Blog

Blog

Últimos mensajes

Últimos mensajes

Temas mas recientes

Temas mas recientes

|

Thank You Posts

Show post that are related to the Thank-O-Matic. It will show the messages where you become a Thank You from an other users.

Mensajes - Derby

Mensajes - Derby

https://ritholtz.com/2025/07/muted-impact-tariffs/The (Muted) Impact of Tariffs on Inflation, Barry Ritholtz

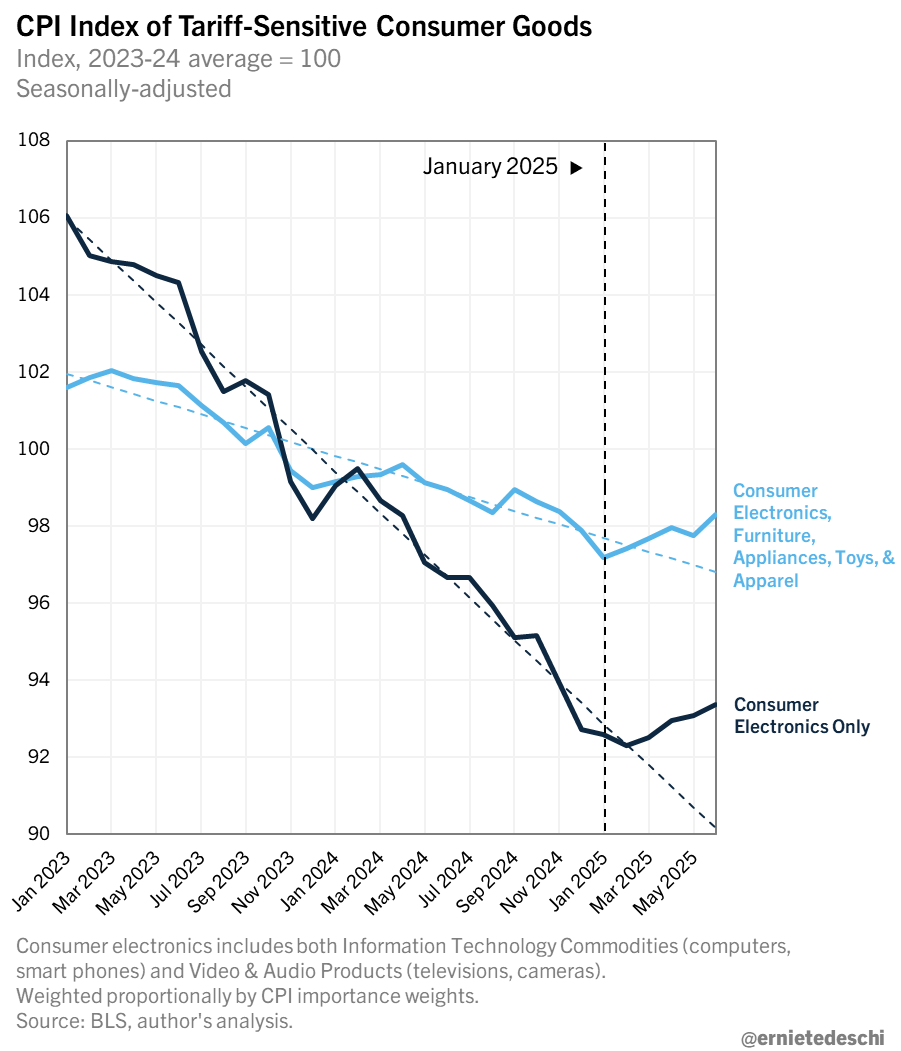

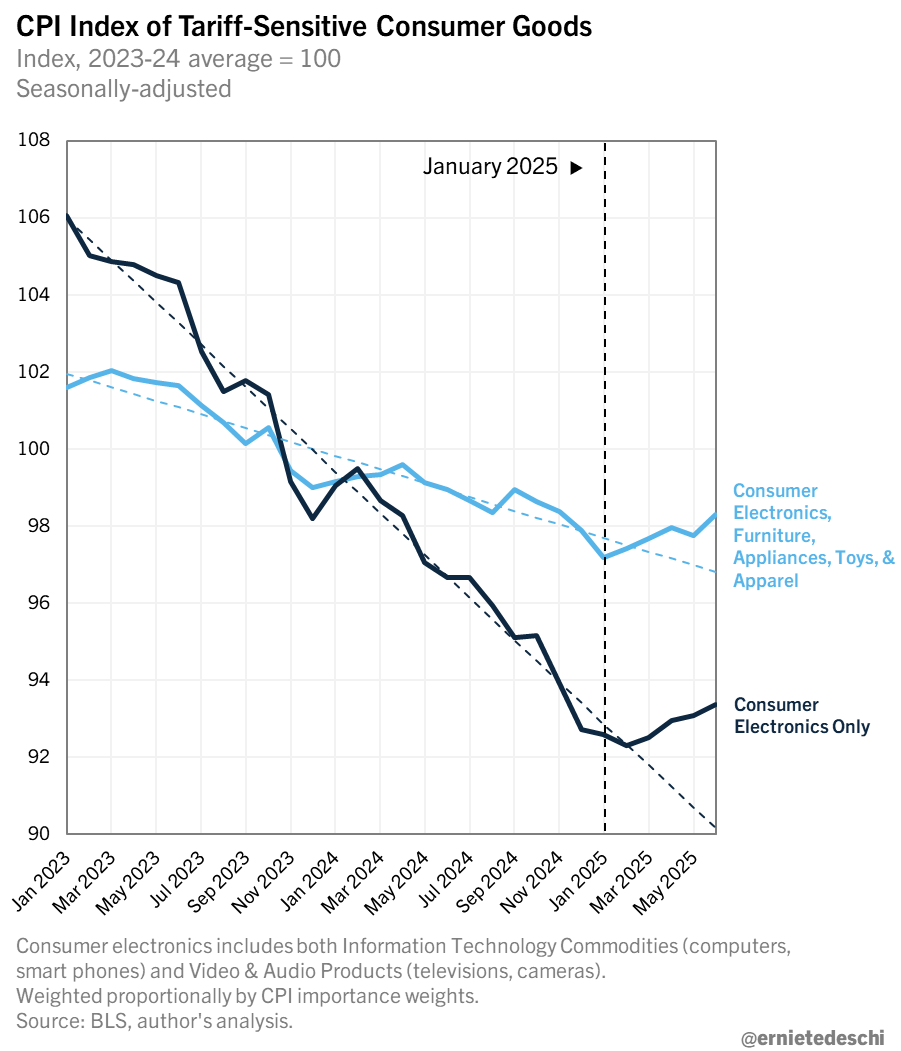

I wanted to drop a quick note about recent CPI data and how tariffs are impacting inflation. There is a fundamental misunderstanding (aka political spin) about this.

It won’t take very much math to put the effect of tariffs into a broader context.

The United States is a ~$30 trillion economy; 70% of this annual activity is consumer spending. And, more than half of that is Services spending.

Imported physical goods account for less than $4 trillion, or approximately 13% of the overall economy.

A 10-20% tariff/tax on these goods is ~$350B to $700B. Even a 30% tariff on every country in the world is less than a trillion dollars. Not nothing, but not recession-inducing by itself.

The problem is that this pile of cash has to come from somewhere. As it turns out, there are only three places it could come from: Producers (exporters), consumers, and/or Domestic companies (Manufacturers, Importers, and/or Retailers).

The producer/exporters could lower prices to offset it, the consumers can pay higher prices, or US companies could lower their margins. It’s more likely to be some combination of all three, but I suspect consumers will bear the biggest brunt of it.

The problem: Tariffs act as a tax on consumption. Any additional dollar spent on tariffs is a dollar that is not spent elsewhere. That reduces overall consumer spending and slows overall economic growth.

For Corporate America, reductions in margins negatively impact profits. Tariffs make corporate America suffer lower revenues and reduced profits.

So far, we have seen only a muted impact on the economy. The tariffs have barely been in effect for a single quarter. Most tariffs are not in place (yet), and we have only a few months of data so far. Once we have a full year’s worth of results, we will see far more data and likely more visible effects from what is effectively a VAT tax on consumption.

~~~

The US economy has proven itself to be both robust and resilient. But any money raised by tariffs will affect consumption and profits.

Past experiments with tariffs have shown that they are a net negative on the economy and one of the least efficient ways to raise tax revenues.

We will find out just how much of a negative they are over the next few quarters…

https://www.azernews.az/region/244825.htmlGeorgia explores switching to China’s CIPS amid SWIFT alternatives

The National Bank of Georgia (NBG) has begun preliminary discussions on potential cooperation with China’s Cross-Border Interbank Payment System (CIPS), signaling a strategic interest in diversifying the country’s financial infrastructure, Azernews reports.

According to Interfax, the talks were initiated following a meeting in Tbilisi between NBG Governor Natia Turnava and CIPS President Fu Huang. The meeting marks Georgia’s first formal engagement with CIPS representatives.

Interest in alternative payment systems has grown after the European Parliament passed a resolution last week suggesting that Georgia could face disconnection from the global SWIFT network—an unprecedented and potentially disruptive move.(...)

https://www.ft.com/content/43c98c4b-8772-4279-ad55-e46bd22409deTrump pushes for 15-20% minimum tariff on all EU goods

US president also rejects reducing 25% sectoral duties on EU cars, say diplomats

The position puts the EU in a bind as it approaches an August 1 deadline, where Trump said he will impose a 30 per cent tariff on all its imports © Krisztian Bocsi/Bloomberg

Donald Trump has escalated his demands in trade negotiations with the EU, pushing for a minimum tariff of 15 to 20 per cent in any deal with the bloc, according to three people briefed on the talks.

The US president’s hardened stance aims to test the EU’s pain threshold after weeks of talks on a framework agreement that would have maintained a baseline tariff of 10 per cent on most goods.

People familiar with the negotiations say Trump has also been unmoved by the latest EU offer to reduce car tariffs, and would be happy to keep duties on the sector at 25 per cent as planned.

Maroš Šefčovič, EU trade commissioner, gave a downbeat assessment of his recent talks in Washington to EU ambassadors on Friday, according to two people briefed on the meeting.

One US official told the FT the administration is now looking at a reciprocal tariff rate that exceeds 10 per cent, even if a deal is reached.

The position puts the EU in a bind as it approaches an August 1 deadline, where Trump said he will impose a 30 per cent tariff on all its imports.

The EU has indicated it would retaliate over such a move, but is divided over taking countermeasures and may be forced to accept a baseline of more than 10 per cent in any deal.

In a sign of the mounting pessimism in Europe over the shape of a deal, German chancellor Friedrich

Merz warned on Friday that Washington remained sceptical about offers to reduce the sectoral tariffs.

“Whether we can still create sectoral rules, whether we can treat individual sectors differently from others, is an open question,” he said. “The European side supports this. The American side views it more critically.” Merz added.

If Trump insists on permanent reciprocal duties of 15-20 per cent they would be as high as they were when trade talks began in April, and could push Brussels towards retaliation, said the senior EU diplomat. The US has also imposed sectoral tariffs of 50 per cent on EU steel and aluminium.

“We don’t want a trade war, but we don’t know if the US will leave us a choice,” they said.

A second EU diplomat added that “the mood has clearly changed” in favour of retaliation. “We are not going to settle at 15 per cent,” they said.

Trump sparked global stock market turmoil in early April when he imposed high “reciprocal” tariffs on almost all US trading partners, before lowering them to 10 per cent for 90 days.

US stocks have surged to record highs since April, and traders have largely shrugged off Trump’s recent threats to increase tariffs on large economies including Japan, South Korea and Brazil.

Although economists have warned that Trump’s trade policy risks stoking US inflation, Trump has been buoyed by only a minor uptick in the US monthly consumer price index this month.

Meanwhile, the US collected nearly $50bn in extra customs revenue in the second quarter while escaping any widespread retaliation measures from its largest trading partners.

The EU has planned several packages of counter-tariffs but has repeatedly pushed back implementation, tying them to Trump’s latest deadline for talks of August 1.

These include duties on €21bn of annual US imports, including chicken and jeans, that would come into effect on August 6.

The European Commission, which runs trade policy, has also proposed retaliation against €72bn of annual US imports, including on Boeing aircraft and bourbon if talks fail.

It is preparing a third list with measures against services. A person familiar with the latest proposal said it would include levies on digital services and online advertising revenue.

US tariffs cover €380bn of annual EU exports, of a total of €532.3bn. The US is the bloc’s biggest single market, accounting for a fifth of exports.

The commission declined to comment.

https://www.msn.com/en-us/news/world/four-eu-countries-bail-out-of-paying-for-trump-s-weapons-for-ukraine/ar-AA1IME3pFour EU countries bail out of paying for Trump’s weapons for Ukraine

At least four countries are already bailing out of commitments to pay the US for weapons supplies for Ukraine, raising a question mark over the level of support Ukraine can expect now that Trump administration has withdrawn.

France, Italy, Hungary and Czechia have all said they will definitely not participate in the weapons-purchase scheme. Nato General Secretary Mark Rutte has claimed that eight countries are willing to pay for the US weapons, but so far only Germany and Denmark have officially confirmed their commitment.

The Dutch Foreign Ministry said that it was considering the possibility of participating in the scheme, but was not committed yet. Rutte said he expects the UK, Sweden and Norway to also participate, but they have not yet commented officially.

European leaders are unhappy with a deal they say was foisted on them, as they were not informed before the announcement was made at a joint press conference in the Oval Office by Trump and Nato General Secretary Mark Rutte on July 14.

Germany has offered two Patriot systems that it has on order from the US, and Norway a third. Rutte said, one country is prepared to supply 17 Patriot systems, but analysts say that is almost certainly only launchers, not full battery systems.

European allies have a total of 18 full batteries and none of them intend to send their own batteries to Ukraine, although they may be willing to send some of the smaller launchers or the interceptor rockets that are the ammo for Patriot systems. Each Patriot battery costs about $1bn, with interceptor missiles approximately $3.7mn each. Denmark, the Netherlands and Sweden have also confirmed they will also join Trump’s initiative.

European leaders were already miffed by Trump’s “big announcement” on July 14 that promised a large increase in military supplies, if Europe pays for it, and 100% tariffs on any country that does business with Russia if no ceasefire deal is agreed in the next 50 days.

According to several European and US officials cited by Reuters on July 16, the plan appears to have been rushed through and announced without prior notification to the countries expected to be involved. PS Chasing Cars... https://www.youtube.com/watch?v=3tE7GEjckZI

https://www.ft.com/content/93f446b1-4d2f-4928-974e-d8f881fa8c3eEU prepares list of potential tariffs on US services

Brussels is also considering export controls if trade talks with Washington fail

The European Commission is assembling a list of measures as part of its retaliation package against Donald Trump’s tariffs © AFP/Getty Images

The EU is preparing a list of potential tariffs on US services, as well as export controls, as part of its possible retaliation if trade talks with Washington fail, two officials briefed on the negotiations said.

The European Commission, which is assembling the list of measures as part of its response to US President Donald Trump’s tariffs, still has to present the list to EU countries.

Trump has announced he plans to hit the bloc with 30 per cent tariffs from August 1.

While Brussels has previously warned that it could expand the transatlantic trade war to services if talks to avoid those tariffs fail, it has not presented concrete measures to European capitals.

One of the officials stressed the list would not only focus on US tech companies, which have strong lobbying power in Trump’s White House.

The list would come on top of a proposal for retaliation against €72bn of annual US imports that EU countries are already discussing and which includes tariffs on Boeing aircraft, cars and bourbon.

A person familiar with the latest proposal said it would include levies on digital services. Commission president Ursula von der Leyen threatened this action in an interview with the Financial Times in April.

“An example is you could put a levy on the advertising revenues of digital services,” she said at the time.

Bernd Lange, the chair of the European parliament’s trade committee, who is frequently briefed on the talks, welcomed the move. The US has a deficit in goods with the EU but a surplus in services, making it more vulnerable to retaliation in that sector.

“It’s not really foreseen that an acceptable balanced deal will be possible between the US and the EU. So it is important to prepare,” Lange said.

“The US tech giants generate a lot of their income in Europe and the US has an annual surplus in services of about $100bn.

“So it is necessary also to prepare a third step on the escalation ladder; a levy on digital services.”

The bloc could use its enforcement regulation to draw up the services list, which would require approval from member states.

This latest package also includes the first export controls, which would add fees to the export of steel scrap and some chemicals.

European scrap is sent to the US where it is melted in electric arc furnaces to be reused in new steel products.

The EU and the US have been negotiating to secure a trade deal since April, when Trump announced 20 per cent “reciprocal” tariffs on EU imports. He then dropped them to 10 per cent to allow time for negotiations before a July 9 deadline, which has since been pushed back to August 1.

Then, on July 13, he threatened he would increase the levies to 30 per cent on August 1.

According to the two officials, the EU could accept 10 per cent tariffs but wants to reduce separate sectoral tariffs of 25 per cent on cars in any deal.

It also wants to guarantee an exemption from future sectoral tariffs promised by Trump on pharmaceuticals and semiconductors.

The EU’s trade chief Maroš Šefčovič is in Washington for discussions with his US counterparts. On Monday, he warned that there was still “quite a big gap” between the two sides. While the EU’s preference is for a deal, he said “all instruments” were being considered for retaliation measures.

The commission has postponed until August 6 a separate plan to hit €21bn of annual US imports — drawn up in response to Trump’s separate duties on imports of steel, aluminium and cars from the EU — to allow time for talks.

The commission declined to comment.

https://www.baha.com/Feds-Goolsbee-Tariffs-pushing-up-goods-inflation/news/details/64482830Fed's Goolsbee: Tariffs pushing up goods inflation

Federal Reserve Bank of Chicago President Austan Goolsbee said Friday that he is "a little wary" because the most recent CPI data indicated that tariffs were driving up goods inflation.

"It pains me to see arguments about central bank independence," he told the Daily Wire Podcast while adding that interest rates could drop by a "fair bit" during the course of the upcoming year.

https://www.baha.com/Eurozone-current-account-surplus-rises-to-euro32B-in-May/news/details/64480162Eurozone current account surplus rises to €32B in May

The euro area recorded a current account surplus of €32 billion in May, up from €19 billion in April, according to data released by the European Central Bank on Thursday.

The monthly rise was fueled by surpluses of €33 billion in goods, €13 billion in services, and €2 billion in primary income, partly offset by a €16 billion deficit in secondary income.

Over the 12 months to May, the surplus totaled €333 billion, representing 2.1% of the eurozone's GDP, down from €364 billion the year prior.

https://www.baha.com/Trump-Fed-choking-out-the-housing-market/news/details/64481049Trump: Fed choking out the housing market

United States President Donald Trump criticized the Federal Reserve and its chair Jerome Powell again on Friday, accusing them of "choking out the housing market with their high rate."

The president argued the central bank's current interest rate policy makes it "difficult for people, especially the young, to buy a house." Trump proceeded to call Powell "truly one of my worst appointments," while blaming his predecessor Joe Biden for reappointing him. "In many ways the Board is equally to blame!" he wrote on Truth Social.

Lastly, Trump declared that the Fed should bring down the rate to 1%, repeating that it would save the country "one trillion dollars a year on interest costs."

https://www.ft.com/content/d882e2dc-add6-4dc5-bf63-9e34732d56b3Central banks face dilemma over rise of dollar-backed stablecoins

Countries balance public demand for digital money against warnings over sector’s risks to financial stability

The Bank for International Settlements last month warned that the unchecked rise of stablecoins could threaten the public’s trust in money © Arnd Wiegmann/Reuters

Global central banks face a dilemma over whether to embrace stablecoins or promote alternatives to the new technology, as the US’s aggressive backing of privately issued tokens thrusts the fast-growing sector into the financial mainstream.

This week, politicians in Washington are advancing legislation to ban the Federal Reserve from issuing a digital currency and provide a regulatory framework for privately issued stablecoins. For the Trump administration, such tokens, which are mostly backed by dollar assets, offer a vehicle to project the strength of the greenback globally.

But the Bank for International Settlements, the umbrella body for central banks, last month warned that the unchecked rise of stablecoins could threaten the public’s trust in money, imperil monetary sovereignty, and potentially pose risks to financial stability. Policymakers are also wary that these tokens can act as conduits for crime.

Some countries are instead trying to develop their own central bank digital currencies, which would give the public access to safe central bank money in digital form and could stem the tide of dollarisation. But such projects have had limited success.

“We’re in this bizarre world right now where dollar-backed stablecoins are dominant. Left unchecked, this is a road towards rampant dollarisation,” said Christian Catalini, founder of the Cryptoeconomics Lab at the Massachusetts Institute of Technology.

“But this isn’t the equilibrium. Other countries around the world understand this,” he added. “Their dilemma is: do you try to slow this down or embrace stablecoins as a source of financial innovation by promoting domestic [versions]?”

There are about $250bn of stablecoins in circulation globally, with virtually all linked to the dollar. Investors have piled into such instruments, which can be used to park cash before trading cryptocurrencies or as a means of payment. Transactions settle in minutes rather than days and usually at a fraction of the fee charged by banks.

Analysts believe the sector will expand rapidly. The Citi Institute recently said it expected the supply of stablecoins to reach $1.6tn by 2030, and to grow to as much as $3.7tn, boosted by the US’s more crypto-friendly legislation. But the sector’s rapid growth creates the risk that countries that do not follow suit could miss out on the sector’s growth and the chance to shape regulation.

The Bank of Korea last month suspended trials of its own central bank digital currency and eight local commercial banks are working on a joint won-backed stablecoin. In recent months, the Bank of England has signalled it would relax its previous restrictive stance on stablecoin issuers.

“UK authorities have moved because they’re suddenly worried about losing competitiveness in a world in which the US wants to make stablecoins mainstream,” said Varun Paul, senior director for financial markets at Fireblocks and former head of the BoE’s fintech unit.

He added that much had changed since the BoE launched its first consultation on regulating stablecoins in 2023. “Back then, the technology was on the fringes of the financial system but now its growth is skyrocketing. The BoE understands that if it doesn’t relax its approach, it will lose the ability to set the rules.”

However, this month BoE governor Andrew Bailey told The Times that moves by big banks to launch their own stablecoins could threaten financial stability. He also said it would be “sensible” for the UK to move towards tokenised deposits — digital versions of commercial bank money that allow for faster settlement — rather than launching a central bank digital currency.

In the Eurozone — where some policymakers hope to promote the euro as an alternative reserve currency to the dollar — the European Central Bank has been a strong advocate for a central bank-issued digital currency. The bank has been working on its own digital euro project for retail use since 2021 and is keen to limit the bloc’s dependence on US companies for payments infrastructure.

But while there are 69 retail CBDC projects in development globally, only three are live while two have been cancelled, according to the Atlantic Council, a think-tank.

Overshadowing CBDC projects is the experience of Nigeria. In 2021, it launched its own digital currency, but consumers largely shunned it, instead opting to buy privately issued dollar-backed stablecoins. The project’s failure led to the government cracking down on cryptocurrency exchanges.

The Nigeria experiment failed in part because the so-called e-naira was only a digital version of the underlying fiat currency, which was also not trusted by the public, said Nitin Datta, chief of staff at UNDCIF, a UN body for digital assets.

“Nigeria was an open market experiment,” he said. “Exchanges and stablecoins will have a role to play as you can’t shut out the market.”

But Ruth Wandhofer, chair of the UK payments systems regulator, said stablecoins still had to prove they could be used at a large scale. A global corporate treasurer “can’t use stablecoins to make large value transactions across borders”, she said at a conference last month, citing foreign exchange costs.

“In some countries, there is also a lack of consumer financial education, payment network and IT hardware and transparency,” she said. “Ultimately it means that if you start using stablecoins in the middle, to get cash in and cash out, you may end up paying more than if you went to Western Union.”

She added that more transactions taking place in cryptocurrencies would mean less taxation for governments. “So, of course, we have to have a digital sterling and digital euro eventually,” she said.

For such projects, the creation of a digital euro was now the litmus test, said Josh Lipsky, senior director of the Atlantic Council’s geoeconomics centre at the Atlantic Council. “If the Eurozone gets this right, it would show the world that a public-sector option is viable — and become the global standard-setter for it,” he said.

https://www.elconfidencial.com/empresas/2025-07-17/sareb-perdio-2-826-millones-en-2024-el-28-5-mas_4174878/Sareb perdió 2.826 millones en 2024, el 28,5% más, y amortizó otros 1.230 millones

La actividad de desinversión de los activos del también conocido como 'banco malo' registró en 2024 unos ingresos totales de 3.060 millones, un 11% superiores

Sareb, la Sociedad de Gestión de Activos Procedentes de la Reestructuración Bancaria, registró un resultado neto negativo de 2.826 millones de euros en 2024, el 28,5% más que en 2023, y amortizó en el pasado ejercicio 1.230,3 millones adicionales.

Como consecuencia de ello, los fondos propios de la compañía al final del ejercicio 2024 se situaron en 7.569 millones de euros negativos, según las cuentas publicadas este jueves tras ser aprobadas por la junta de accionistas de la sociedad, participada en más del 50 % por el Estado a través del Frob.

La actividad de desinversión de los activos del también conocido como 'banco malo' registró en 2024 unos ingresos totales de 3.060 millones, un 11% superiores.

Repaga un 44%

Con las últimas amortizaciones, Sareb ha repagado más de un 44% de la deuda senior (22.598 millones de euros) que emitió en 2012 para poder realizar el traspaso de los activos problemáticos procedentes de las cajas de ahorro que recibieron ayudas públicas durante la crisis financiera.

El importe de la cifra de negocios de Sareb en 2024 sumó 2.399 millones, el 13,2% más que un año antes, gracias a los activos inmobiliarios (2.407 millones), mientras que los activos financieros tuvieron un impacto negativo de 7 millones.

En el área de venta de activos inmobiliarios, alcanzó unos ingresos de 1.753 millones, un 6% más que en 2023. En 2024 se vendieron 8.900 viviendas a particulares, actividad que en 2025 ha sido paralizada en el marco del traspaso de activos anunciado por el Gobierno (40.000 viviendas y 2.400 suelos) para su posterior integración en la nueva sociedad estatal de vivienda y suelo.

Con la actividad de desarrollo inmobiliario, Sareb elevó sus ingresos hasta los 588 millones, un 7% más. Su división Árqura Homes entregó 1.650 viviendas en el ejercicio y elevó un 5% sus ingresos hasta los 414 millones.

Dentro de la cartera de activos financieros, Sareb alcanzó unos ingresos de 658 millones, un 1% más, en línea con el proceso de transformación de préstamos en cartera de inmuebles. Además, el área de gestión social superó los 9.000 alquileres sociales aprobados.

Deterioro de 8.895 millones

Al cierre de 2024 la valoración contable de la cartera de Sareb obligó a tener constituido un fondo de deterioro de 8.895 millones, de los que 7.698 millones corresponden con la unidad de activos financieros (que incluye los activos inmobiliarios procedentes de la adjudicación de activos financieros) y 1.197 millones, con la de inmobiliarios. El deterioro de 7.698 millones (8.934 millones el año anterior) relativo a activos financieros originales representa en torno al 50,7 % de su valor contable.

La unidad de activos inmobiliarios, que recoge aquellos inmuebles traspasados como tal en origen, presentó una minusvalía de 1.197 millones -969 millones el año anterior-, lo que representa un 31,6% de su valor contable. Los gastos no financieros se redujeron en el ejercicio un 13% hasta 511 millones y los gastos financieros por los intereses pagados en el año de la deuda emitida por Sareb aumentaron un 21% en 2024, hasta 1.042 millones por el alza de los tipos de interés.

La cartera de activos se reduce un 62% desde su origen

A cierre de 2024, Sareb tenía en cartera 12.050 activos inmobiliarios y 6.949 activos financieros. La cartera de activos de Sareb se ha reducido un 62,6% desde su origen -50.781 millones- tras las desinversiones realizadas y en 2024 descendió en 4.105 millones, hasta los 18.999 millones. En cuanto al número de activos, durante 2024 la cartera se ha reducido hasta las 139.002 unidades.

Sareb se creó para liquidar de forma ordenada sus activos, optimizando su valor, durante un periodo de 15 años, hasta noviembre de 2027.

https://www.foxbusiness.com/lifestyle/chinese-buyers-snap-up-us-homes-americans-contend-affordability-crisisChinese buyers snap up US homes as Americans contend with affordability crisis

Chinese buyers represented largest portion of foreign investors in terms of total spending and transaction volume

A surge of international buyers, mainly from China, have picked up homes in the U.S. over the past year as U.S. households continue to face mounting challenges in the market.

The number of existing homes purchased by foreign buyers from April 2024 to March 2025 increased for the first time since 2017, according to a recent report from the National Association of Realtors (NAR). The report highlights that Chinese buyers represented the largest portion of foreign investors in terms of total spending and transaction volume, purchasing $13.7 billion worth of existing homes – an 83% increase from the prior year.

That is a significant uptick from the $7.5 billion worth of purchases in the prior year, according to NAR. These buyers also have the highest average purchase price at $1.2 million, with the majority of purchases being concentrated in states with hefty price tags. For instance, about 36% of Chinese buyers purchased a property in California, while 9% purchased property in New York, according to the report.

The number of existing homes purchased by foreign buyers from April 2024 to March 2025 increased for the first time since 2017. (Paul Morris/Bloomberg via Getty Images / Getty Images)

The persisting U.S. housing affordability crisis, which has been making it particularly hard for American buyers and sellers to enter the market, is creating more opportunities for overseas buyers, according to real estate experts.

Roughly 78,100 properties were purchased by foreign buyers, representing a 44% increase from the prior year, though it is still the second-lowest level since NAR began estimating foreign buyer purchases in 2009.

While foreign buyers aren't necessarily edging out American buyers, they are capitalizing on the weak demand in the market as mortgage rates remain one of the biggest barriers to entry for U.S. buyers and sellers, according to Realtor.com senior economist Joel Berner.

Real estate experts say the housing affordability crisis in the U.S. is creating more opportunities for overseas buyers. (Steve Pfost/Newsday RM via Getty Images) / Getty Images)

"If you look in that NAR report, over half of these international buyers are making cash purchases, because they can. They're wealthy international folks who are looking at the market in the U.S. right now and seeing there's not a lot of demand for homes in the U.S.," Berner said, adding that American buyers are content to sit on the sidelines right now because of affordability issues.

The average rate on a 30-year fixed mortgage is 6.67%, according to mortgage buyer Freddie Mac. That's more than double the roughly 3% rate seen in December 2021, highlighting the growing pressure Americans face with borrowing costs.

While foreign buyers aren't necessarily edging out American buyers, they are capitalizing on the weak demand in the market. (SAUL LOEB/AFP via Getty Images) / Getty Images)

On top of that, home prices are hitting record highs. Nationwide, prices have risen nearly 4% year over year and a staggering 60% since 2019, according to the Joint Center for Housing Studies' State of the Nation's Housing report. In turn, it drove the cost of a typical existing single-family home to a record $412,000 in 2024.

However, if paying in cash, experts say it is a good time to buy, regardless if it is an international or American buyer, given that they are skirting those high borrowing rates.

Berner said the interest from international buyers is a welcome relief to certain sellers amid slow sales activity.

"It's helping to kind of eat up some of the inventory that would otherwise go unsold," Berner said, adding that Realtor.com has seen a rise in delisting activity because "people are just kind of giving up on selling their home."

One expert told FOX Business that interest from international buyers is a welcome relief to certain sellers amid slow sales activity. (David Paul Morris/Bloomberg via Getty Images / Getty Images)

Delistings outpaced overall inventory gains in May, jumping 35% year to date and 47% year over year, according to Realtor.com's June report. Comparatively, active listing growth was 28.4% and 31.5%, respectively.

Jaque... https://www.bloomberg.com/news/articles/2025-07-16/trump-softens-tone-on-china-to-secure-xi-summit-and-a-trade-dealTrump Softens Tone on China to Secure Xi Summit and a Trade Deal

US President Donald Trump speaks during a news conference at the Great Hall of the People in Beijing in 2017. Photographer: Qilai Shen/Bloomberg

President Donald Trump has dialed down his confrontational tone with China in an effort to secure a summit with counterpart Xi Jinping and a trade deal with the world’s second-largest economy, people familiar with internal deliberations said.

Six months into his second term, Trump has softened his harsh campaign rhetoric that focused on the US’s massive trade deficit with China and resulting job losses. The warmer posture contrasts with his threats against other trading partners to ravage their economies with crushing tariffs.

Trump is now focused on cutting purchase deals with Beijing — similar to one he forged during his first term — and celebrating quick wins instead of addressing root causes of the trade imbalances. China posted a record trade surplus in the first half of the year amid booming exports.

On Tuesday, the US president said he would be fighting China “in a very friendly fashion.”

In meetings with his staff, Trump is often the least hawkish voice in the room, some of the people said.

Administration officials stressed that Trump has always liked Xi personally and pointed to moments in his first term when he nevertheless imposed sweeping restrictions on Huawei Technologies Co. and tariffs on the majority of Chinese exports.

Trump’s fluid playbook and his departure from promised hawkish policies have worried policymakers inside his administration as well as outside advisers, the people said. This week only exacerbated concerns that previous US red lines with China are now negotiable.

Allowing Nvidia Corp. to sell its China-focused, less-advanced H20 chip once again — something multiple senior officials had said was not on the table — reversed the administration’s own stated approach of keeping the most critical American technologies out of Beijing’s hands.

Treasury Secretary Scott Bessent last month cited H20 controls as evidence of the administration’s toughness on China when pressed by senators who worried the US could trade advanced semiconductors for the Asian country’s rare-earth minerals.

While the US will still require approval for such exports — a restriction former President Joe Biden declined to impose — some Trump officials have privately objected to granting licenses they say will only embolden China’s tech champions, the people said.

Others have argued successfully that allowing Nvidia to compete with Huawei on its own turf is essential to winning the AI race with China. That view, championed by Nvidia Chief Executive Officer Jensen Huang, has gained traction inside the administration, people familiar with the matter said.

‘Productive’ Talks

Trump has the final say in all trade decisions, an administration spokesman said. The president has “consistently fought to level the playing field for American workers and industries, and the Administration continues to have productive discussions with all of our trading partners,” White House spokesman Kush Desai said.

In a further effort to ease tensions, US officials are preparing to delay an Aug. 12 deadline when US tariffs on China are set to snap back to 145% after the expiration of a 90-day truce. Bessent signaled in a Bloomberg Television interview this week that the deadline was flexible.

One person familiar with the plans said the tariff truce could be extended another three months. This comes as Trump is rolling out duties for other countries — including key allies — and threatening more actions on industries including pharmaceuticals and semiconductors.

Last week, US Secretary of State Marco Rubio said a summit between Trump and Xi is likely. Rubio, once among the staunchest China hawks in the Senate, said he had a “very constructive and positive” sit-down Friday with Chinese Foreign Minister Wang Yi.

Some administration officials, meanwhile, are focused on getting China to agree to purchase some volume of to-be-determined US goods and services, people familiar with the matter said. That could satisfy Trump’s concerns about the trade deficit but won’t do much to close the yawning trade gap over the longer term.

Trump’s gentler handling of China is causing a rift among his advisers. Some members of his trade team want to hold a tough line against Beijing and have promised privately that export controls would never be part of trade discussions, people familiar with their deliberations said.

Yet during last month’s trade talks in London, Commerce Secretary Howard Lutnick openly said that recent export controls — officially justified on the basis of national security — were also designed to “annoy” Beijing. And this week, he — along with Bessent and White House AI and Crypto Czar David Sacks — said plainly that allowing some less-advanced Nvidia chip sales to China is indeed part of ongoing trade negotiations.

This development is raising questions about how far Trump would go in negotiating away national security actions if the Chinese demanded it. Some hawkish advisers fear that a further rollback of chip controls is now inevitable, people familiar with the matter said. Others have maintained that allowing sales of H20s — which are far less capable than Nvidia’s best models — is a far cry from exporting that leading-edge hardware, which they say is not up for discussion.

“You want to sell the Chinese enough that their developers get addicted to the American technology stack,” Lutnick said Tuesday on CNBC.

Closely watching the situation are allies and companies across Europe and Asia whose help the US wants to squeeze China’s tech sector. Government and industry officials in those regions have gotten the message that Washington’s strategy is subject to change, people familiar with the matter said.

A half-dozen tech industry officials who’ve interacted with Trump’s team on China said they often leave meetings wanting details only to see core goals evolve in later discussions.

Surprise Reversals

In many cases, those in charge of China tech policy have made decisions without involving offices that historically have played a role. Restrictions imposed in May on sales of chip design software to China — which have since been reversed — were part of a raft of Commerce Department measures that came as a surprise to many within the administration, Bloomberg has reported.

The decision on H20 chips was also tightly held, people familiar with the matter said. Other actions that have been under consideration for months — including sanctions on Chinese chip giants and an effort to slap curbs on Chinese tech subsidiaries — have been delayed as officials pursue a trade deal.

But Trump is also known for reversing course on China often and sometimes quickly after taking a position — as was the case when he fulfilled Xi’s personal request to lift sanctions on Chinese telecom giant ZTE Corp. in 2018.

He’s also susceptible to criticism of his approach, which might indicate Trump could change his tone yet again.

“President Trump is set on a China deal, but it may be short-lived,” said Derek Scissors, a China expert at the American Enterprise Institute. “The US trade deficit is well higher to date this year and the new budget will boost demand for imports in the fourth quarter. If a record 2025 trade deficit gets reported, all bets are off, including with China.”

Beijing has made no secret it believes it has the upper hand. In London, US officials were taken aback by their Chinese counterparts’ gloating over the position they find themselves in, people familiar with the exchange said.

The Asian country’s leverage stems from its grip on rare earth magnets and its ability to weaponize America’s dependence on those supplies. China now requires companies to hand over sensitive data and reapply for rare-earth export licenses every six months.

El tuit... https://x.com/Markzandi/status/1944446986519712226 https://www.fingerlakes1.com/2025/07/15/housing-market-warning-july-15-2025/ https://www.fingerlakes1.com/2025/07/15/housing-market-warning-july-15-2025/Housing market warning: High mortgage rates may stall U.S. economy

With mortgage rates holding steady near 7%, housing activity across the country is slowing down—dragging down sales, new home construction, and price growth. According to Moody’s Analytics Chief Economist Mark Zandi, the trend could evolve into a “full-blown headwind” for the U.S. economy.

Home sales, building, and prices all slowing

Home prices are now projected to grow at their slowest pace in 14 years, based on analysis from Goldman Sachs. The combination of high borrowing costs and affordability pressures is leading more would-be buyers to the sidelines.

Zandi called current housing conditions “a red flare,” warning that persistently high mortgage rates are putting serious pressure on what has long been a foundational pillar of the U.S. economy.

Key developments:

Mortgage rates: Averaging just under 7% nationwide

Home price growth: Slowest pace since 2011

Homebuilding activity: Flattening after initial post-pandemic surge

Economic risk: Housing could shift from a growth engine to a drag

What’s driving the downturn?

Several key factors are contributing to the slowdown:

Federal Reserve policy: Elevated interest rates are keeping mortgage rates high.

Affordability crisis: Skyrocketing home prices during the pandemic have outpaced income growth.

Builder caution: Developers are pulling back due to demand uncertainty and rising costs.

Buyer’s fatigue: Many potential homeowners are priced out or choosing to wait.

What it means for the broader economy

The housing market traditionally plays a central role in economic growth through construction, consumer spending, and financial services. A slowdown in housing could ripple outward, curbing demand for labor, materials, and goods.

“High mortgage rates are now impacting not just affordability, but also confidence,” Zandi noted. “If these trends continue, the sector could act as a brake on overall economic momentum.”

What happens next?

Analysts say much depends on the Federal Reserve’s next moves. If inflation cools and interest rates come down, mortgage rates could ease and help revive demand.

Until then, experts advise:

Buyers: Wait for rates or prices to soften, unless a deal fits your long-term needs.

Sellers: Price competitively and be prepared for longer selling times.

Builders: Focus on smaller or more affordable homes to meet real-time demand. https://www.foxbusiness.com/video/6375682136112

|