal, social landlords may be breathing a sigh of relief this week at the prospect of a new, more sympathetic government. They would be foolish to relax. Public scrutiny is likely to return as another crisis heads towards them: the desperate plight of shared owners.

Shared owners tend to be lower-middle income families. Priced out of the mainstream housing market, they buy a share of a property (usually less than 50 per cent of its value, raising a deposit of usually between 5 and 10 per cent of that share’s value) and rent the remainder from a housing association. The product was designed more than three decades ago to meet the needs of low-paid key workers, such as teachers and nurses, in Britain’s expensive cities. It worked well: as their salaries increased over time, they could “staircase” up to take full ownership of their homes. Meanwhile, the property itself rose in value. It offered a good deal compared with private renting.

In the last 20 years, things changed. As the cost of housing spiralled, with the average house price tripling between 1999 and 2019, the product became popular with a growing group of priced-out people on middle incomes. Funding for social housing from central government was cut dramatically in the years since 2010, forcing housing associations to be creative in finding ways to house the poorest families. They did it by building shared ownership homes and channelling the profits back into social housing. They were balancing their books on the backs of the not-quite-poor.

Because when it goes wrong, shared ownership is a very bad deal. Shared owners now face a triple threat to their finances, placing many in a desperate position. Higher mortgage payments are compounded by housing associations rapidly increasing rents on their portion of the property — linked to the consumer price index, which has shot up in the last two years. In the wake of the building safety crackdown sparked by the Grenfell fire, service charges for building maintenance (including remediation on cladding, or 24-hour security guards) have also rocketed.

The shared ownership agreement requires a buyer to take on the maximum equity they can afford when assessed for eligibility. The day they complete and collect their keys, they are already financially stretched. No shared owner enters the agreement with the capacity for rapid and vertiginous growth in monthly housing costs. Yet one shared owner I interviewed in east London described how their service charge had almost doubled since signing her agreement at the end of 2018. Meanwhile, her rent has risen from £630 to £883; her mortgage repayments have also doubled. Her total monthly repayments are now more than £2,000. They are stuck in a building yet to have cladding fully removed — meaning the lease cannot be extended and the property cannot be remortgaged.

Many shared owners now feel far worse off than in private rentals, even though in London rents have risen by 7 per cent in the last year. They are desperate to get out, but even many who own flats in blocks without issues around cladding or fire safety say they cannot find a buyer. The combination of house price inflation and rents that make saving for a deposit unthinkable has pushed even shared ownership out of reach of the lower-middle income market. The ongoing political battle over the future of leasehold has only added to the uncertainty for prospective buyers.

In March, a long-running select committee inquiry finally reported: MPs concluded that shared ownership was now failing to provide an affordable route to home ownership. Worse than that, it has become a form of financial entrapment. Housing associations and successive governments should be challenged about their role in creating it.

13

« en: Mayo 29, 2024, 21:59:54 pm »

https://finance.yahoo.com/news/fed-warns-against-rising-delinquency-203014867.htmlFED Warns Against Rising Delinquency Rates, Calls It A "Leading Indicator That Things Are About To Get Worse"

Austan Goolsbee, President of the Chicago Federal Reserve Bank, highlighted that consumer delinquencies are among the most worrisome economic indicators currently being monitored. His concerns now appear prescient as new data reveal a significant uptick in delinquency rates in the first quarter of 2024.

"If the delinquency rate of consumer loans starts rising, that is often a leading indicator that things are about to get worse," Goolsbee stated.

Recent figures from the Federal Reserve published last week confirm these fears, showing that aggregate delinquency rates have increased, "with 3.2% of outstanding debt in some stage of delinquency as of the end of March."

This marks a notable rise in financial distress among consumers.

The data indicates that the transition rates into delinquency have surged across all debt categories.

About 8.9% of credit card balances and 7.9% of auto loans have become delinquent annually. Although the transition rate for mortgages increased by 0.3 percentage points, it remains low by historical standards.

"In the first quarter of 2024, credit card and auto loan transition rates into serious delinquency continued to rise across all age groups," said Joelle Scally, Regional Economic Principal within the Household and Public Policy Research Division at the New York Fed. "An increasing number of borrowers missed credit card payments, revealing worsening financial distress among some households."

Despite these concerning trends, the Federal Reserve has not identified a single cause for the rising delinquency rates. Instead, it suggests that several factors could be at play.

Amid the pandemic, Americans increased both savings and spending, potentially continuing their high expenditure rates without the cushion of substantial savings, thus relying more on debt.

Additionally, there has been an uptick in lending to borrowers with lower credit scores in recent years, which might also contribute to the increasing delinquency rates.

As the situation develops, policymakers and financial institutions must closely monitor these indicators to address potential economic fallout. Rising delinquency rates could signal more significant economic issues, necessitating a cautious and proactive approach to prevent further deterioration.

14

« en: Mayo 29, 2024, 21:47:03 pm »

Siempre me han gustado los periódicos de tarde. Me recuerdan a mi abuelo trayendo a casa el Noticiero Universal. https://www.bbc.com/news/articles/cyrr0yex40yoLondon's Evening Standard axes daily print edition

The Evening Standard newspaper has announced plans to drop its daily print edition and go weekly.

The London paper launched in its original incarnation in 1827, and became free of charge in 2009.(...)

15

« en: Mayo 29, 2024, 21:42:51 pm »

https://www.ft.com/content/7fe47b5c-c6e5-42f8-8faa-9bc6305027a5Stocks sink as bond sell-off fuels jitters

Tepid demand for new US Treasury auctions drives rates higher and prompts a retreat in major stock indices

A global bond sell-off intensified on Wednesday and prompted a stock retreat as well, following the latest in a series of US Treasury auctions to receive a lukewarm reception from investors.

An auction for $44bn of new seven-year Treasury notes in the early afternoon was met with tepid interest from buyers, the third weak US government bond auction in two days. Auction sizes were increased earlier this year and investors and analysts have since warned about the market’s capacity to absorb the deluge of new supply.

Treasury yields broadly rose to their highest levels in a month following the seven-year auction, building on a sell-off that had started the day before in the wake of weak two- and five-year auctions. The benchmark 10-year Treasury yield rose to a peak of 4.64 per cent, its highest level since early May. Bond yields rise as prices fall.

Stocks had sold off earlier in the day, though the auction ultimately had little effect on the main Wall Street indices. The S&P 500 was down 0.5 per cent in mid-afternoon, while the Nasdaq Composite was down 0.2 per cent.

European stocks were more downbeat. London’s FTSE 100 shed 0.7 per cent, France’s Cac 40 lost 1.5 per cent and Germany’s Dax fell 1.1 per cent. The region-wide Stoxx 600 fell 1 per cent.

The equity and bond market moves came after the release of strong consumer confidence data on Tuesday — which lowered expectations of interest rate cuts in the near future.

Hawkish comments from Minneapolis Federal Reserve President Neel Kashkari fanned the sell-off as traders looked ahead to Friday’s release of the US Federal Reserve’s preferred inflation gauge. “I don’t think anybody has totally taken rate increases off the table,” Kashkari said on Tuesday.

“Blame bond yields” for the stock market slide, said Chris Turner, a currency strategist at ING.

Soft Treasury auctions and higher than expected Australian inflation overnight had pushed longer-dated global bond yields higher, all of which eventually proved “a headwind to equities,” he said.

Analysts at Royal Bank of Canada said “yesterday’s [US Treasury] weakness, spurred by weak auction results . . . continued overnight” and “weighed on equities”.

Yields on 10-year German bonds rose 0.10 percentage points to 2.69 per cent, the highest level since November.

Data published on Wednesday showed German inflation picked up more than forecast to a four-month high owing to an acceleration of services prices. German wages rose 6.4 per cent in the first quarter, separate data showed, giving workers in Europe’s largest economy their biggest real-terms pay rise after inflation since records began in 2008.

Investors turned to energy stocks even as prices for Brent crude, the international oil benchmark, slipped 0.6 per cent to $83.70 a barrel. Among the Stoxx 600’s 20 constituent sectors, only energy rallied on the day, up 0.3 per cent.

The “global trend of risk-off” in equity and bond markets has left companies tied to in-demand commodities as the “only safe havens”, JPMorgan analysts said in a note to clients on Wednesday.

The US dollar index, a measure of the dollar’s strength against a basket of six other currencies, was up 0.4 per cent.

Sterling, meanwhile, rose to a 21-month high against the euro as traders backed away from bets on imminent Bank of England rate cuts.

|